On May 21, 2024, Michael Novogratz, the founder and CEO of Galaxy Digital, appeared on CNBC’s “Squawk Box” to share his insights on the recent price movements in cryptocurrencies, the Biden administration’s interaction with the SEC regarding cryptocurrencies, and the broader implications for the industry.

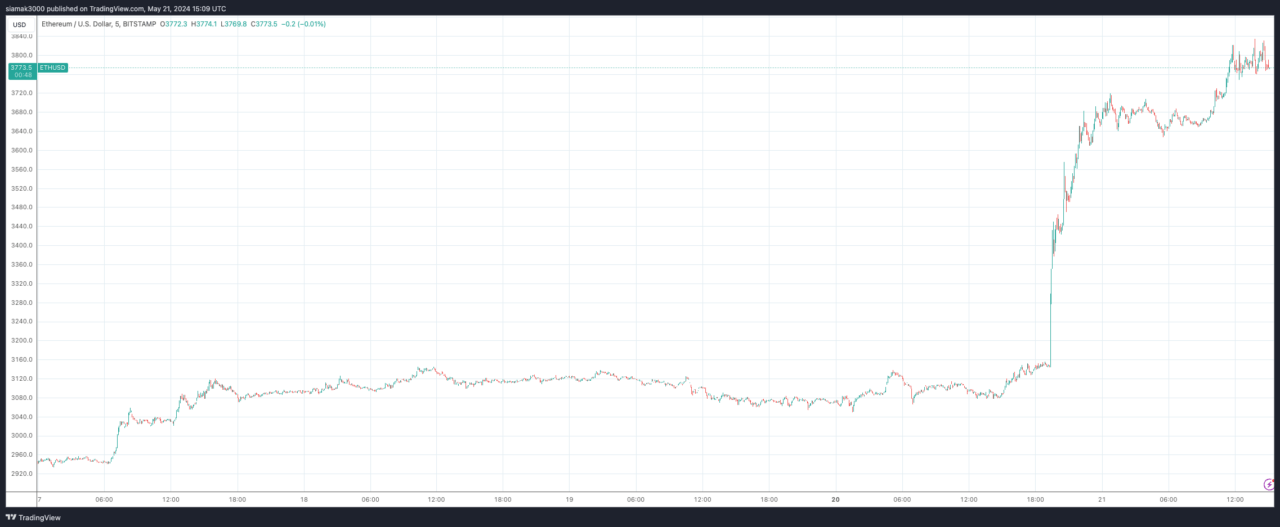

Novogratz started by highlighting the significant rise in Ethereum’s price over the past 24 hours. He attributed this surge to speculation surrounding the potential approval of US-based spot Ethereum ETFs. This optimism, he noted, stems from the evolving political landscape in the United States, particularly in relation to the Biden administration’s stance on cryptocurrencies.

Novogratz delved into the political shifts impacting the crypto market. He recounted a pivotal moment two weeks prior when former President Donald Trump declared himself the “crypto president” on the same day President Joe Biden threatened to veto bill H.J. Res. 109, which, if passed into law, would overturn SAB 121 (this mandated that crypto assets in custody be held on balance sheets, a move that sparked significant debate).

According to Novogratz, this incident turned into a political litmus test, with Republicans being seen as pro-crypto and Democrats as anti-crypto. However, the Democrats have since realized the potential repercussions of this stance, especially considering the vast number of crypto owners in the country—85 million, which surpasses the number of dog owners. Many of these crypto owners are single-issue voters, making it a critical demographic for any political party.

In response to the growing political pressure, there has been a noticeable shift among Democrats. Novogratz pointed out that several Senators and 21 Congressmen crossed the aisle to support the repeal of the SEC’s rule, which is now awaiting President Biden’s decision. This bipartisan move indicates a significant change in the political climate regarding cryptocurrencies.

Novogratz speculated that a call might have been made from the White House to SEC Chair Gary Gensler, urging a more favorable stance towards crypto ETFs. He emphasized that while he does not have inside information, market behavior suggests a possible shift in policy.

Novogratz stressed the necessity of a bipartisan approach to cryptocurrency regulation. He noted that for the industry to thrive, it needs support from both sides of the political spectrum. He criticized figures like Elizabeth Warren, who have been staunchly opposed to crypto, for holding the Democrats back on this issue. He highlighted that significant figures like Senate Majority Leader Chuck Schumer have started to push back against this anti-crypto stance, indicating a broader acceptance within the party.

When asked about his involvement in these efforts, Novogratz acknowledged his active role in advocating for a bipartisan approach. He has been engaging with both Democrats and Republicans to educate and promote sensible crypto policies. He believes that making crypto a political issue is detrimental and hopes that his message is beginning to resonate within political circles.

In the past 24 hours, Ether (ETH) has surged by 22%. This rally was triggered by a significant update from Bloomberg ETF analysts Eric Balchunas and James Seyffart, who dramatically raised their estimated likelihood of the U.S. Securities and Exchange Commission (SEC) approving spot ETH ETFs.

On the social media platform X, Balchunas announced that he and Seyffart had increased their odds of spot Ether ETF approval from 25% to 75%. This adjustment was influenced by rumors indicating that the SEC might be reconsidering its position on this politically charged issue. As a result, market participants are now scrambling to adjust their positions, having previously assumed that the ETFs would be denied approval.