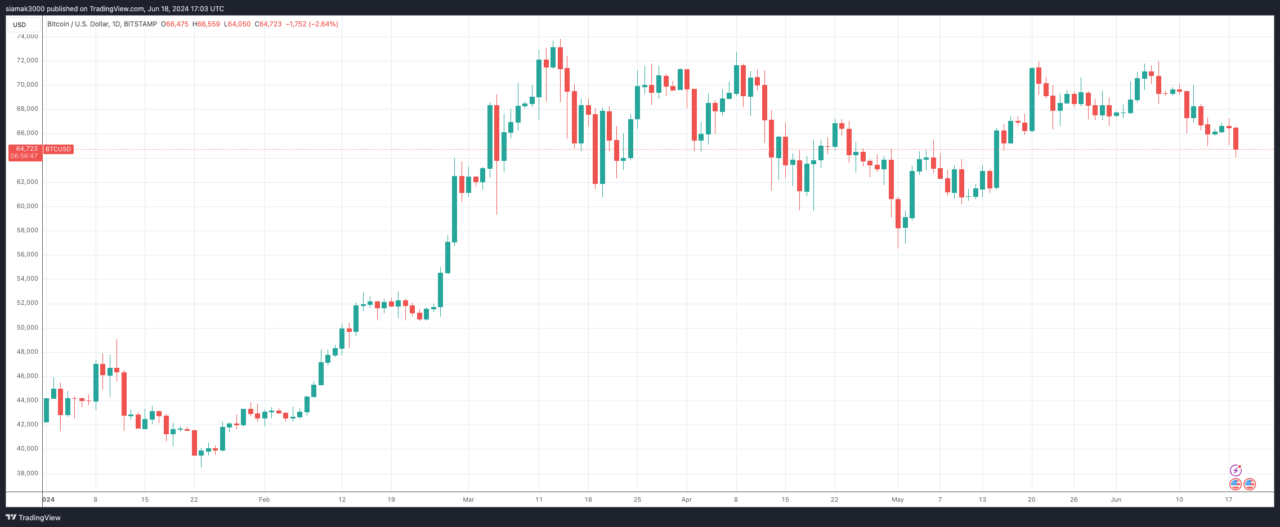

Bitcoin’s price recently dropped below $65,000 for the first time since May 15, surprising many in the cryptocurrency community. This downturn contradicts the bold predictions from Crypto Twitter, which had anticipated Bitcoin reaching $1 million following the U.S. SEC’s approval of spot Bitcoin ETFs. In this blog post, we’ll explore why these optimistic forecasts have not yet materialized and what the future might hold for Bitcoin.

The Hype Around Spot Bitcoin ETFs

The approval of spot Bitcoin ETFs by the U.S. SEC was hailed as a significant milestone for the cryptocurrency market. Proponents argued that these ETFs would provide institutional investors with an easier and more secure way to gain exposure to Bitcoin, potentially leading to massive inflows of capital and driving up the price. Crypto enthusiasts on Twitter and other social media platforms were quick to predict that Bitcoin could skyrocket to $1 million as a result.

Market Realities vs. Predictions

Despite the excitement, Bitcoin’s price has not lived up to these lofty expectations. Several factors contribute to this divergence between prediction and reality:

- Economic Conditions and Market Sentiment: According to a report by CNBC, Marko Jurina, CEO of Jumper.Exchange, says that traders are currently reacting to global economic conditions and geopolitical uncertainties. He says many are either selling at a discount to minimize losses or exiting riskier positions to wait out the uncertainty. He believes the summer months typically see thinner market activity, which can lead to more volatile moves. Additionally, he points out that the U.S. presidential election is adding another layer of unpredictability to the market.

- Federal Reserve’s Monetary Policy: Last Wednesday, the Federal Reserve projected only one rate cut for this year, which was fewer than previously anticipated. This dashed hopes for a more accommodative monetary policy this summer. The political uncertainty in Europe, particularly with the snap election in France, has also contributed to a stronger U.S. dollar. A higher U.S. dollar index (DXY) generally puts downward pressure on Bitcoin and other cryptocurrencies.

- Market Sentiment and Volume Trends: The CNBC article says that current on-chain data from CryptoQuant suggests that traders have been reducing their Bitcoin holdings since it peaked at around $70,000 in late May. This reduction in holdings indicates a lack of bullish momentum and a cautious market sentiment. Despite the approval of the spot Bitcoin ETFs, the expected influx of institutional investment has been slower than anticipated, contributing to the price decline.

Current Market Overview

As of June 18, 2024, Bitcoin’s price stands at approximately $64,758, down 1.8% over the last 24 hours.

The broader cryptocurrency market is also experiencing a downturn, with significant coins like Ethereum, BNB, and Solana seeing declines over the past week. Here is the current state of the top 10 cryptocurrencies by market cap:

- Bitcoin (BTC): $64,758.48, down 1.8% in 24 hours, 2.2% in 7 days.

- Ethereum (ETH): $3,427.85, down 2.8% in 24 hours, 0.7% in 7 days.

- Tether (USDT): $1.00, stable over 24 hours and 7 days.

- BNB (Binance Coin): $581.19, down 3.6% in 24 hours, 2.7% in 7 days.

- Solana (SOL): $134.89, down 6.1% in 24 hours, up 9.6% in 7 days.

- USD Coin (USDC): $1.00, stable over 24 hours and 7 days.

- Lido Staked Ether (STETH): $3,423.70, down 3.1% in 24 hours, 1.4% in 7 days.

- XRP (XRP): $0.4824, down 5.8% in 24 hours, 12.7% in 7 days.

- Dogecoin (DOGE): $0.12, down 7.8% in 24 hours, up 12.1% in 7 days.

- Toncoin (TON): $7.06, down 9.6% in 24 hours, up 11.9% in 7 days.

Additionally, the US equity markets reflect mixed sentiment:

- DJIA: 38,771.69, down 0.02%

- S&P 500: 5,482.56, up 0.17%

- NASDAQ: 17,864.70, up 0.04%

- Russell 2000: 2,029.88, up 0.39%

- VIX: 12.54, down 1.65%

This mixed performance in equity markets also contributes to the uncertainty and cautious sentiment observed in the crypto market.

The Path Forward for Bitcoin

While Bitcoin’s price dip below $65,000 is notable, it’s important to keep the long-term perspective in mind. The approval of spot Bitcoin ETFs remains a significant achievement, and its full impact on the market may take time to unfold. Here are a few key points to consider for the future:

- Long-Term Institutional Interest: Institutional interest in Bitcoin is likely to grow steadily as the market matures and regulatory clarity improves. Over time, this could lead to more substantial and sustained price increases.

- Technological and Regulatory Developments: Continued advancements in blockchain technology and favorable regulatory developments could provide further support for Bitcoin and the broader cryptocurrency market.

- Market Resilience: Bitcoin has demonstrated remarkable resilience over the years, bouncing back from numerous downturns. While short-term volatility is expected, the long-term trajectory for Bitcoin remains promising.

- Community and Innovation: The Bitcoin community continues to drive innovation and adoption. Initiatives such as the Lightning Network, which aims to improve Bitcoin’s scalability and transaction speed, are positive developments that could enhance its utility and value.

Featured Image via Pixabay