Yesterday, in a post on social media platform X (formerly known as Twitter), Brad Garlinghouse, the CEO of Ripple, shared his thoughts on the current state of the cryptocurrency market. Garlinghouse, who has experienced multiple cycles of “crypto is back,” emphasized the importance of real-world utility accompanying the current bullish sentiment.

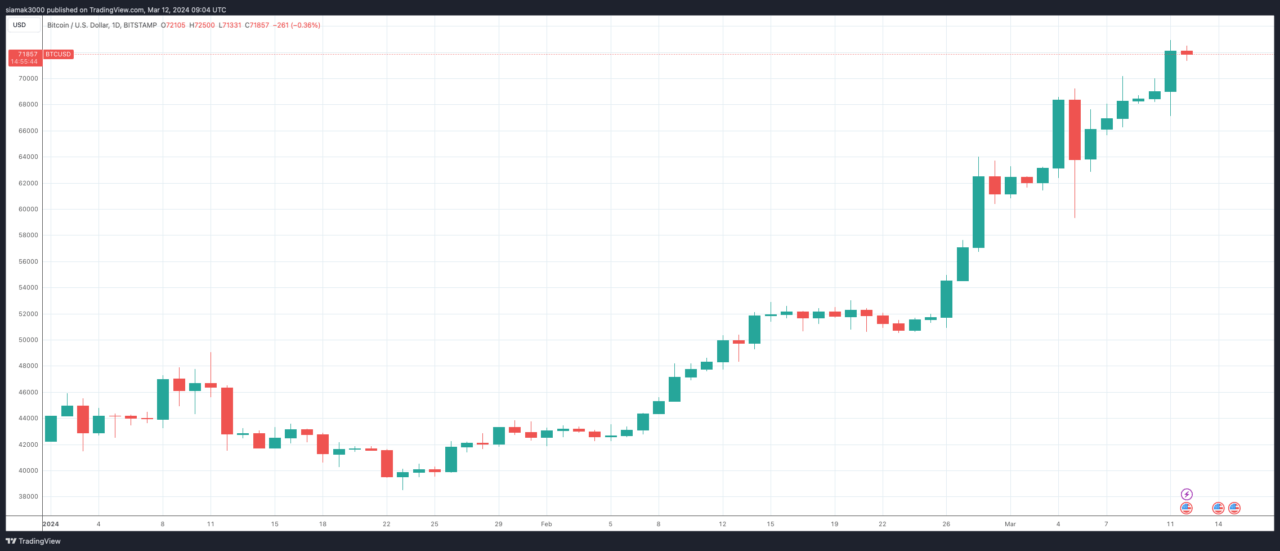

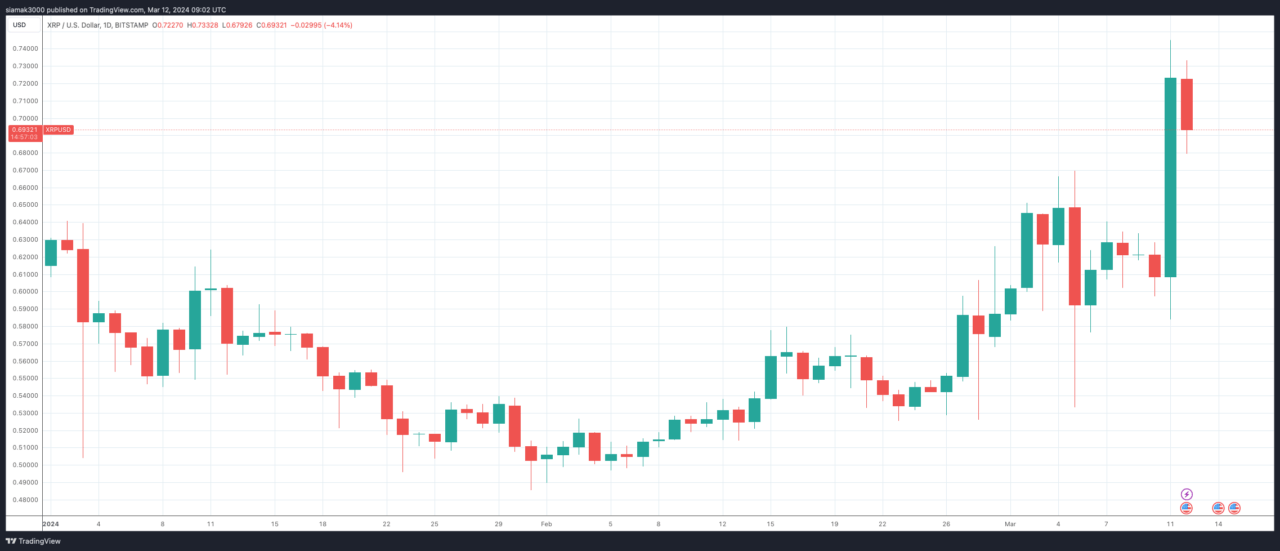

Garlinghouse’s comments come amidst a surge in Bitcoin ETF volumes following the approval of 11 spot Bitcoin ETFs by the U.S. on January 10, 2024. The approval of these ETFs, particularly the one from BlackRock, has led to significant gains for both Bitcoin and altcoins since the start of the year. In the past 30-day period, Bitcoin (BTC) and Ripple (XRP) have seen impressive gains of 48.71% and 31.90%, respectively.

The Ripple CEO also highlighted the upcoming Bitcoin halving, which is expected to occur in April 2024. A Bitcoin halving is an event that occurs approximately every four years, where the reward for mining new Bitcoin blocks is cut in half. This event is significant because it reduces the rate at which new Bitcoins are created, thus limiting the supply of new coins entering the market. Historically, Bitcoin halvings have been associated with bull runs in the cryptocurrency market, as the reduced supply can lead to increased demand and, consequently, higher prices.

Garlinghouse’s observation that the broader crypto market is following Bitcoin’s lead is consistent with historical trends. Bitcoin, being the largest and most well-known cryptocurrency, often sets the tone for the entire market. When Bitcoin experiences significant gains or losses, altcoins tend to follow suit.

However, the Ripple CEO’s main point in his post is the crucial role of real-world utility in sustaining the current bullish momentum. Garlinghouse stresses that while the current market surge and the anticipation surrounding the Bitcoin halving are positive signs, it is imperative that this bullishness is accompanied by practical applications of blockchain technology and cryptocurrencies in the real world.

An article published by Bloomberg News on March 12 reported on Bitcoin’s record-breaking run, fueled by the unprecedented influx of capital into crypto products and the impending reduction in the digital token’s supply growth. The flagship cryptocurrency reached an all-time high of nearly $72,881 on Monday and was trading at $71,815 as of 9:10 a.m. UTC on Tuesday. The article also mentioned that according to a report from CoinShares International Ltd., a record $2.7 billion flowed into crypto assets last week, with the majority of that capital being directed towards Bitcoin.

Bloomberg identified the success of the recently-approved US-listed spot Bitcoin ETFs as a key driver of the recent momentum. It went on to say that spot Bitcoin ETFs from major players such as BlackRock Inc. and Fidelity Investments have attracted a net inflow of about $9.5 billion to date. The article also noted that the London Stock Exchange had announced on Monday its willingness to accept applications for Bitcoin and Ether ETNs in the UK, while Thailand’s securities regulator had recently indicated that it would open overseas crypto ETFs to retail buyers.

Featured Image via Pixabay