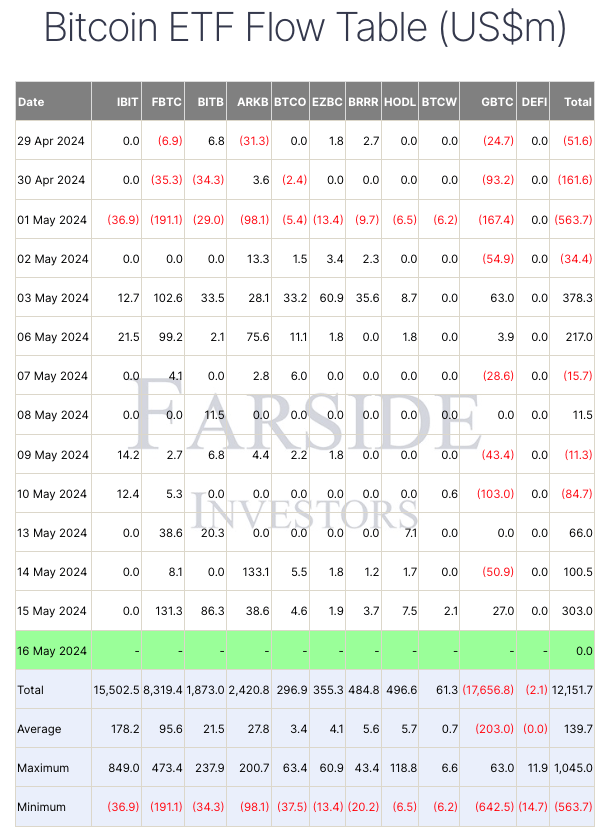

Matt Hougan, Chief Investment Officer of Bitwise Asset Management, recently published an in-depth analysis of the success of the 11 spot Bitcoin ETFs approved by the U.S. Securities and Exchange Commission (SEC) on 10 January 2024. Since their launch, these ETFs have attracted over $12.15 billion in assets, making them collectively the most popular ETF launch in history.

Hougan emphasizes the significance of identifying whether professional or retail investors are driving these inflows. The involvement of professional investors is particularly important because it suggests a substantial and growing pool of capital investing in Bitcoin. Initially, it was challenging to determine the source of the inflows due to the anonymous nature of ETF purchases through brokerage accounts. However, quarterly “13F” filings, mandated by the SEC for investors managing more than $100 million in publicly traded securities, have provided clarity.

Analyzing 13F filings as of 9 May 2024, Hougan discovered that numerous professional investment firms own substantial amounts of Bitcoin ETFs. Notable firms include Hightower Advisors, Bracebridge Capital, Cambridge Investment Research, Sequoia Financial Advisors, Integrated Advisors, and Brown Advisory. Collectively, 563 professional investment firms reported owning $3.5 billion worth of Bitcoin ETFs. Hougan anticipates that by the 15 May filing deadline, this number could exceed 700 firms, with total assets under management (AUM) nearing $5 billion.

Hougan says this level of professional investor involvement is unprecedented for a new ETF launch. He says that Bloomberg ETF analyst Eric Balchunas has described the scale of ownership as “bonkers,” highlighting its historical significance.

According to the Bitwise CIO, despite the impressive professional participation, retail investors currently hold the majority of the Bitcoin ETF assets, accounting for approximately 90% of the total $50 billion in AUM.

Hougan points out that this high level of retail investment should not overshadow the significant institutional interest. He explains that professional investors typically follow a phased approach to new asset classes, involving due diligence, personal allocations, isolated client allocations, and eventually platform-wide allocations. Hougan believes the initial allocations seen in the 13F filings represent only the beginning of a broader trend. For example, he points out that Hightower Advisors’ $68 million allocation to Bitcoin ETFs is just 0.05% of their total assets, suggesting considerable potential for future growth.

Hougan concludes that the substantial initial investments by professional firms are a promising indicator of Bitcoin’s growing acceptance and integration into traditional financial portfolios.

Featured Image via Pixabay