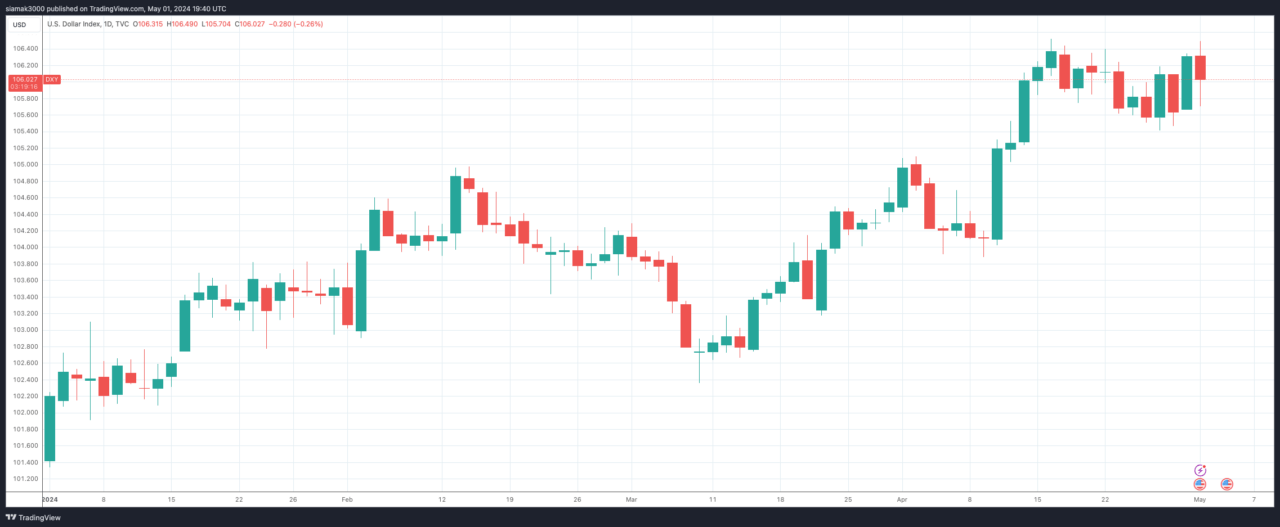

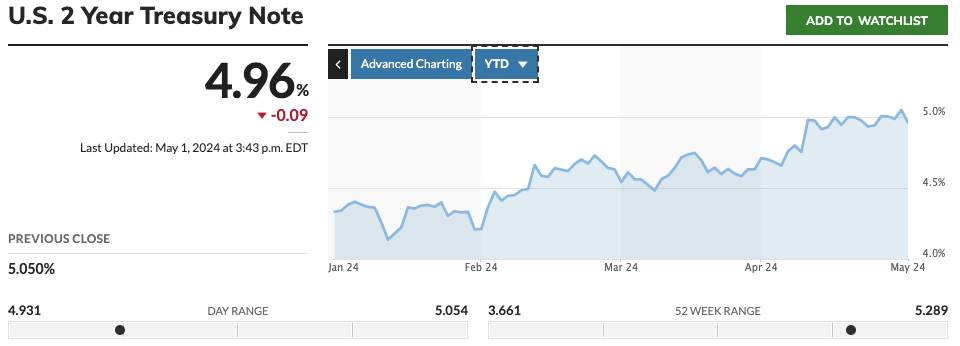

According to a recent article by Joe Rennison and Karl Russell for The New York Times (NYT), the U.S. dollar has been gaining strength against nearly every major currency in the world this year. The Times reports that two-thirds of the roughly 150 currencies tracked by Bloomberg have weakened against the dollar, largely due to expectations about the Federal Reserve’s interest rate decisions.

The article explains that high Fed rates, a response to persistent inflation, have made American assets more attractive to investors worldwide. As a result, money has been flowing into the United States, creating ripple effects felt by policymakers, politicians, and people from Brussels to Beijing, Toronto to Tokyo.

The Times highlights the far-reaching consequences of a strong dollar, including intensified inflation abroad, higher interest bills for countries that have borrowed in dollars, and potential benefits for foreign businesses exporting to the U.S. However, the article also notes that American companies selling abroad may be put at a disadvantage, potentially widening the U.S. trade deficit.

The impact of the dollar’s strength, as reported by The New York Times, depends on the underlying reasons for high U.S. interest rates. If rates remain elevated due to stubborn inflation despite slowing economic growth, policymakers worldwide may face a difficult choice between supporting their domestic economies or bolstering their currencies.

The article emphasizes that Asia has been particularly affected by the strong dollar, with the Japanese yen and Korean won reaching multi-year lows. The Times also points out that China has allowed the yuan to weaken, raising questions about the strength of its economy.

Per the NYT article, European policymakers are considering cutting rates but must be mindful of the potential impact on the euro’s value relative to the dollar. The article also notes that central banks in South Korea, Thailand, and Indonesia are grappling with similar challenges.

Featured Image via Pixabay