According to Bloomberg, the 90-day correlation coefficient between Bitcoin and the Nasdaq 100 index, a tech-heavy benchmark, reached 0.46 this week—the highest since late August. A coefficient of 1 indicates that assets move in perfect sync, while -1 suggests they move in opposite directions. Per the article, when the Fed began raising rates in early 2022, the correlation peaked at over 0.8, the highest since Bitcoin gained mainstream recognition.

Joshua Lim, co-founder of Arbelos Markets, told Bloomberg that investors are increasingly viewing crypto as a growth asset, valuing its technological capabilities and function as a value transfer mechanism. This perspective aligns Bitcoin more closely with growth-oriented assets like tech equities.

Bitcoin has been variously described as digital gold, an inflation hedge, and a store of value. However, its price volatility has challenged these narratives. The U.S. approval of spot Bitcoin ETFs in January directly introduced the cryptocurrency to a broader investor base.

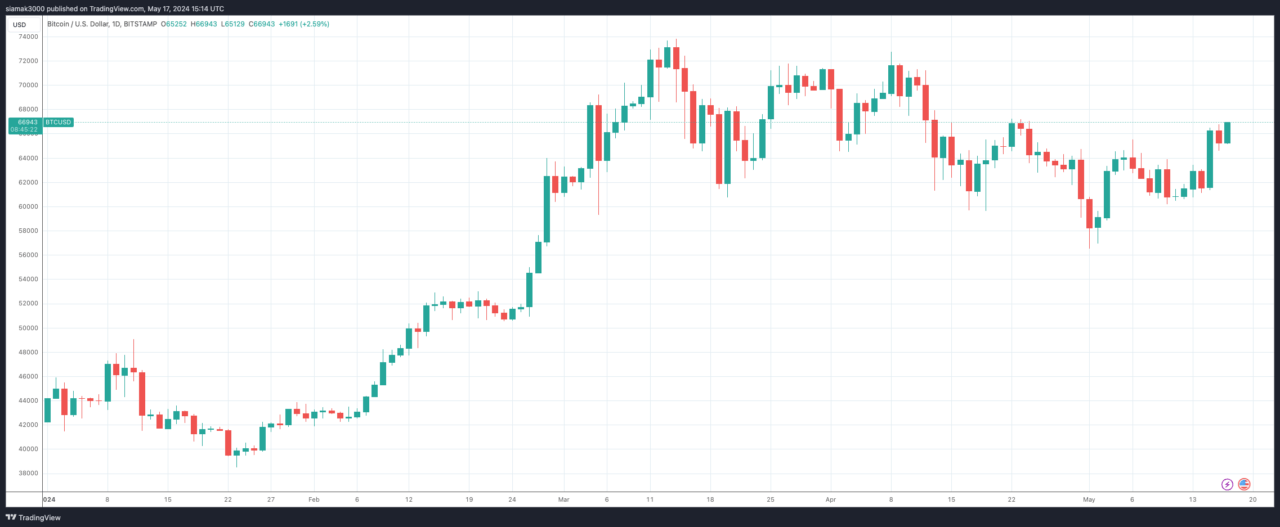

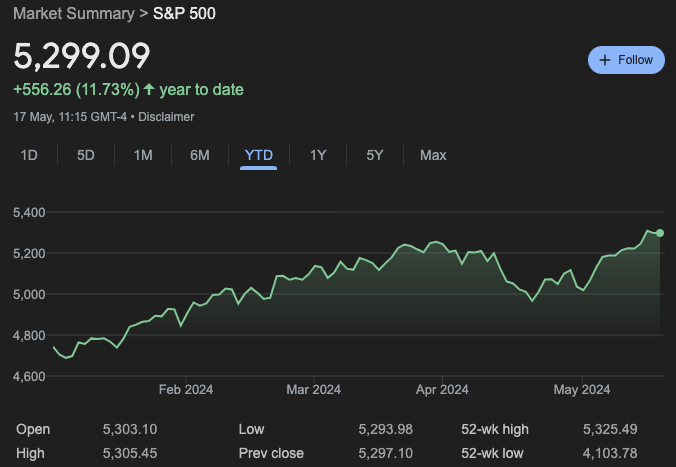

Toby Winterflood, Chief Product Officer at CCData, said to Bloomberg that since the beginning of 2024, Bitcoin’s correlation with the S&P 500 has risen, which challenges its reputation as a store of value. He attributes Bitcoin’s recent highs to the maturation of these ETFs, which have rapidly grown to become some of the fastest in history. Bitcoin surged following the launch of these ETFs on January 11, reaching nearly $74,000 in March before stabilizing as demand cooled. On Friday, Bitcoin rose by about 2.3% to around $67,064, marking a nearly 10% increase this week. Year-to-date, Bitcoin has jumped approximately 60%, compared to an 11.73% rise in the S&P 500 and a 12.19% increase in the Nasdaq-100.

Lim pointed out that traditional investors started paying more attention to Bitcoin due to catalysts like US ETFs, its record high in March, and the halving event in April. Now, apparently, with these catalysts behind, the focus has shifted to the broader macroeconomic picture.

On May 15, the U.S. Bureau of Labor Statistics announced yesterday that the Consumer Price Index for All Urban Consumers (CPI-U) rose by 0.3 percent in April on a seasonally adjusted basis, following a 0.4 percent increase in March. Over the past 12 months, the all-items index has climbed 3.4 per cent before seasonal adjustment. Despite this progress, Bloomberg says, several Fed officials have suggested maintaining higher borrowing costs to ensure inflation continues to decline, indicating they are not in a hurry to cut rates.

Featured Image via Pixabay