CCData, an FCA-authorized benchmark administrator and a leading figure in digital asset data, offers institutional-grade insights into the digital asset landscape. By harnessing tick data from globally recognized exchanges and integrating various datasets seamlessly, CCData provides a comprehensive view of the market, covering trade, derivatives, order books, historical, social, and blockchain data.

In recent times, the stablecoin sector has witnessed significant growth and garnered increased attention. Serving as a vital tool for trading digital assets, stablecoins facilitate the transition of fiat-pegged funds into blockchain applications. However, recent events such as Tether’s collateral concerns and TerraUSD’s collapse have sparked apprehension among investors and regulators alike.

CCData’s Stablecoins Report aims to capture pivotal developments within the stablecoin domain. The report delves into market capitalization and trading volume, segmented by collateral type and pegged asset. Conducted on a monthly basis, the report caters to a broad audience, including crypto enthusiasts seeking an overview of the stablecoin landscape and stakeholders such as investors, analysts, and regulators seeking detailed analysis.

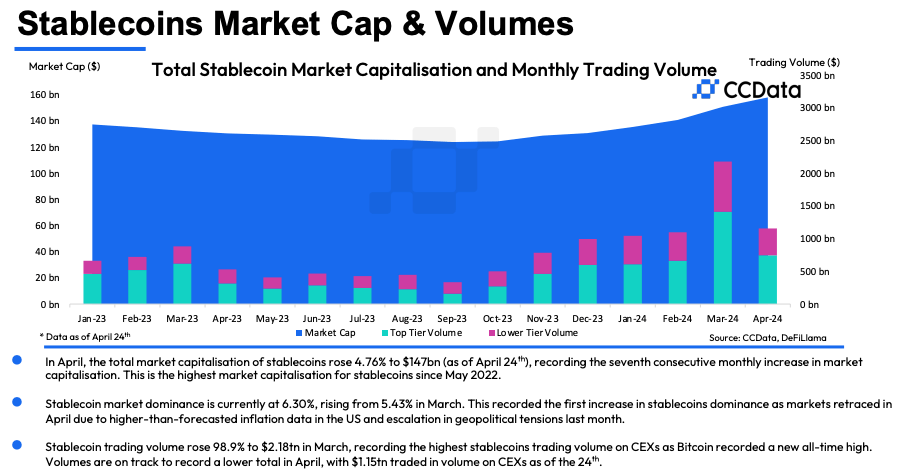

The April 2024 edition of this report highlighted a remarkable 4.76% increase in the total market capitalization of stablecoins, reaching an impressive $158 billion. This surge marked the seventh consecutive monthly increase, culminating in the highest end-of-month market cap since May 2022. Notably, the stablecoin market added $27.1 billion since the beginning of the year, mirroring the recent surge in trading activity and overall market performance.

One standout from the report was the exceptional performance of FDUSD, which experienced a staggering 77.6% increase in market capitalization, soaring to a new all-time high of $3.89 billion. As the fourth-largest stablecoin, FDUSD continued to solidify its position in the market, with trading pairs registering nearly $388 billion in March alone. The stablecoin maintained its status as the second most popular choice among traders on centralized exchanges (CEXs).

The report also unveiled unprecedented trading volume highs for stablecoins, driven by increased market volatility and positive sentiment following Bitcoin’s surpassing of its previous all-time high in March. Trading volume on CEXs surged by an astounding 98.9% to reach $2.18 trillion in March, marking an all-time high for stablecoin trading volume on centralized exchanges. USDT dominated the landscape, accounting for a significant 77.8% share of the volumes.

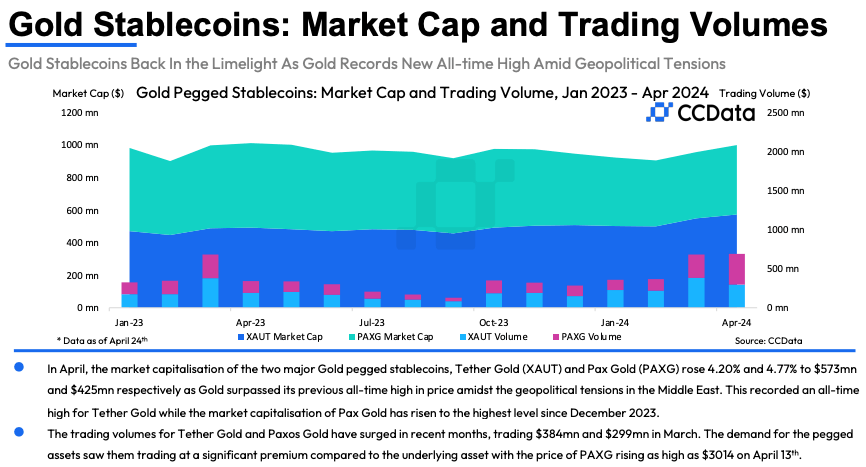

In April, major gold-pegged stablecoins, including Tether Gold (XAUT) and Pax Gold (PAXG), witnessed substantial growth in market capitalization, rising by 4.20% and 4.77%, respectively. This increase, totaling $573 million for XAUT and $425 million for PAXG, coincided with a surge in gold prices driven by geopolitical tensions in the Middle East. The heightened demand for gold-backed stablecoins led to premium trading prices on centralized exchanges, with PAXG peaking at $3014 on April 13th.