Veteran analyst and trader Peter Brandt has shared his thoughts on the historical performance of Bitcoin’s bull market cycles in a blog post published on April 26. Brandt presents data that suggests a troubling pattern of exponential decay in the magnitude of Bitcoin’s price advances over the years.

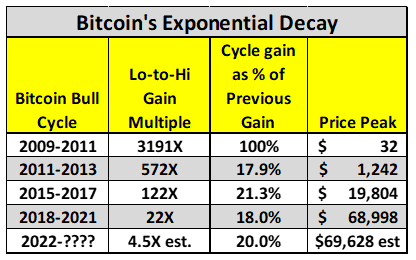

According to Brandt, there have been four major bull cycles in Bitcoin, with the current advance being the fifth. He lists the cycles and their respective price advances as follows:

- Dec 21, 2009 to Jun 6, 2011 [3,191X advance]

- Nov 14, 2011 to Nov 25, 2013 [572X advance]

- Aug 17, 2015 to Dec 18, 2017 [122X advance]

- Dec 10, 2018 to Nov 8, 2021 [22X advance]

- Nov 21, 2022 to xxx x,, yyyy [high so far is $73,835 registered on Mar 14, 2024]

Brandt points out that the magnitude of each successive bull cycle has been approximately 20% of the previous cycle, indicating that 80% of the exponential energy of each successful bull market cycle has been lost. Applying this pattern to the current cycle, Brandt projects a potential high of around $72,723, a price that has already been reached.

While acknowledging the potential impact of the recent Bitcoin halving, which has historically been followed by significant price increases, Brandt emphasizes the need to consider the exponential decay pattern. He places a 25% chance that Bitcoin has already topped for this cycle.

In the event that Bitcoin has indeed topped, Brandt suggests a potential decline back to the mid-$30s or the 2021 lows. However, he notes that from a classical charting perspective, such a decline could be considered the most bullish scenario for Bitcoin’s long-term prospects, citing the Gold chart from August 2020 to March 2024 as an example of a similar chart structure.

Although Brandt admits that he doesn’t want to believe the analysis he presents, he maintains that the data speaks for itself. He stresses the importance of dealing with the fact of exponential decay, even if it may be an unpleasant reality for Bitcoin investors, including himself, as Bitcoin is one of his largest personal investment positions.

Featured Image via Pixabay