Ray Dalio is the Founder of Bridgewater Associates, where he serves as a CIO Mentor and remains an active member of the firm’s board. He is known for his principle-based approach to investing, emphasizing the study of historical economic cycles to mitigate risks. His focus on data-driven analysis and a deep understanding of macroeconomic forces have been instrumental in Bridgewater’s long-term success. Dalio is also the author of “Principles: Life and Work,” sharing his unique management philosophies and insights into building a successful organization.

Dalio begins by defining good money as being both a good medium of exchange and a good storehold of wealth that is widely accepted around the world. He identifies the dollar, euro, yen, and Chinese renminbi as the most globally recognized and accepted currencies, noting that they are all debt-backed monies. Dalio explains that when you hold these monies, you are holding debt liabilities, which are promises to deliver you money.

However, Dalio cautions that when there are significant risks of debts not being paid back or being paid back with money of depreciated value, the debt and the money become unattractive. He points out that when a government has too much debt to be paid, its central bank is likely to print money, leading to inflation and the devaluation of the currency.

In contrast to debt-backed currencies, Dalio highlights gold as a non-debt-backed form of money. He compares it to cash, except unlike cash and bonds, which are devalued by risks of default or inflation, gold is supported by risks of debt defaults and inflation. Dalio notes that gold is the third-most-held reserve currency by central banks, surpassing the yen and renminbi.

Dalio also acknowledges cryptocurrencies as another form of non-debt money, while suggesting that some people might argue that gems and art act similarly due to their non-debt nature, portability, and wide acceptance as storeholds of wealth.

According to Dalio, when the financial system is functioning well, with borrower-debtor governments meeting their obligations without resorting to money printing and devaluation, debt assets and other financial assets are good to hold. However, he emphasizes that when debt and inflation crises arise, gold becomes a valuable asset to own. Dalio states that this is the main reason that gold is a good diversifier and why he has some in his portfolio.

In a postscript, Dalio clarifies that he is sharing his thoughts on investments but not providing investment advice. He notes that he is not recommending that you buy gold. Dalio explains that in his communications, he is trying to convey how the markets work, explain what he thinks you should be aware of, and give some strategic investment thinking.

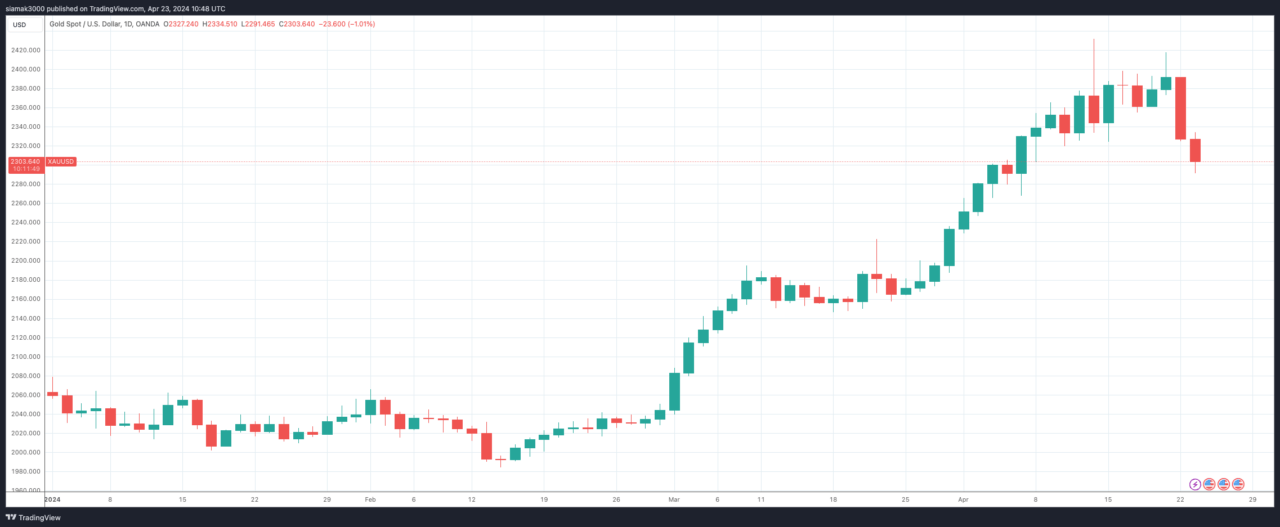

At the time of writing (10:45 a.m. UTC on April 23), gold is trading at $2,303.21 an ounce, down 1.3% on the day.

Featured Image via Unsplash