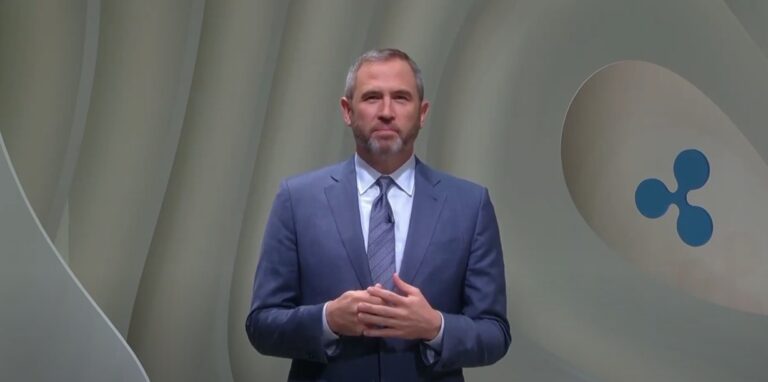

In an insightful dialogue with CNBC, Brad Garlinghouse, the Chief Executive Officer of Ripple, articulated a robust and optimistic projection for the cryptocurrency sector, envisaging the market’s total value catapulting to $5 trillion over the course of the year, according to CNBC. Garlinghouse’s forecast is rooted in an analysis of significant macroeconomic developments and sector-specific milestones, notably the advent of the inaugural U.S. spot bitcoin ETFs and the forthcoming bitcoin halving event.

Garlinghouse’s tenure in the crypto industry has endowed him with a deep understanding of its cyclical nature, reinforcing his confidence in the market’s capacity for growth. He pointed to the introduction of spot Bitcoin ETFs in the U.S. in January as a watershed moment, attracting substantial institutional investment for the first time, which, when juxtaposed with a tightening supply and escalating demand, presages an upward trajectory in market value.

Further elaborating on the mechanics propelling the market, Garlinghouse highlighted the Bitcoin halving, an engineered scarcity event that reduces the rewards for Bitcoin mining, thereby decelerating the introduction of new bitcoins into circulation. This event, scheduled for later in the month, coupled with the ETFs’ launch on January 11, is poised to significantly influence the market’s dynamics.

The Ripple CEO said:

“The overall market cap of the crypto industry … is easily predicted to to double by the end of this year … [as it’s] impacted by all of these macro factors.“

As of 9:00 a.m. UTC on April 8, the total crypto market cap is roughly around $2.77 trillion with Bitcoin trading at $71,989 (up 3.7% in the past 24-hour period).

Garlinghouse also brought attention to the prevailing sentiments and regulatory landscape in the United States, which, despite being challenging, shows signs of evolving favorably for the crypto industry. He underscored the significance of the U.S. market in the global economic arena and expressed optimism for a regulatory environment that would foster the industry’s growth. His commentary extends beyond Ripple, reflecting a broader industry anticipation for a policy shift that could catalyze market expansion.

According to CNBC’s article, echoing Garlinghouse’s sentiments, other industry stalwarts have voiced similar forecasts for the crypto market’s growth potential. Among them is Marshall Beard from Gemini, who predicts a significant upsurge in Bitcoin’s price, further corroborating the industry’s bullish outlook.