Costco, the well-known warehouse retailer, has apparently become a go-to destination for Americans looking to invest in gold bars, according to an article published by The Wall Street Journal (WSJ). The retail giant began offering gold bars online and in select stores last year, and the response has been overwhelming. Costco has reported selling out of the precious metal within hours of restocking, as consumers seek a safe haven for their money amidst economic uncertainty and fears of inflation, as reported by the WSJ.

The demand for gold among Costco shoppers is driven by a variety of factors, as per the WSJ article. Many buyers, particularly millennials, view gold as a hedge against potential catastrophes, such as natural disasters, wars, and financial calamities. The COVID-19 pandemic, along with ongoing conflicts in Ukraine and the Middle East, has heightened these concerns, leading more people to seek out tangible assets like gold, claims the WSJ report.

The WSJ article also mentions that inflation in the U.S. has also played a significant role in the surge of gold purchases at Costco. Some customers have expressed eroding trust in the U.S. dollar due to inflation. As a result, they have increased their investments in physical silver and gold to diversify their portfolios, which also include traditional assets like 401(k)s, stocks, and cryptocurrencies.

Interestingly, millennials are more optimistic about the benefits of gold compared to older generations, as per the WSJ, which cites research by financial services company State Street revealing that the average millennial allocates 17% of their investments to gold, including exchange-traded funds (ETFs), while Gen X and baby boomers allocate only 10% of their portfolios to the precious metal. This trend is likely influenced by a combination of economic uncertainty and a growing distrust in the financial system, particularly after a series of bank failures in 2023.

Costco’s decision to offer gold bars has made it easier for consumers to invest in the precious metal. Despite per-customer limits, many gold buyers have reported that Costco’s prices are lower than those offered by other retailers. In 2023, the warehouse retailer sold an impressive $100 million in gold bars and later expanded its inventory to include silver coins. These precious metal sales contributed to an 18% year-over-year growth in e-commerce sales for Costco during its most recent quarter, as per the WSJ article.

While gold has historically performed better during economic downturns, its rise in popularity among Costco shoppers is notable given the continued growth of the economy and cooling inflation in 2023, according to the WSJ.

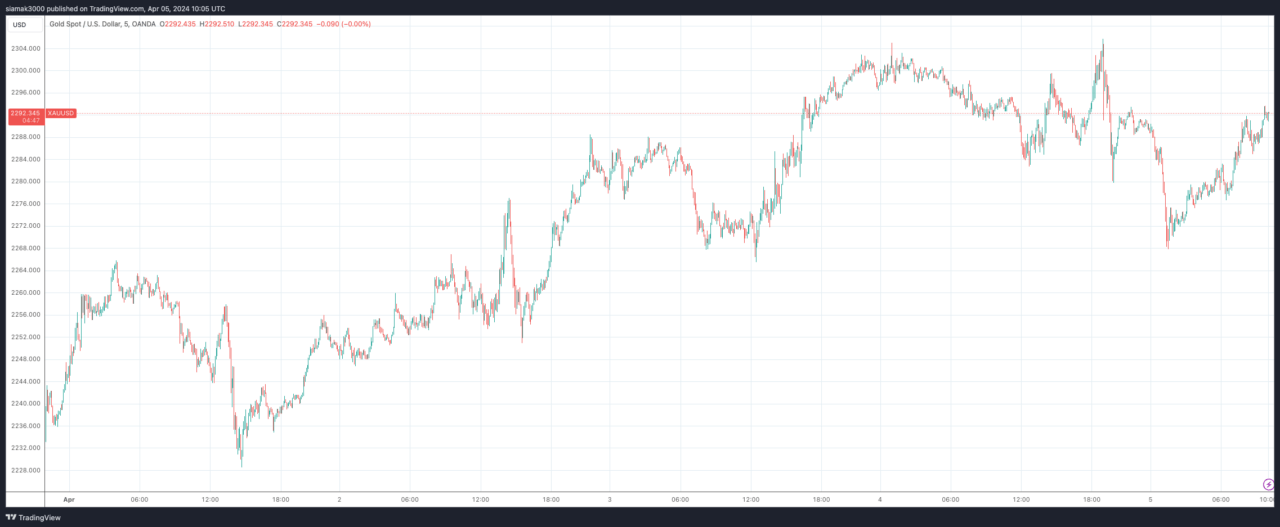

On Thursday, the gold price hit a new all-time high of $2,305.65 an ounce. At the time of writing (10:05 a.m. UTC on April 5), gold is trading at $2,292.61, essentially flat on the day.

A CNBC report on April 1 conveyed Joseph Cavatoni from the World Gold Council’s enthusiasm for the present market trends, underscoring an increased optimism among investors. This optimism is seemingly driven by expectations of imminent rate cuts by the Federal Reserve, with the financial community anticipating a decrease in interest rates by June, further enhancing gold’s appeal.

Per the CNBC report, despite the personal consumption expenditures price index, excluding food and energy, rising by 2.8% over 12 months as of February, the Federal Reserve held its interest rate position during its March assembly, forecasting three reductions over the year.

CNBC also looked at gold’s price behavior as an intriguing aspect of economic interrelations, especially its negative correlation with interest rates. With a fall in interest rates, gold turns into a more appealing option relative to fixed-income assets like bonds, which see reduced returns in a lower interest rate environment. This principle is central to gold’s impressive performance in the current market.

The surge in gold prices is also propelled by strong international demand, CNBC added, with Caesar Bryan from Gabelli Funds highlighting China’s growing gold interest. This interest is attributed partly to the real estate sector’s lackluster performance and the broader economic hurdles the country faces. Amidst signs of economic slowdown, with both the stock market and currency facing difficulties, gold stands out as a stable investment choice for private investors in China.

Central banks’ purchasing power significantly contributes to the rising gold prices as they seek to diversify their reserves amid geopolitical uncertainties, domestic inflation fears, and fluctuations in the U.S. dollar’s value, as per CNBC. Cavatoni emphasized this vigorous buying trend, making a solid argument for gold’s position, though the persistence and impact of this trend remain to be seen.

Featured Image via Pixabay