Semler Scientific, Inc. (NASDAQ: SMLR), known for its innovative solutions to combat chronic diseases, has announced a strategic shift in its treasury management by adopting Bitcoin as its primary reserve asset. The decision, revealed on 28 May 2024, marks a significant move in the company’s financial strategy.

Semler Scientific, a leader in developing and marketing medical products and services, primarily focuses on its flagship product, QuantaFlo®. This FDA-cleared rapid point-of-care test measures arterial blood flow in the extremities, aiding in the diagnosis of cardiovascular diseases such as peripheral arterial disease (PAD). The company is currently seeking new 510(k) clearance for expanded indications of QuantaFlo, which is utilized by healthcare providers to assess patients’ risks of mortality and major adverse cardiovascular events (MACE).

In a press release issued from Santa Clara, California, Semler Scientific disclosed the purchase of 581 bitcoins at an aggregate cost of $40 million, inclusive of fees and expenses. This acquisition underscores the company’s belief in Bitcoin’s potential as a reliable store of value and an attractive investment opportunity.

Eric Semler, the company’s chairman, emphasized Bitcoin’s status as a major asset class, now boasting over $1 trillion in market value. He highlighted Bitcoin’s unique characteristics as a scarce and finite asset, positioning it as a reasonable hedge against inflation and a safe haven amid global economic instability. Semler further argued that Bitcoin’s digital and architectural resilience offers advantages over gold, which has a market value of approximately ten times that of Bitcoin. Given this disparity, he suggested that Bitcoin could potentially yield significant returns as it gains acceptance as digital gold.

Semler also noted the growing global acceptance and institutionalization of Bitcoin, particularly the U.S. Securities and Exchange Commission’s approval of 11 Bitcoin exchange-traded funds (ETFs) in January 2024. According to the press release, these ETFs have reported over $13 billion in net inflows, attracting investments from nearly 1,000 institutions, including global banks, pensions, endowments, and registered investment advisors. It is estimated that institutions now hold more than 10% of all bitcoins.

Semler Scientific’s board and senior management conducted a thorough examination of potential uses for their cash reserves, including acquisitions, before deciding on Bitcoin. Eric Semler explained that after evaluating various alternatives, the company concluded that holding Bitcoin was the best use of its excess cash.

As Semler Scientific continues to generate revenue and free cash flow from QuantaFlo sales, the company will actively evaluate the use of its excess cash. Bitcoin will serve as the principal treasury holding, subject to market conditions and the company’s anticipated cash needs.

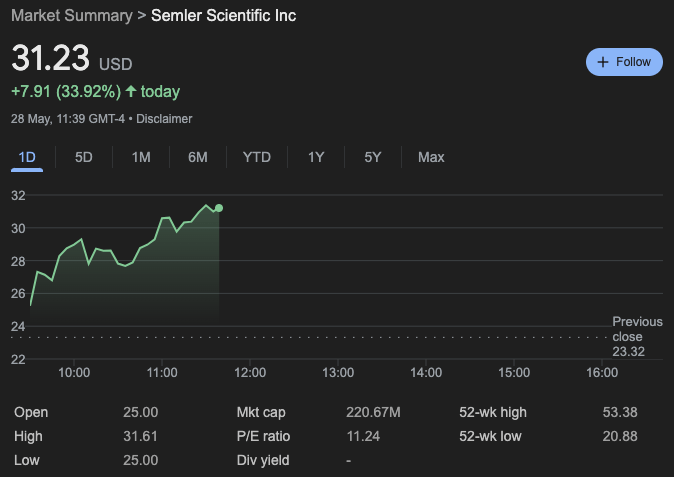

As of 11:39 a.m. EDT, Semler Scientific shares are trading at around $31.23, up nearly 34% on the day.

Featured Image via Pixabay