On April 4, 2024, Ripple, a prominent provider of enterprise blockchain and cryptocurrency solutions, unveiled plans to introduce a stablecoin tied to the US dollar on a 1:1 basis. This stablecoin will be fully backed by a mix of US dollar deposits, short-term US government securities, and other cash equivalents, with transparency upheld through monthly attestations by an independent accounting firm. Ripple’s entrance into the stablecoin market, currently estimated at $150 billion and expected to surge to over $2.8 trillion by 2028, responds to the growing demand for reliable and functional stablecoins.

Ripple’s CEO, Brad Garlinghouse, described the launch as a strategic extension of Ripple’s efforts to merge traditional financial systems with the crypto world. He noted that Ripple’s consistent performance and expansion through diverse market cycles underscore its capability and commitment as it steps into this market. This initiative will enrich the XRP Ledger community by enhancing use cases, liquidity, and opportunities for developers and users.

Initially, Ripple’s stablecoin will be accessible on the XRP Ledger and Ethereum platforms, with future expansions planned across various blockchains and decentralized finance (DeFi) applications. Monica Long, President of Ripple, highlighted the strategic importance of this dual-chain approach, which aims to catalyze institutional and DeFi applications across different ecosystems, thus fostering broader adoption and development.

Ripple’s press release detailed multiple advantages of their stablecoin, emphasizing its enterprise-grade design tailored for financial institutions, a compliance-first approach supported by a growing portfolio of licenses, and enhanced liquidity on the XRP Ledger’s Decentralized Exchange (DEX). Furthermore, Ripple commits to maintaining transparency and reliability, with regular attestations on the stablecoin’s reserves, while its compatibility with multiple blockchain networks promises expanded utility across various platforms.

Later that day, Ripple’s CTO highlighted the transformative potential of this stablecoin. The CTO emphasized that integrating a high-quality USD stablecoin with XRPL’s decentralized exchange capabilities, along with innovative features such as issued currencies, auto-bridging using XRP as the native currency to facilitate trades between other assets, and the Automated Market Maker (AMM), would significantly enhance the functionality and utility for both users and developers.

During the recent XRP Las Vegas (May 3-4, 2024) event, Ripple’s Chief Technology Officer, David Schwartz, shared his thoughts on this project.

David Schwartz explained that Ripple’s upcoming stablecoin is designed to provide a stable value peg, which is crucial in environments where cryptocurrency volatility can be a barrier. Schwartz noted that while digital assets like XRP offer significant benefits, their fluctuating value can deter their use in specific scenarios, particularly in regulated financial transactions where stability is paramount. The stablecoin will address this by offering a dependable medium of exchange that can integrate seamlessly with traditional financial systems.

Schwartz outlined the stablecoin’s deep integration into the XRP Ledger, which is renowned for its efficiency and low transaction fees. He highlighted that the stablecoin would leverage features such as issued currencies, auto-bridging, and the recently implemented Automated Market Maker (AMM) to enhance its functionality.

During his talk, Schwartz emphasized the strategic importance of the stablecoin in Ripple’s vision to bridge the gap between traditional finance and the burgeoning world of digital currencies. He discussed how the stablecoin is poised to play a pivotal role in cross-border transactions, where stability and speed are crucial. Additionally, the stablecoin could underpin new financial products and services on the XRP Ledger, potentially transforming the platform into a more versatile and widely used blockchain.

Schwartz encouraged the Ripple community to engage with the development process of the stablecoin, suggesting that their input would be crucial in refining its functionality and broadening its applications. He also teased further discussions and more detailed announcements at future conferences, including the XRP Ledger Apex event in Amsterdam (June 11-13, 2024), where Ripple plans to unveil additional specifics about the stablecoin.

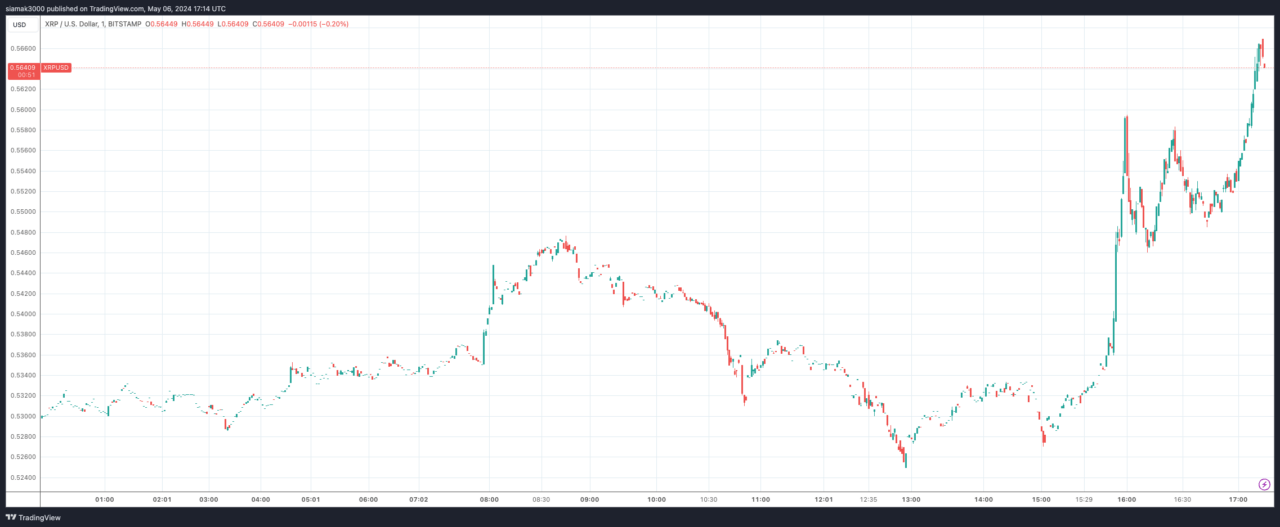

At the time of writing (5:13 p.m. UTC on May 6), XRP is trading at around $0.5615, up 5.5% in the past 24-hour period.

Featured Image via Pixabay