On May 23, the U.S. Securities and Exchange Commission (SEC) gave the green light to applications from major exchanges like Nasdaq, CBOE, and NYSE to list exchange-traded funds (ETFs) tied to the price of Ether. This move has the potential to open the doors for these products to start trading later this year, pending final approvals from the ETF issuers themselves.

The cryptocurrency industry was caught off guard by this decision, as it had been largely expecting the SEC to reject the filings until Monday. The approval marks a significant milestone for the nine issuers, including big names like VanEck, ARK Investments/21Shares, and BlackRock, who are now one step closer to launching spot Ether ETFs following the SEC’s approval of spot Bitcoin ETFs in January.

According to a report by Reuters, Andrew Jacobson, vice president and head of legal at 21Shares, described the moment as “exciting” and “a significant step” towards getting the products to market. The SEC’s apparent change of heart has left many in the industry puzzled, with the regulator’s chair, Gary Gensler, declining to comment on the decision.

The approval process is not yet complete, as the ETF issuers still need the SEC to approve their registration statements detailing investor disclosures. While there is no set timeline for this, industry participants believe that many issuers are ready to launch once they receive the green light. However, the SEC’s corporate finance division is expected to request changes and updates in the coming days and weeks.

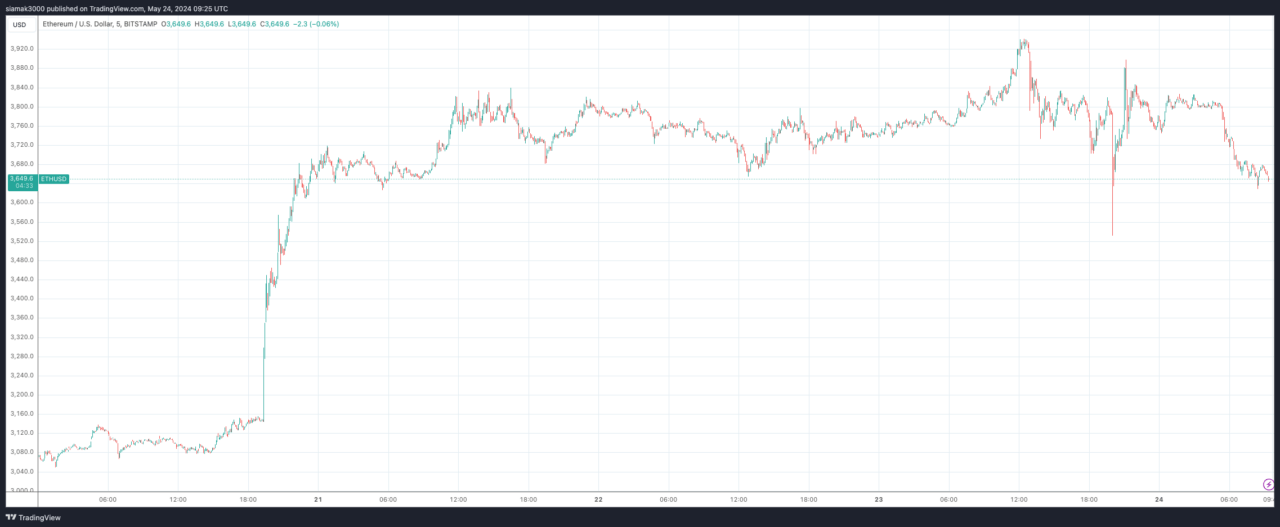

At the time of writing (9:23 a.m. UTC on May 24), ETH is trading at around $3,655, down 4.6% in the past 24-hour period.

As cryptocurrency analyst Michaël van de Poppe explained earlier today, the Ether price did not surge following the news that the SEC had approved 19b-4 filings for spot Ether ETFs from the sponsor changes because this approval had already been priced in. In fact, many in the crypto space were expecting that such approval would enable these ETFs to start trading as early as this week or next week, and when people realized that there could be several more months of waiting before the launch of these ETFs happens, there was disappointment, which seems to have led to some selling pressure.

The eventual approval of US-listed spot Ether ETFs would be another positive development for the cryptocurrency industry, which has been making significant strides towards mainstream finance. The recent passage of a landmark bill in the U.S. House of Representatives seeking to provide regulatory clarity for cryptocurrencies, coupled with the UK regulator’s approval of listed cryptocurrency products, further demonstrates the growing acceptance and legitimacy of digital assets.

In a recent blog post, CCData, a leading provider of institutional-grade market data for digital assets, explained that a significant SEC decision could impact investors. The SEC has decided to prohibit staking in the initial ETFs, meaning entities holding potential ETH ETFs will miss out on the annual yield from Ethereum staking. CCData illustrated a scenario where holding native Ether with staking rewards over a decade shows substantially higher returns compared to holding an ETF without staking, highlighting potential investor losses.

Despite Ethereum’s recent struggles in trading activity on centralized exchanges and on-chain activity compared to other altcoins and Layer 2 solutions, the approval of spot ETH ETFs could revitalize the Ethereum ecosystem. CCData suggests that increased network usage and Ethereum’s deflationary supply mechanism might create favorable supply dynamics and boost Ethereum’s price.

The CCData Research team analyzed potential inflows for Ethereum ETFs, predicting substantial amounts if they attract a portion of the funds that have flowed into Bitcoin ETFs. Their linear regression analysis indicates a potential 30% price increase for Ethereum within the next 100 days if there is a significant shift in funds. However, the team also notes that Ethereum might face short-term struggles due to outflows from the Grayscale Ethereum Trust, similar to what happened after the approval of spot Bitcoin ETFs.

The CCData Research team also explored unique factors that could impact ETH ETF net flows and prices, such as order book liquidity, the deflationary supply mechanism, staked supply, and Grayscale’s strategic management. These factors could amplify price reactions, reduce selling pressure, and potentially lead to greater net inflows and price stability for Ethereum.

Featured Image via Pixabay