The highly anticipated Bitcoin halving event is set to occur between April 19 and April 20, 2024. This quadrennial event, which cuts the supply of new bitcoins in half, has historically set the stage for new market cycles and bull runs. However, as CNBC explained in a recent article, the 2024 halving is shaping up to be a unique event due to several factors that could potentially lead to explosive growth in the Bitcoin price.

According to CNBC, one key difference in this year’s halving is the U.S. SEC’s January 2024 approval of eleven spot Bitcoin spot ETFs, which has already driven significant demand for the cryptocurrency. Antoni Trenchev, co-founder of crypto trading platform Nexo, told CNBC:

“The halving is the ultimate geek event for Bitcoiners, but the 2024 iteration takes it up a notch because reduced supply combined with fresh ETF demand creates an explosive cocktail … What makes this halving unique is bitcoin has already surpassed the last cycle’s high — something it’s never done ahead of the quadrennial event — which makes trying to forecast the length and ferocity of this cycle much trickier.“

CNBC reports that the Bitcoin price has already surpassed the previous cycle’s high ahead of the halving, a feat never seen before, making it more challenging to predict the length and intensity of this cycle.

CNBC states that historically, Bitcoin has experienced substantial price increases following each halving event. After the 2012, 2016, and 2020 halvings, CNBC reports that the Bitcoin price increased by approximately 93x, 30x, and 8x, respectively, from the halving day price to the cycle top.

While past performance does not guarantee future results, and the magnitude of the halving’s impact on price may diminish over time, Steven Lubka, head of private clients and family offices at Swan Bitcoin, suggests to CNBC that if there was ever a moment to be optimistic about post-halving returns, it’s this year:

“This Bitcoin bull cycle — which kicked into gear earlier because of the January approval of the spot ETFs — might well be shorter and more explosive, culminating in a peak in late 2024 or early 2025.“

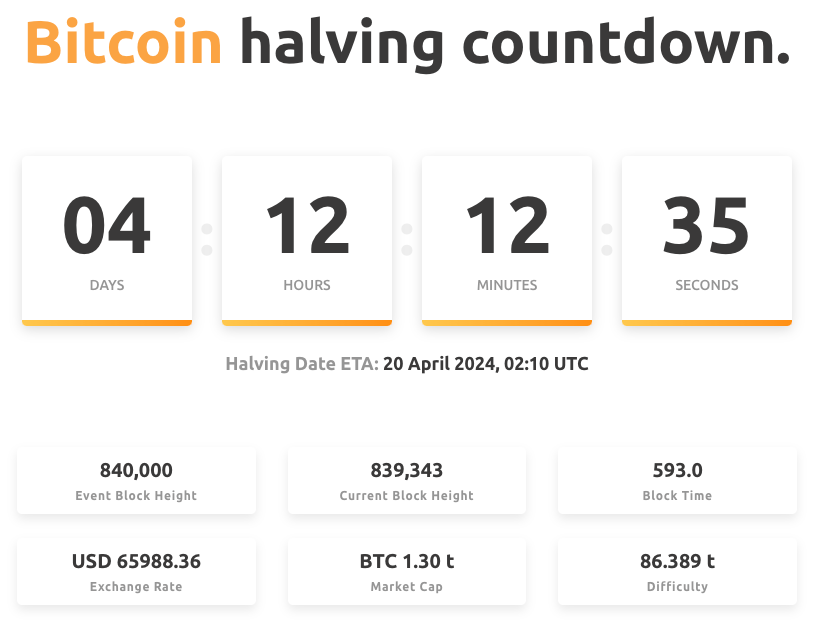

As explained by CNBC, the halving event itself is a technical change that occurs on the Bitcoin network, reducing the incentives for Bitcoin miners. Miners, who run the machines that record and add new blocks of transactions to the blockchain, are rewarded with newly created bitcoins and transaction fees. CNBC reports that the current mining reward of 6.25 bitcoins will be reduced to 3.125 bitcoins during the halving. This reduction in block rewards slows the pace at which new coins are created, helping to maintain Bitcoin’s scarcity and its status as “digital gold.”

CNBC notes that while the halving day itself may not result in immediate market volatility, the long-term impact of the reduced supply can be significant. Lubka estimates to CNBC that every day following the halving, there will be approximately $30 million less in Bitcoin being sold by miners, who are the most regular sellers in the market. This reduced selling pressure can compound over time, potentially making a substantial impact on the Bitcoin price in the months following the event.

CNBC also says that, in addition to the supply shock, the 2024 halving is occurring in an environment of unprecedented demand for Bitcoin. Data from CryptoQuant, cited by CNBC, shows that “whale” demand, which includes long-time Bitcoiners, new investors, and Bitcoin ETF holders, is already at an all-time high, even before the block reward reduction. This suggests that demand growth, rather than the halving itself, may be the primary driver for higher prices in this cycle, according to CNBC.

At the time of writing (2:10 p.m. UTC on 15 April 2024), Bitcoin is trading at around $65,681, up 2.5% in the past 24-hour period.

Featured Image via Pixabay