EigenLayer is a protocol built on the Ethereum blockchain that introduces a new concept called “restaking”. Restaking allows users who have already staked their Ethereum (ETH) to essentially leverage it again. By opting into EigenLayer’s smart contracts, users can put their staked ETH to work in securing other applications on the Ethereum network, potentially earning them additional rewards.

Essentially, EigenLayer acts as a middle layer that connects existing Ethereum stakers with new applications on the network that need security. This allows these new applications to benefit from the strong security of the Ethereum network without needing to set up their own validator system, and it allows stakers to potentially earn more rewards on their ETH. By utilizing the extensive network of transaction validators on Ethereum, EigenLayer seeks to enhance the typical 3% yield from staking, albeit with added risks.

According to an article by Bloomberg News published earlier today, the eagerly awaited launch of EigenLayer’s new token, $EIGEN, has captured significant attention within the decentralized finance (DeFi) sphere. Since its soft launch in 2023, the project has apparently amassed $14 billion in assets and is poised to distribute its tokens via an airdrop this Friday. Despite the anticipation, the launch has stirred controversy due to the exclusion of users from several countries, including the United States, Canada, and China.

The success of the project is partly driven by a points system that rewards early adopters with EIGEN tokens, attracting numerous users keen on accumulating points for the airdrop. However, recent revelations that virtual private network (VPN) users and residents of certain countries are ineligible to claim tokens have sparked disillusionment within the crypto community.

Addressing the exclusion issue, Robert Drost, executive director at the Eigen Foundation, discussed the necessity of complying with regulatory guidelines during a recent podcast. He acknowledged the regulatory ambiguities that compel many projects to adopt conservative approaches in token distribution.

The unfolding drama around EigenLayer’s token launch underscores the intricate challenges DeFi projects face in navigating a complex regulatory landscape. Nick Cote, co-founder of Secondlane, highlighted the critical need for transparency. He noted that issuers who omit details about jurisdictional restrictions risk alienating their user base, potentially leaving a “sour taste” when participants discover they are ineligible for rewards.

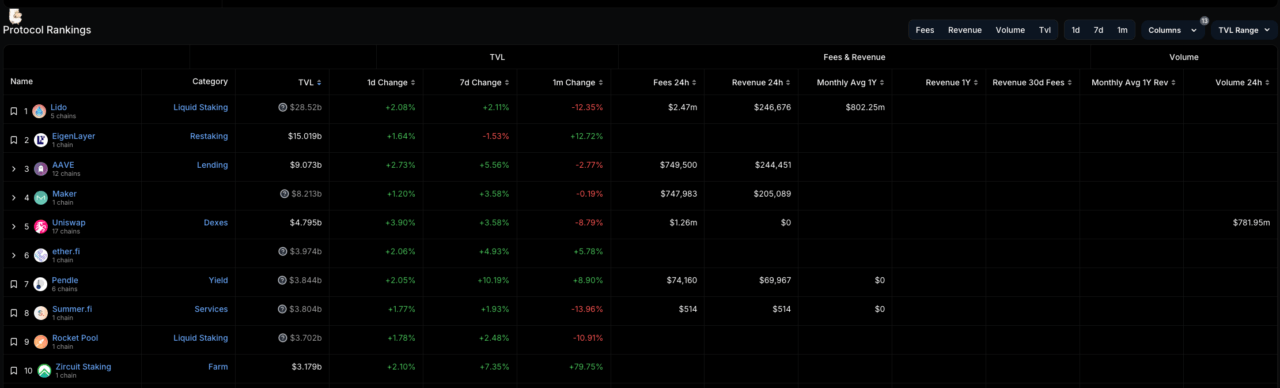

The Bloomberg article went on to say that despite these controversies, EigenLayer has rapidly ascended to become the second most popular DeFi application, edging out established liquid staking protocols like Lido and Rocket Pool. These platforms have experienced a 27% drop in total value locked since their peak in March. Meanwhile, nearly 4% of all Ether is now restaked through EigenLayer, signaling a significant shift in user preferences within the DeFi landscape.

Featured Image via Pixabay