In recent weeks, social media personality and former professional kickboxer Andrew Tate has been vocal about his views on the current state of investments and the potential of cryptocurrencies, particularly Bitcoin (BTC). Tate, known for his controversial opinions and massive following on social media platforms, has stirred up discussions within the crypto community and beyond.

Tate’s latest assertion, shared via an X (formerly Twitter) post on April 28, suggests that Bitcoin might become the only acceptable monetary and investment choice in the face of a failing United States dollar and increasing government tyranny.

He argues that as the dollar becomes “f**ked” and the government potentially seizes control of real estate and other investments, the pioneering cryptocurrency will emerge as the sole option for investors seeking to protect their wealth.

This stance is not entirely surprising, given Tate’s well-known admiration for Bitcoin. On March 29, he revealed his dollar-cost averaging (DCA) strategy, claiming to have been purchasing BTC consistently every week since 2018. Peter Schiff criticized Tate’s stance on Bitcoin, suggesting that Tate’s promotion of the cryptocurrency contributes to ongoing market mania and predicting that Tate will ultimately lose money.

However, his views on the broader crypto landscape have been mixed. While endorsing the recently launched Layer-0 blockchain, Venom, and hinting at the existence of “genuinely technological useful or innovating blockchain coins,” Tate has also criticized the crypto community as the “biggest degenerate losers on the planet.”

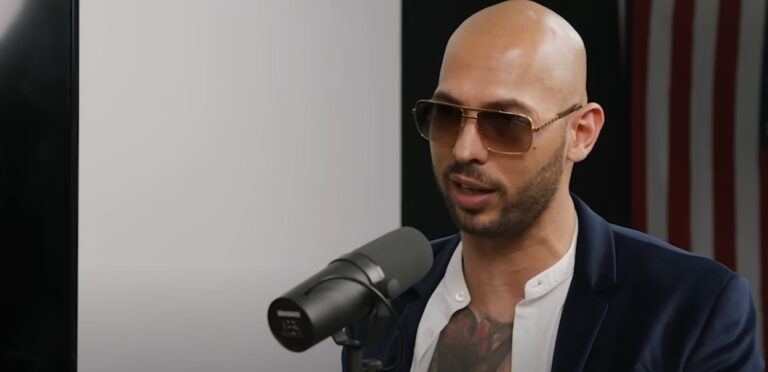

In an interview with Anthony Pompliano in 2022, Tate shared his insights on Bitcoin, emphasizing its value as a means to truly own and control one’s money. Highlighting the challenges of dealing with traditional banking systems, Tate recounted his personal experience of transferring $900,000 to Qatar for a property purchase. He described the process as a bureaucratic nightmare that led to him being flagged at airports for about a year, illustrating the inefficiencies and privacy concerns associated with conventional bank transfers.

Tate contrasted this experience with the ease of using Bitcoin, noting that cryptocurrency solves a multitude of problems associated with traditional financial systems. He expressed a lack of trust in banks and even in the stability of real estate as an investment, citing government overreach as a significant concern. According to Tate, the fear of government confiscation has led him to reconsider property investments in countries like Romania and Russia, where he owns real estate.

Expressing a broader mistrust of government intentions, especially in light of actions taken during the COVID-19 pandemic, Tate argued that people should be more concerned about government overreach than the virus itself. He criticized the public’s focus on divisive issues, suggesting that it distracts from more significant threats to personal freedom and control over one’s assets.

Tate also reflected on the cryptocurrency market’s volatility, specifically mentioning the Bitcoin crash at the onset of the pandemic when its value plummeted to $5,400. Despite widespread pessimism at the time, Tate was confident in Bitcoin’s recovery and advised investing in it. He shared that he invested $600,000 in Bitcoin when it was undervalued, which significantly appreciated in value, underscoring his belief in cryptocurrency as a resilient asset.

Featured Image via YouTube (Anthony Pompliano’s Channel)