Pantera Capital has emerged as one of the successful bidders in the latest auction of Solana tokens, orchestrated by the administrators overseeing the bankruptcy proceedings of the now-defunct cryptocurrency exchange, FTX. According to a report by Bloomberg News, this recent development involves the acquisition of approximately 2,000 SOL tokens, a sale that has not been publicly disclosed, as per sources close to the matter.

Bloomberg says the identities of the individuals involved and the finer details of the transaction remain confidential, with those privy to the information choosing to remain anonymous. Both Pantera Capital and the representatives of the FTX estate have been contacted for comments but have yet to respond.

This sale is apparently part of a larger effort by the FTX estate to liquidate its holdings, which included a significant stash of Solana tokens valued at around $2.6 billion. Earlier this month, the estate managed to offload about two-thirds of these tokens in a deal that attracted major cryptocurrency players like Pantera and Galaxy Digital. The tokens sold in this and prior auctions are subject to a pre-agreed vesting period, rendering them non-tradable on the open market until they are gradually released over the next four years.

Interestingly, per the Bloomberg article, the sale price for the Solana tokens in this recent auction was reported to be higher than the previous rate of approximately $60 per token. This suggests a growing confidence in the value of Solana despite the broader market challenges that have plagued the token in the past. Industry insiders anticipate further auctions as the FTX estate continues to divest its cryptocurrency assets.

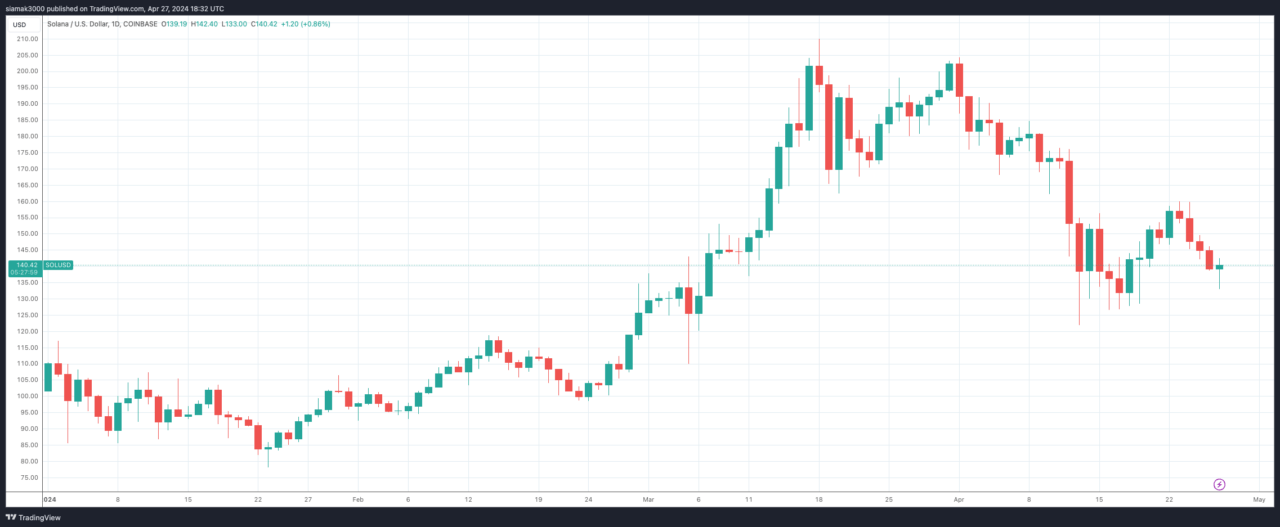

At the time of writing (6:30 p.m. UTC on April 27), SOL is trading at around $140.66, down 2.0% in the past 24-hour period. In the year-to-date period, SOL is up 34.91%.

Popular pseudonymous crypto analyst “Altcoin Sherpa” believes that the SOL price could go over $500 before the end of this year: