Coinbase Institutional is a division of Coinbase that caters to the needs of institutional investors, such as hedge funds, family offices, endowments, and other large-scale financial entities. It provides secure custody services through Coinbase Custody, offering segregated cold storage with robust security measures and insurance coverage. The division also offers advanced trading services via Coinbase Prime, which includes OTC trading and algorithmic trading solutions.

Additionally, Coinbase Institutional delivers comprehensive research and analytics to help clients make informed investment decisions. They offer staking services, enabling institutions to earn rewards on their digital assets and provide a prime brokerage service that includes lending, margin trading, and tailored financing solutions. Emphasizing regulatory compliance, Coinbase Institutional adheres to strict standards to ensure a trustworthy and reliable service for its clients, aiming to provide a comprehensive and secure platform for institutional engagement in the digital asset market.

On 15 May 2024, David Han, a Research Analyst at Coinbase Institutional, published an insightful report titled “Monthly Outlook: Expectations on Ethereum.”

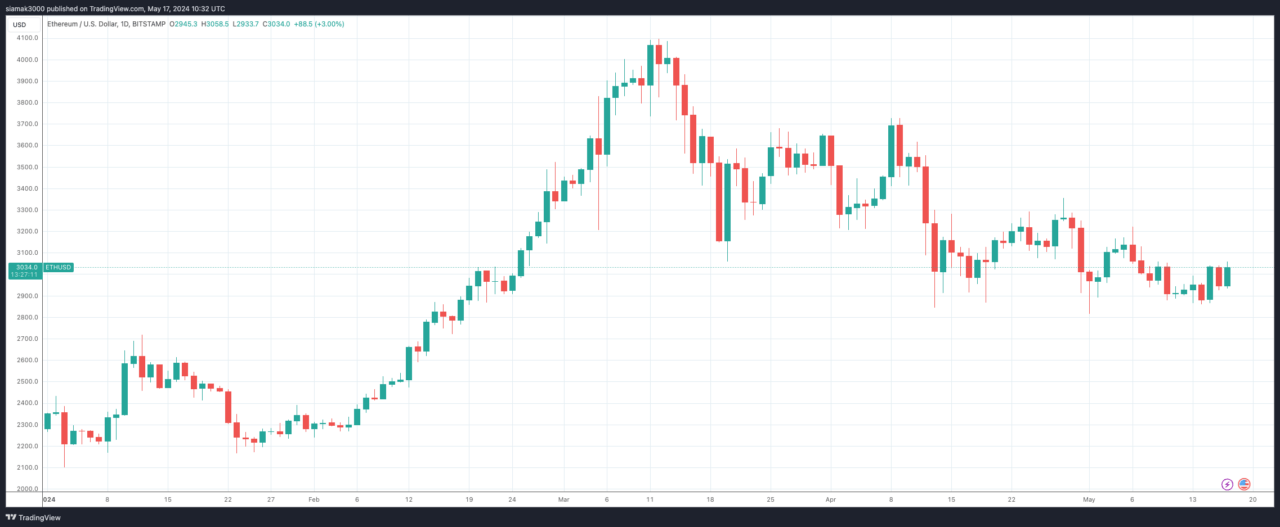

Han asserts that although Ethereum has underperformed so far this year, its long-term positioning remains robust. He believes that Ethereum has the potential to surprise investors with an upward trend later in the cycle. According to Han, Ethereum benefits from strong persistent demand drivers and possesses unique advantages in its scaling roadmap.

Han highlights that Ethereum’s historical trading patterns demonstrate its dual narrative as both a “store-of-value” and a “technology-token.” This combination, he suggests, contributes to Ethereum’s resilience and appeal in the cryptocurrency market. Han also points out that Ethereum does not face significant supply-side pressures such as token unlocks or miner sell-offs. Instead, the growth in staking and Layer 2 (L2) solutions has created substantial and growing sinks for ETH liquidity, which he views as a positive indicator.

Furthermore, Han emphasizes Ethereum’s central role in the decentralized finance (DeFi) ecosystem. He believes that Ethereum’s dominance in DeFi is unlikely to be challenged due to the widespread adoption of the Ethereum Virtual Machine (EVM) and ongoing innovations in Layer 2 technologies. These developments ensure that Ethereum remains at the heart of DeFi, providing a strong foundation for future growth.

One of the critical points in Han’s report is the potential impact of spot US ETH ETFs. Han argues that the market may be underestimating the timing and likelihood of these ETFs being approved. He suggests that if approved by the U.S. SEC, these ETFs could significantly boost Ethereum’s market position, leading to positive price movements.

Featured Image via Pixabay