On April 22, Fidelity Digital Assets released its Q1 2024 Signals Report, providing valuable insights into the performance and dynamics of the two largest cryptocurrencies, Bitcoin and Ethereum. The report highlights the significant impact of Bitcoin’s 2024 halving and Ethereum’s Deneb-Cancun upgrade on their respective networks and the broader cryptocurrency market.

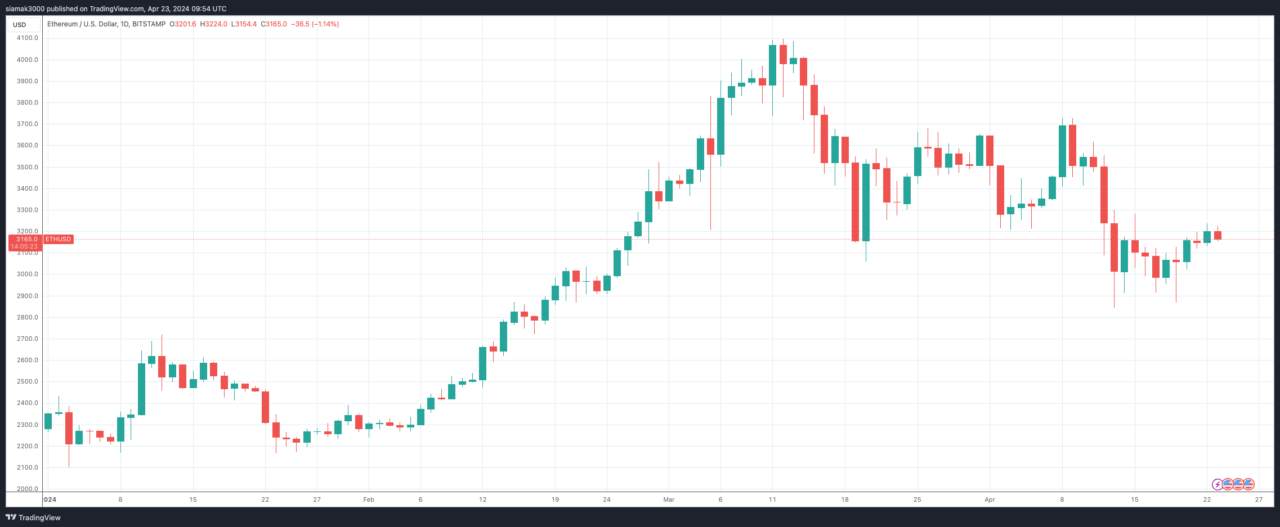

According to the report, Bitcoin experienced a strong start to the year, with a 64% price increase by mid-March, just short of Ethereum’s impressive 74% run. However, since then, Bitcoin has retraced 2%, while Ethereum has fallen by approximately 19%.

The report indicates that the high fee environment has subsided, but elevated spot prices and the anticipation of the 2024 halving have incentivized miners to take profits, contributing to the current sell pressure.

Despite the selling pressure, the report highlights positive developments for Bitcoin. The short-term outlook remains positive, with the price trading above the 200-day moving average and maintaining a position 156% higher than the realized price. The golden cross formed on October 30, 2023, also indicates a favorable market sentiment. However, long-term holders are adding to the selling pressure, and 99% of addresses are in profit, which could incentivize selling if the price reaches an all-time high.

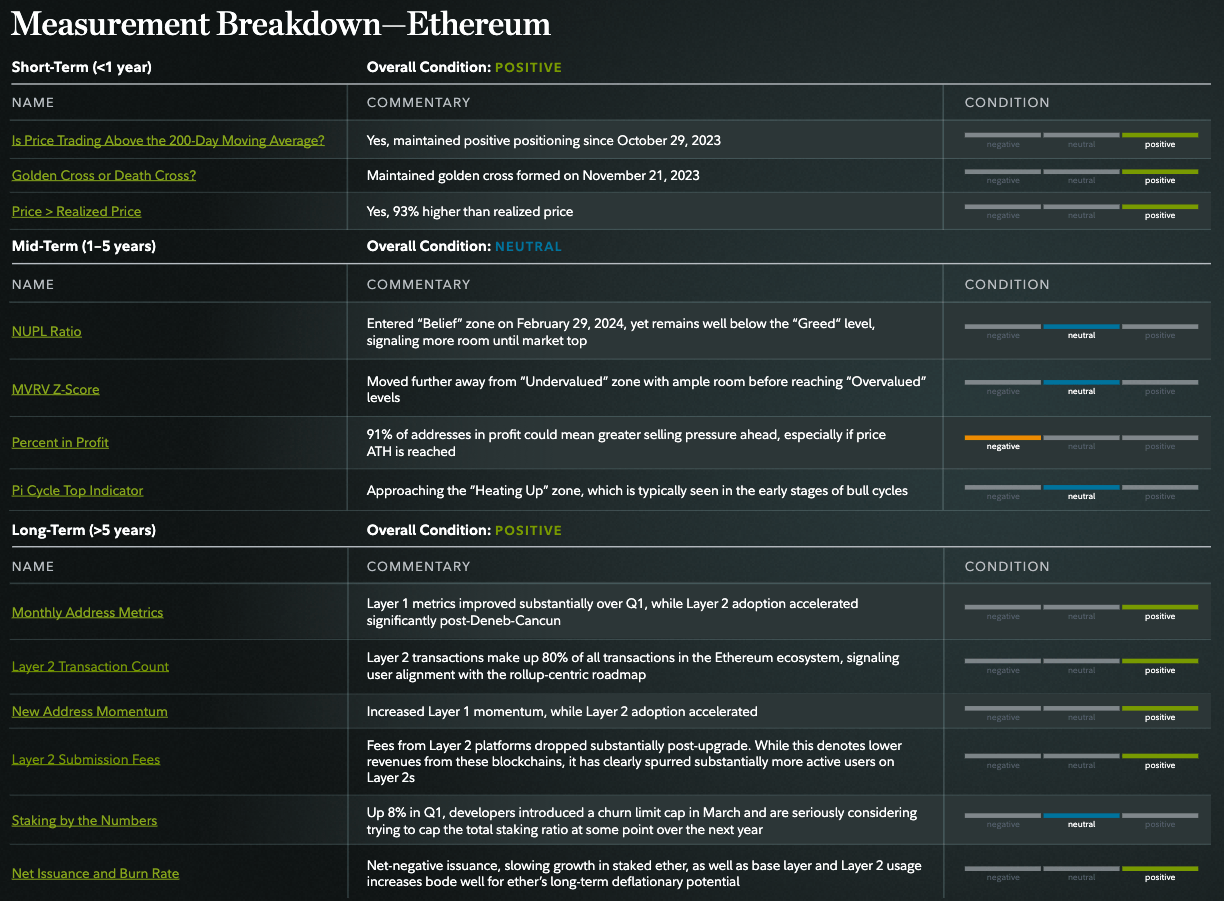

Fidelity argues that on the Ethereum front, the Deneb-Cancun upgrade, which took place on March 13, has significantly impacted the network’s fundamentals. The report suggests that users may be pleased with the results thus far, as Ethereum experienced a 55% price increase in Q1 and has shown positive short-term price signals and growing on-chain metrics. Fidelity says the short-term outlook for Ethereum remains positive, with the price trading above the 200-day moving average and the golden cross formed on November 21, 2023, indicating favorable market sentiment.

The Ethereum network has maintained a higher rate of burn than issuance since the implementation of The Merge in September 2022, resulting in the removal of nearly 450,000 ETH from the network. Additionally, the number of validators staking on the network has increased by 8% since January, matching the growth rate seen in Q4 2023. Layer 2 adoption has accelerated significantly post-Deneb-Cancun, with Layer 2 transactions making up 80% of all transactions in the Ethereum ecosystem and fees from Layer 2 platforms dropping substantially.

The report also highlights the growing interest in staking, with an 8% increase in Q1 developers introducing a churn limit cap in March. It claims this change aims to benefit long-term network health by making it easier for lower resource nodes to participate effectively in staking. It goes on to say the net-negative issuance, showing growth in staked Ether, as well as base layer and Layer 2 usage, increases bode well for Ether’s long-term deflationary potential.

Featured Image via Pixabay