A recent Bloomberg News article suggests that optimistic Bitcoin traders are dialing back their bets on the leading cryptocurrency as two significant driving forces – robust inflows into U.S. spot Bitcoin ETFs and the hype surrounding the Bitcoin halving event – lose steam.

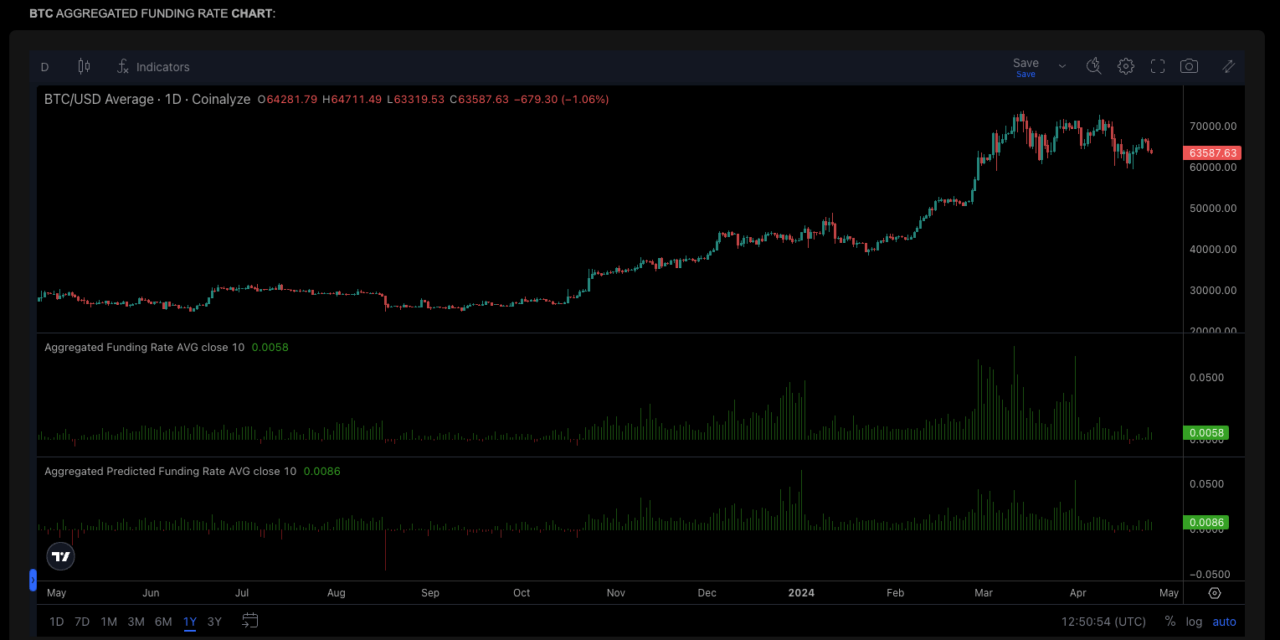

As reported by Bloomberg, the Bitcoin funding rate, which represents the premium traders pay to open new long positions in the perpetual futures market, dipped into negative territory on April 19, marking the first such occurrence since October 2023. This shift implies a cooling of demand for Bitcoin following a period of all-time highs propelled by the launch of ten US-listed spot Bitcoin ETFs on January 11.

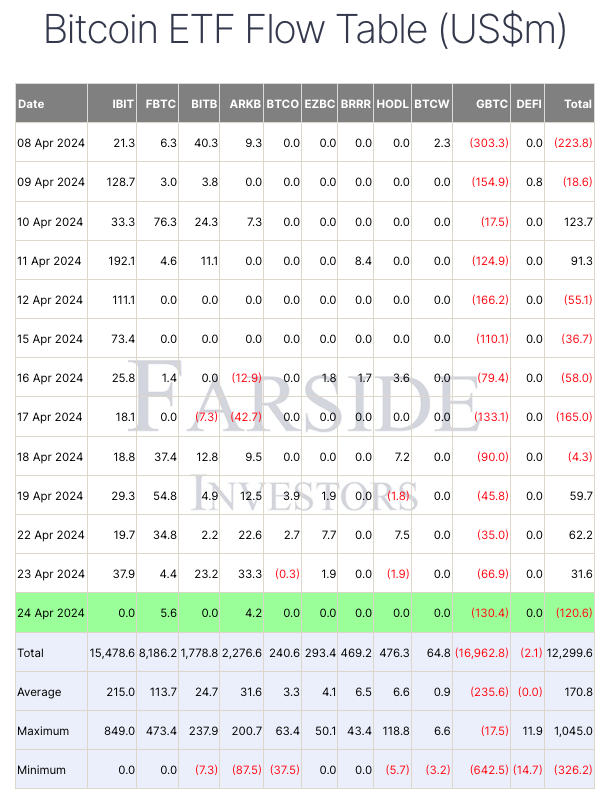

The article notes that net inflows into these ETFs have decreased in recent weeks, while the long-awaited Bitcoin halving event, which took place last week and cut the supply of new coins, had a limited effect on the cryptocurrency’s price.

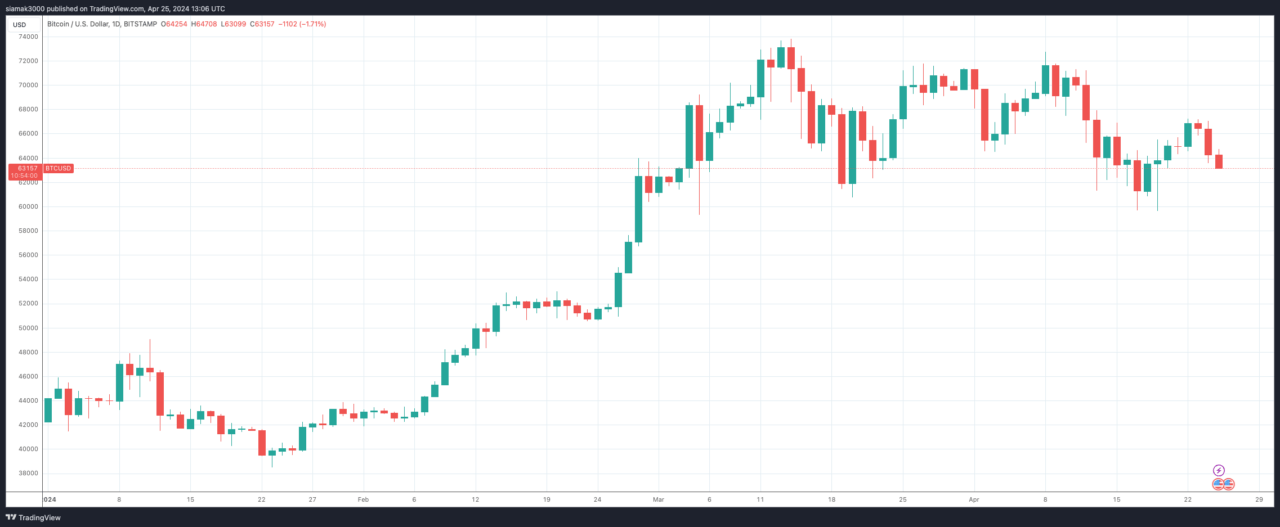

Bloomberg says that Bitcoin hit a peak of $73,798 in March but has since experienced a nearly 13% correction, trading at $64,214 as of Thursday morning in London.

The waning enthusiasm for Bitcoin among buyers is partly attributed to increasing risk aversion stemming from tensions in the Middle East and expected delays in Federal Reserve rate cuts, according to the article. Julio Moreno, Head of Research at CryptoQuant, is quoted saying that the negative funding rate indicates a decreased desire among traders to open long positions.

Bloomberg also cites Vetle Lunde, an analyst at K33 Research, who pointed out that the current 11-day streak of neutral-to-below-neutral funding rates is uncommon, as previous dips were quickly followed by an influx of leveraged bets. Lunde suggests that this prolonged period of discounted perpetual futures could signal further price consolidation.

The article highlights that the decrease in the Bitcoin funding rate coincides with a decline in daily inflows into the US-based spot Bitcoin ETFs. Bloomberg’s data shows that these ETFs have attracted a net inflow of $170 million so far this month, a significant drop compared to the $4 billion they garnered during the same number of trading days in March.

Moreover, Bloomberg reports that open interest in Bitcoin futures at the Chicago-based CME Group has fallen 18% from its record high, signaling a diminishing interest in crypto-related exposure and hedging among U.S. institutions. As the crypto market looks for new driving forces, the article states that attention is turning to Hong Kong, which is set to launch its own batch of spot Bitcoin ETFs and spot Ethereum ETFs on April 30. However, it is uncertain whether these new products can attract even a small portion of the demand seen by U.S. issuers.

Featured Image via Pixabay