Earlier today, in an interview with Jim Cramer on CNBC’s “Squawk on the Street,” Starbucks Corp (NASDAQ: SBUX) CEO Laxman Narasimhan provided a candid look at the company’s disappointing fiscal Q2 2024 results. Yesterday, Starbucks issued a detailed press release shedding light on the complexities and strategic adjustments the company is navigating through these challenging times.

Starbucks reported a 2% decline in consolidated net revenues, amounting to $8.6 billion, which the company attributes to a complex operating environment. Both GAAP and Non-GAAP earnings per share were recorded at $0.68, marking a significant decrease from the previous year, with GAAP earnings per share down by 14% and Non-GAAP earnings per share down by 8%.

Key performance highlights from the fiscal second quarter include:

- Global Comparable Store Sales: There was a 4% decline overall, driven by a sharp 6% decrease in transactions but partially offset by a 2% increase in average ticket prices.

- North American Performance: Comparable store sales in North America fell by 3%, with transactions down 7%, though mitigated slightly by a 4% rise in average ticket prices.

- International Markets: International comparable store sales saw a 6% decrease, with an 11% decline in China due to significant drops in both ticket prices and transaction volumes.

The company also continued its expansion, opening 364 net new stores globally, bringing the total count to 38,951 stores, split between company-operated and licensed outlets.

The operating margin showed a contraction, with GAAP operating margins decreasing by 240 basis points to 12.8%. This was primarily due to increased investments in store partner wages, benefits, and promotional activities. Despite these challenges, Starbucks is committed to its long-term strategy and is actively implementing the “Triple Shot Reinvention with Two Pumps” strategy, aimed at revitalizing the brand and ensuring future growth.

The Starbucks Rewards loyalty program reported an increase in 90-day active members in the U.S. to 32.8 million, up by 6% from the previous year. This highlights a resilient aspect of Starbucks’ customer engagement strategy despite broader market challenges.

The Starbucks CEO remarked on the quarter’s performance, “In a highly challenged environment, this quarter’s results do not reflect the power of our brand, our capabilities, or the opportunities ahead.” He emphasized the comprehensive roadmap and action plans the company has laid out to navigate through the current complexities.

CFO Rachel Ruggeri also commented on the financial discipline and strategic focus, highlighting the company’s continued commitment to capital allocation and operational efficiencies as they steer through dynamic market conditions.

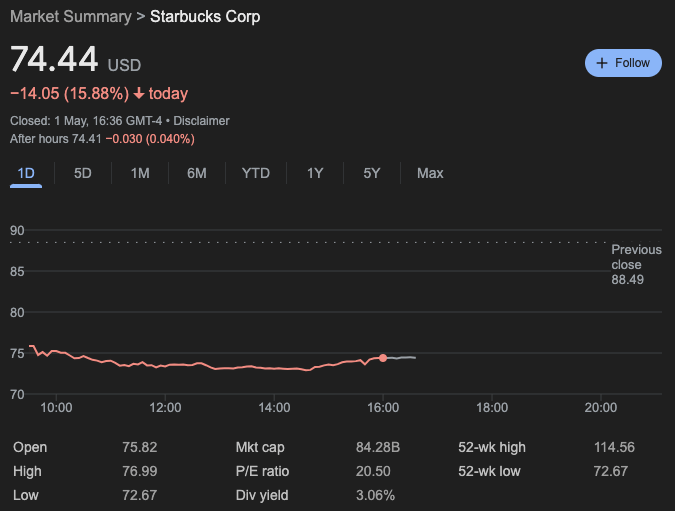

The Starbucks share price closed at $74.44, down 15.88% on the day.

Featured Image via Pixabay