In an astonishing display of market acumen, a crypto whale achieved a substantial profit of over $3 million in just four days.

Initial Purchase and Withdrawal On May 3, amid a market downturn, the whale took a strategic position by purchasing 767 bitcoins when the prices were relatively low, paying an average price of $59,226 per BTC. This purchase was made from Coinbase, one of the most reputable cryptocurrency exchanges, amounting to a total investment of approximately $45.44 million. The decision to buy at this point was predicated on a sharp insight into market movements, pinpointing when Bitcoin hit what the whale perceived as a bottom price.

Subsequent Deposit and Sale Four days after the initial acquisition, as the market rebounded, the whale then transferred the same 767 BTC, now valued at $48.46 million, to Binance—another leading global cryptocurrency exchange. This transaction represents a clear intention to capitalize on the price recovery of Bitcoin over those four days. By depositing the Bitcoins into Binance, the whale positioned themselves to sell at a higher price, securing a profit that exceeds $3 million from this sequence of trades.

Address and Transparency The transaction details, including the Bitcoin address involved (1PGncMc8diiELpe4JAVCY51fcQ215JegAF), underscore the transparency and traceability inherent in blockchain technologies. This allows entities like Lookonchain to track and report on such movements, providing insights into how significant players are influencing the market dynamics.

Market Impact and Strategy This example of buying low and selling high showcases not only the individual trader’s prowess but also highlights how large-scale transactions can influence the broader cryptocurrency market. The whale’s ability to maneuver such large amounts of capital effectively and profitably emphasizes the sophistication and risks associated with high-stakes trading in digital assets.

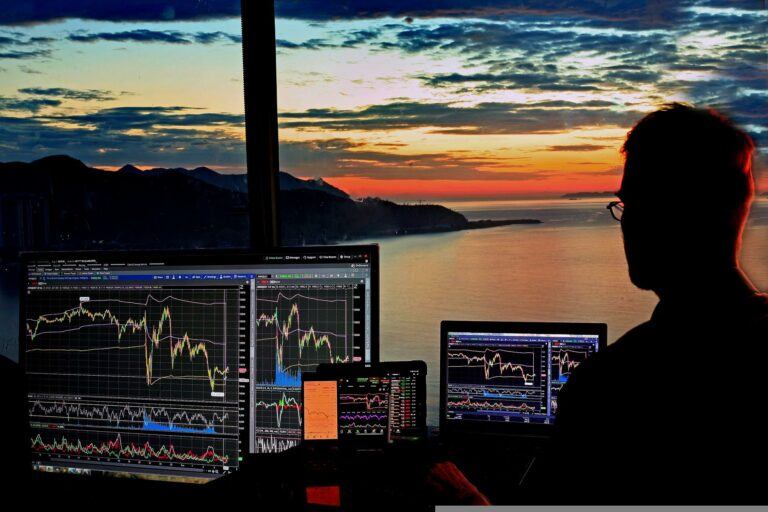

Featured Image via Pixabay