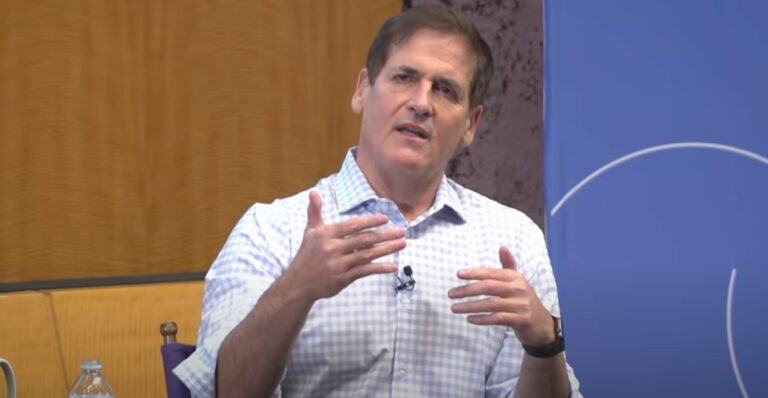

Billionaire investor and entrepreneur Mark Cuban has recently unleashed a series of scathing posts on the social media platform X (formerly Twitter), targeting the U.S. Securities and Exchange Commission (SEC) and its chairman, Gary Gensler, for their approach to regulating the cryptocurrency industry. Cuban’s criticism highlights the growing frustration among crypto enthusiasts and investors who believe that the SEC’s current stance is hindering innovation and failing to adequately protect investors.

In his posts, Cuban argues that the SEC’s regulatory approach has made it nearly impossible for legitimate crypto companies to operate in the United States. He contends that the complex and time-consuming registration process, which can take hundreds of hours for securities lawyers to complete, has discouraged entrepreneurs from launching their projects in the country. Cuban believes that this has led to the loss of countless businesses and has shattered the dreams of many aspiring entrepreneurs.

Moreover, Cuban asserts that the SEC’s actions have not effectively protected investors against fraud. He points out that despite the agency’s claims of safeguarding investor interests, it has failed to prevent major scandals like the collapse of FTX. In contrast, Cuban highlights Japan’s regulatory approach, which he believes has been more successful in protecting investors and fostering a healthy crypto ecosystem.

The billionaire investor also warns that the SEC’s stance on crypto could have political consequences, particularly in the upcoming U.S. presidential election. He suggests that if President Joe Biden loses the election, it could be attributed to Gensler and the SEC’s handling of the crypto industry. Cuban argues that younger and independent voters, who make up a significant portion of the crypto community, could voice their dissatisfaction at the polls.

Cuban calls on Congress to take action and address the regulatory challenges facing the crypto industry. He proposes two potential solutions: either pass legislation that defines a specific registration process tailored to the crypto industry, similar to other industries or assign the regulation of all crypto-related matters to the Commodity Futures Trading Commission (CFTC). By doing so, Cuban believes that the U.S. could create a more conducive environment for crypto businesses to operate while ensuring proper investor protection.

Furthermore, Cuban criticizes the SEC for its apparent unwillingness to streamline the registration process, making it more accessible to entrepreneurs. He suggests that the agency has enough experience to modify the application process, making it easier for companies to comply with regulations. However, he believes that the SEC deliberately maintains a complex and burdensome process to discourage token releases in the United States.

As a result of the SEC’s approach, Cuban states that he now rejects investment opportunities involving token releases. He explains that this decision is not based on the merits of the companies themselves but rather on the SEC’s obstruction of their operations. The high costs and legal fees associated with attempting to register and comply with the SEC’s requirements make it virtually impossible for these companies to function effectively.

Cuban argues that the SEC’s actions have created a destructive environment that could easily be remedied by adopting a more pragmatic approach to regulation. He believes that the crypto industry is eager to comply with regulations and wants to eliminate speculative noise. However, as he points out, the SEC’s current stance makes it difficult for legitimate companies to distinguish themselves from “junk tokens,” leaving investors with little guidance on separating credible projects from fraudulent ones.

Featured Image via YouTube