On Wednesday, the Federal Reserve concluded its latest FOMC meeting by keeping interest rates unchanged, maintaining the target range at 5.25% to 5.5%. This decision was widely anticipated by market participants and came as a relief to investors, who had been closely monitoring the central bank’s stance on monetary policy.

According to a report by CNBC, during the post-meeting press conference, Federal Reserve Chair Jerome Powell provided insights into the Fed’s decision-making process and its outlook for the future. Powell emphasized that the central bank’s rate decisions are not influenced by political factors, particularly the upcoming U.S. presidential election. He stressed the importance of focusing on getting the economics right and stated that considering political factors would reduce the likelihood of achieving that goal.

Powell also addressed concerns about the Federal Reserve’s balance sheet reduction process, known as quantitative tightening (QT). He clarified that the decision to slow the pace of reducing the balance sheet is not intended to provide accommodation to the economy or be less restrictive. Instead, the move aims to ensure a smooth process and avoid financial market turmoil, drawing lessons from the previous instance of balance sheet reduction.

When asked about the possibility of the U.S. entering a period of “stagflation,” characterized by slowing economic growth and persistent inflation, Powell downplayed these concerns. He pointed out that, by some measures, economic growth is at 3%, and inflation is below 3%, suggesting that the current economic environment does not fit the definition of stagflation.

Perhaps the most significant takeaway from Powell’s remarks was his indication that it is unlikely the next policy move will be a rate hike. This statement prompted a rally in the stock market, with the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all initially experiencing sharp gains. Powell’s comments provided reassurance to investors who had been anticipating a potential pause in the Fed’s tightening cycle.

Powell also acknowledged that the Federal Reserve has not yet gained “greater confidence” in the trajectory of inflation this year. He stated that the central bank is prepared to maintain the current target federal funds rate for as long as necessary until there is persuasive evidence that inflation is sustainably moving towards the 2% target.

While the Fed’s decision to hold rates steady was largely expected, the central bank’s cautious tone and willingness to remain patient in the face of uncertain economic conditions have provided some comfort to market participants. As investors digest the implications of the Fed’s latest meeting, attention will now turn to upcoming economic data releases, particularly those related to the labor market and inflation, which will help shape expectations for future monetary policy decisions.

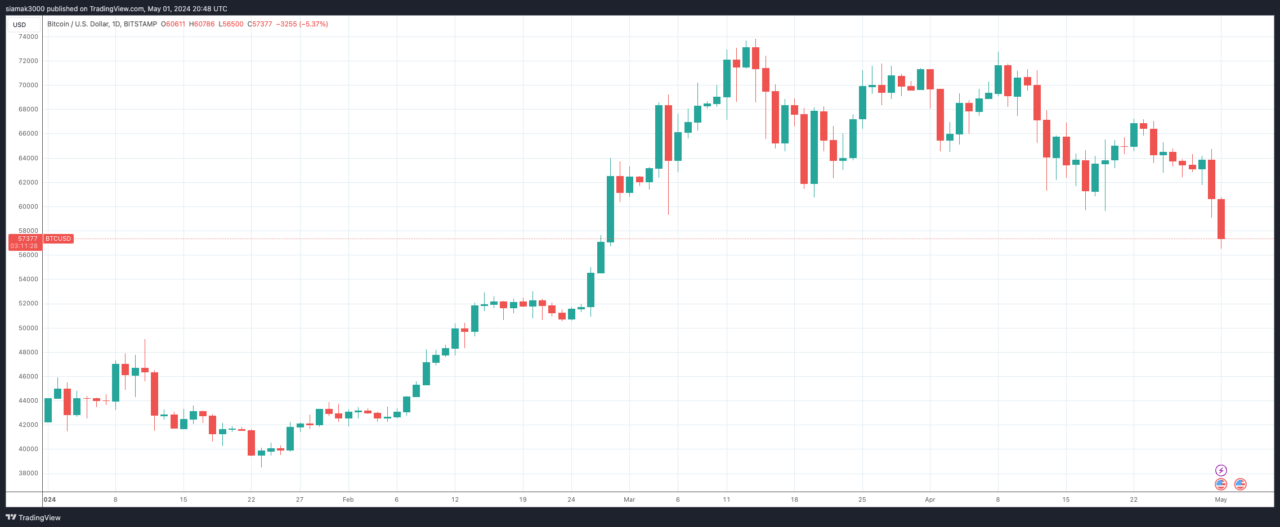

At the time of writing (8:48 p.m. UTC on May 1), Bitcoin is trading at $57,313, down 4.6% in the past 24-hour period.

Macroeconomist Alex Krüger had this to say about the crypto market’s reaction to Fed Chair Powell’s comments: