Russia is set to introduce a ban on organizing the circulation of cryptocurrencies from September 1, according to Anatoly Aksakov, Chairman of the State Duma Committee on the Financial Market. The decision, as reported by local news outlet National News Service (NSN), will allow only digital financial assets issued within the Russian jurisdiction.

Anatoly Gennadyevich Aksakov is a prominent figure in Russian political and financial circles, serving as the Deputy of the State Duma of the Federal Assembly of the Russian Federation. He holds the influential position of Chairman of the State Duma Committee on Financial Market and extends his leadership to the financial sector as the Chairman of the Council of the Association of Banks of Russia.

His involvement extends regionally as the Chairman of the Supreme Economic Council of the Chuvash Republic. A committed member of the “Just Russia – Patriots – For Truth” political party, he is also a member of the National Financial Board of the Bank of Russia and the Interregional Banking Council under the Federation Council.

His expertise is further recognized through his memberships in the Advisory Council for the Development of the National Payment System under the Governor of the Bank of Russia, the Expert Council for Financial Literacy under the Ministry of Finance, and the Management Board of the Russian Union of Industrialists and Entrepreneurs (RSPP). In 2022, the UK government sanctioned him in relation to the Russo-Ukrainian War.

According to the NSN report, a group of State Duma deputies led by Aksakov recently re-introduced a bill to the lower house of parliament, proposing to regulate mining activities and ban the organization of digital currency circulation in Russia. The document outlines exceptions for miners of digital currencies, mining pools, and test projects of the Central Bank within the experimental legal regime framework.

Aksakov stressed that the decision to ban cryptocurrency circulation had been made, explaining, “We are talking about a ban on transactions with bitcoins and other cryptocurrencies. Digital financial assets issued in Russian jurisdiction, digital rubles, will be allowed. The need for a ban is due to the fact that today cryptocurrency is a quasi-currency that replaces the ruble in the country. But only the Russian ruble fulfills the mission of a monetary unit, which is why this decision was made. From September 1, the ban will be introduced.”

The Bank of Russia is advocating for the establishment of a mechanism for international payments using cryptocurrencies, although it maintains a stance against the domestic circulation of such currencies, according to statements made by Central Bank chief Elvira Nabiullina in the State Duma, as reported by the TASS news agency on April 10.

Nabiullina highlighted the central bank’s support for cryptocurrencies as a medium for international transactions but reiterated its long-standing position against their use within the national economy. Additionally, she emphasized the urgency of passing legislation that would allow cryptocurrency transactions in an experimental legal framework for international payments, underscoring a cautious approach to integrating digital currencies into Russia’s financial system.

Update at 4:45 p.m. UTC on April 29:

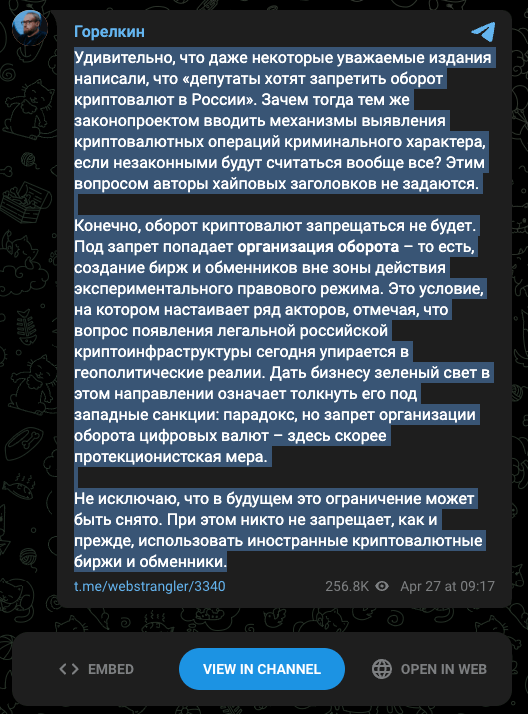

In a recent clarification on the state of cryptocurrency regulations in Russia, Anton Gorelkin, Deputy Chairman of the State Duma Committee on Information Policy, Information Technologies, and Communications, addressed misconceptions circulated in the media. As reported by Finbold, Gorelkin responded to widespread reports suggesting an outright ban on cryptocurrencies in Russia, labeling such claims as misrepresentations.

Gorelkin used Telegram to express his concerns, highlighting that some reputable publications inaccurately reported that “deputies want to ban the circulation of cryptocurrencies in Russia.” He questioned the logic behind such reports, asking why there would be legislative efforts to identify cryptocurrency transactions linked to criminal activities if all such transactions were to be deemed illegal.

He clarified that the proposed regulations do not aim to prohibit the circulation of cryptocurrencies. Instead, per his statement, the focus is on restricting the organization of crypto exchanges and exchangers outside the experimental legal frameworks established by the government. According to Gorelkin, this measure is not an outright ban but a protective strategy to safeguard the budding Russian crypto infrastructure from potential Western sanctions. This approach, according to Gorelkin, stems from current geopolitical realities, where setting up a domestic exchange could inadvertently expose businesses to international sanctions.

Gorelkin also noted the paradox in these regulations, describing them as protective rather than restrictive. He remains optimistic about the future, suggesting that these restrictions might be lifted as the geopolitical and regulatory landscape evolves. Gorelkin says, for now, the use of foreign cryptocurrency exchanges and exchangers remains permissible, offering a temporary solution for Russian crypto traders and investors.

Featured Image via Pixabay