ConsenSys is a prominent blockchain technology company founded by Joseph Lubin, who is also a co-founder of Ethereum. The company was established in 2014 with the goal of building decentralized software products and tools for the Ethereum ecosystem.

ConsenSys is known for developing a wide range of blockchain-based solutions, including:

- MetaMask: A popular browser extension and mobile app that functions as an Ethereum wallet and allows users to interact with decentralized applications (dApps).

- Infura: A scalable infrastructure service that provides developers with access to Ethereum and IPFS (InterPlanetary File System) networks.

- Truffle: A development environment, testing framework, and asset pipeline for Ethereum.

- Quorum: An enterprise-focused version of Ethereum designed for privacy and permissioned networks.

- Codefi: A suite of blockchain-based commerce and finance applications for enterprises.

In addition to these products, ConsenSys also offers consulting and development services to help organizations navigate and build on blockchain technology. The company has been a significant contributor to the growth and adoption of Ethereum and decentralized technologies, working with a wide range of partners, including enterprises, governments, and other blockchain projects.

In a significant announcement posted on the social media platform X (formerly known as Twitter) on 19 June 2024, ConsenSys shared news of a major victory for the Ethereum community. According to ConsenSys, the Enforcement Division of the U.S. Securities and Exchange Commission (SEC) has formally notified the company that it is closing its investigation into Ethereum 2.0, the network’s major upgrade. ConsenSys states that this decision means the SEC will not pursue charges alleging that sales of ETH, the native cryptocurrency of the Ethereum network, constitute securities transactions.

ConsenSys reveals that the SEC’s decision comes in response to a letter the company sent on June 7, requesting confirmation that the agency would close its Ethereum 2.0 investigation. The request, as per ConsenSys, was based on the premise that the SEC’s approval of Ethereum ETFs in May was an indication that the agency considered ETH to be a commodity.

While acknowledging the significance of the SEC’s decision to close the Ethereum investigation, ConsenSys emphasizes that this development does not resolve all the challenges faced by blockchain developers, technology providers, and industry participants who have been subjected to what the company describes as the SEC’s “unlawful and aggressive crypto enforcement regime.”

ConsenSys underscores its ongoing commitment to fighting for regulatory clarity, mentioning that the company’s lawsuit against the SEC also seeks a declaration affirming that offering user interface software like MetaMask Swaps and Staking does not violate securities laws. The company expresses its belief that the industry, which serves as the backbone for numerous new technologies and innovations, should not have to resort to legal action to obtain much-needed regulatory clarity. However, ConsenSys acknowledges that this is the reality they are facing at the moment.

In closing, ConsenSys reiterates the importance of its continued efforts to advocate for the blockchain industry and to push for a more transparent and supportive regulatory environment that fosters innovation and growth in the sector.

On 20 March 2024, Fortune reported that the SEC issued subpoenas to several companies regarding efforts to classify ETH as a security. In April, ConsenSys filed a lawsuit against the SEC, claiming that the regulator intended “to seize control over the future of cryptocurrency,” a stance they reiterated in a recent post.

On 25 April 2024, ConsenSys filed a lawsuit against the United States Securities and Exchange Commission (SEC) and its five commissioners, alleging plans to regulate ETH as a security.

As Cointelegraph reported, in a filing in the U.S. District Court for the Northern District of Texas, ConsenSys claimed that the SEC has been conducting a campaign “to seize control over the future of cryptocurrency” through enforcement actions aimed at classifying Ether as a security. The company referenced the SEC’s history — including statements from Chair Gary Gensler — asserting that ETH was not considered a security as early as 2018. ConsenSys warned of the significant implications if the SEC were to change its stance, highlighting that many firms have built businesses based on the existing regulatory precedent.

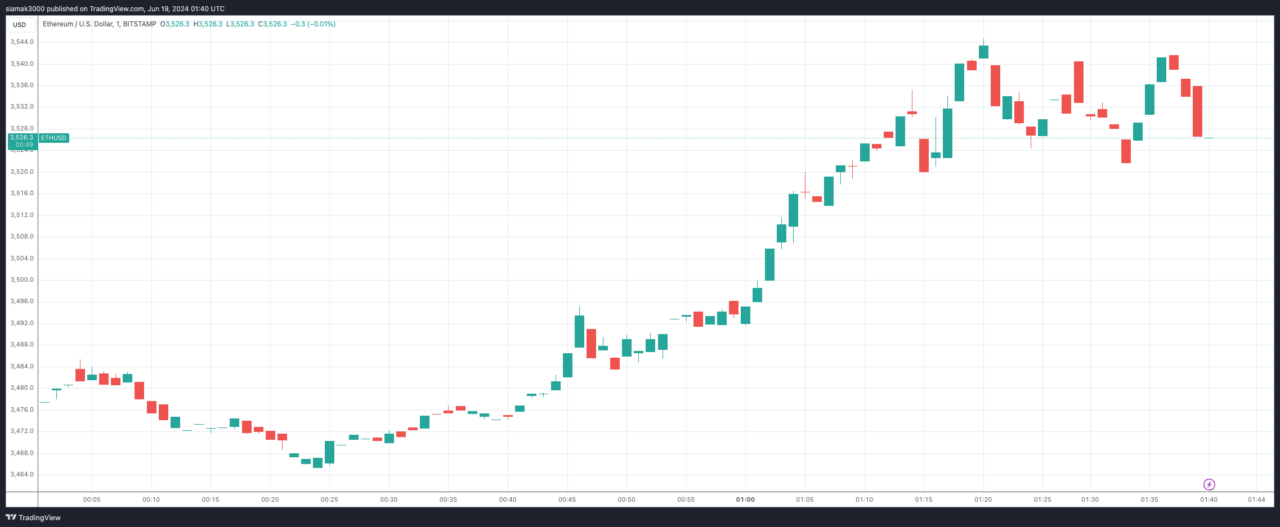

This news seems to have helped the Ethereum price, which is currently around $3,535, up 1.7% in the past one-hour period.

Featured Image via Pixabay