On May 14, during a segment on CNBC’s “Squawk Box,” former U.S. SEC Chairman Jay Clayton shared his views on the meme stock phenomenon, particularly focusing on the astronomical trading volumes of stocks like GameStop and AMC.

Concerns Over Investment Practices: Clayton expressed significant concern over the behavior of market participants, especially retail investors who are often swayed by social media and other non-traditional forms of investment advice. He pointed out that the massive swings in stock prices based on tweets and speculative buying resemble gambling more than genuine investing. According to him, these activities could potentially undermine the integrity of financial markets.

Legal vs. Ethical Investing: Clayton clarified the distinction between legal and potentially unethical trading practices. He questioned the legality of actions like tweeting to influence stock prices without genuine investment rationale. He highlighted that while not all actions might be illegal, such as openly liking a stock, manipulative actions designed to influence market prices without substantial backing could border on illegality.

Call for Responsible Communication: Emphasizing the responsibility of influencers in the financial markets, Clayton urged individuals like Keith Gil, a prominent figure in the meme stock saga, to be more transparent about their investment decisions. He suggested that influencers should explain their rationale on public platforms, contributing to a more informed and less speculative market environment.

Impact on Market Integrity: Clayton’s main concern lies in the integrity and sustainability of financial markets. He remarked that while market manipulation might not always be clear-cut in legal terms, its potential to harm investor trust and market function is significant. He advocates for a market environment where investment decisions are made based on robust financial analysis rather than speculative hype.

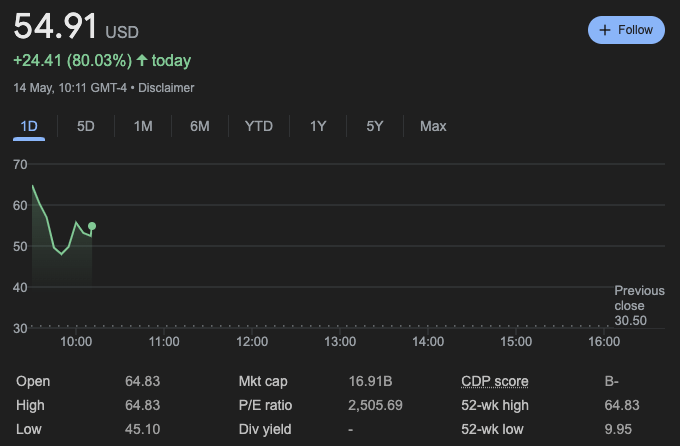

Currently, GameStop shares are trading at $54.91, up over 80% on the day.