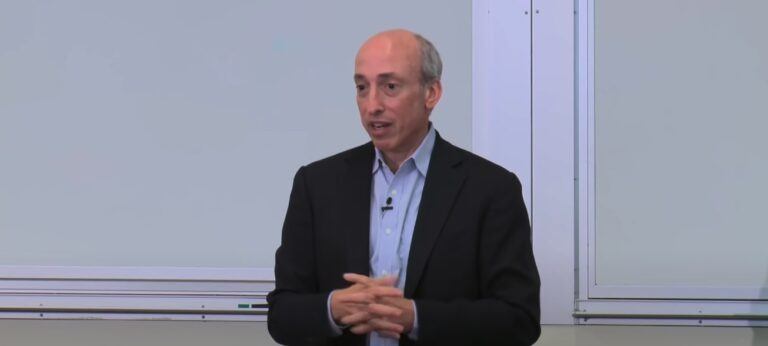

On May 7, 2024, U.S. SEC Chair Gary Gensler appeared on CNBC’s “Squawk Box” to discuss various pressing issues related to the oversight of the crypto market and several high-profile cases involving financial oversight and regulation. Below is a detailed analysis of his statements during this interview.

Oversight of the Crypto Market and SEC’s Role

Gary Gensler highlighted the SEC’s ongoing commitment to ensuring transparency and fairness in the crypto market. He emphasized the need for full, fair, and truthful information to be provided to investors, which he believes is not currently the case in the crypto sector. Gensler pointed out that if crypto products are securities, then they must adhere to the same rigorous standards as other securities, reinforcing the SEC’s role in protecting investors from misleading information.

Trump Media Auditor Charged with ‘Massive Fraud’

Gensler discussed the case of Trump Media’s auditor, BF Borgers, which was charged with massive fraud. He explained the importance of auditing standards, which BF Borgers failed to meet by not adequately reviewing their work and misleading clients. This case highlights the crucial role of auditors as gatekeepers in the financial system, ensuring the accuracy and reliability of public company disclosures.

Market Manipulation Concerns

In response to a question about the unusual stock movements of Trump Media & Technology Group Corp (NASDAQ: DJT) and other “meme stocks,” Gensler reiterated that market manipulation is illegal. He stressed that while investors are free to make their own decisions, these must be based on accurate disclosures, and any intent to manipulate market prices is not permissible.

Valuation Issues in Private Funds

Gensler touched on the broader issue of asset valuations within private funds, like those managed by Blackstone. He pointed out the necessity for fund advisors to adhere to appropriate valuation methods, ensuring that investors do not overpay and that redemptions are fair, underscoring the SEC’s role in maintaining the integrity of valuations in the investment industry.

Future Plans

When asked about his future, Gensler expressed his focus on his current role and the privilege of serving as the SEC Chair. He noted his commitment to continue in his role well into 2026, contributing to the robustness of American capital markets and protecting investor interests.

Earlier this week, Robinhood Markets, Inc. (Nasdaq: HOOD) announced that its subsidiary, Robinhood Crypto (RHC), had received a Wells Notice from the U.S. Securities and Exchange Commission (SEC) staff. This notice indicates that the SEC is considering recommending an enforcement action against RHC. Robinhood, a prominent player in the financial technology space, has expressed disappointment in the SEC’s decision, emphasizing its long-standing efforts to work collaboratively with the agency to achieve regulatory clarity in the crypto industry.

Dan Gallagher, Chief Legal, Compliance and Corporate Affairs Officer at Robinhood, underscored the company’s dedication to constructive engagement with the SEC over the years. Robinhood has actively sought guidance from the regulator, including its noted initiative to “come in and register” with the SEC. Nevertheless, the receipt of the Wells Notice has left the company disheartened yet resolute in defending its practices.

Robinhood Crypto asserts that the digital assets offered on its platform are not securities. The company has deliberately avoided listing certain tokens and offering services like lending and staking—activities the SEC has challenged as securities in previous cases against other platforms.

In response to the SEC’s urging, Robinhood endeavored to register a special purpose broker-dealer with the commission, a move demonstrating its willingness to align with regulatory expectations.

Despite facing possible enforcement, Robinhood is confident about its legal position and is ready to robustly engage with the SEC to reinforce its case. The company believes that the facts and the law support its position and is prepared to expose the flaws in any potential case against Robinhood Crypto.

Robinhood has assured its customers that their accounts and the services provided by the platform will not be affected by this development.