In a recent update shared on social media platform X on March 25, Robert Kiyosaki announced his intention to increase his Bitcoin holdings by an additional 10 coins before April. This decision is strategically timed with the upcoming Bitcoin “Halving,” an event that historically impacts the digital currency’s value. Kiyosaki’s move underscores his belief in cryptocurrency’s potential for significant appreciation, projecting an ambitious Bitcoin value of $100,000 by September 2024.

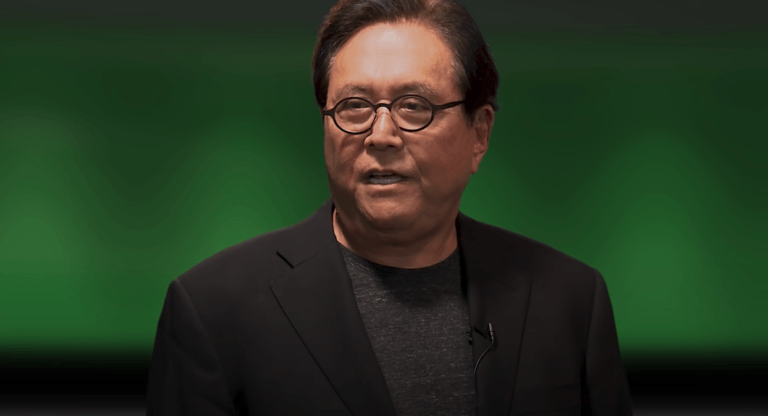

Robert Kiyosaki is an American businessman and author, best known for his book “Rich Dad Poor Dad,” which is part of the “Rich Dad” series. He has built a significant part of his reputation on being a financial educator, advocating for financial independence through investing in assets, real estate, starting and owning businesses, as well as increasing one’s financial intelligence to improve one’s business and financial decisions.

Kiyosaki’s teachings emphasize the importance of creating passive income streams and building wealth through savvy investments rather than traditional saving. His perspectives often challenge conventional wisdom on personal finance, making him a somewhat polarizing figure in the financial advice community. Despite criticism, he remains a popular and influential figure in personal finance and investment education circles.

Going back to his post on X, Kiyosaki’s advice doesn’t just stop with Bitcoin; he extends his investment strategy to include silver, particularly emphasizing the value of acquiring US silver eagles. Highlighting conversations with his friend Andy Schectman, a notable figure in the precious metals space, Kiyosaki paints a picture of a rapidly depleting silver supply, pointing to the scarcity of pre-1964 US silver coins, often referred to as “junk” silver, due to their historical and material value.

The rationale behind Kiyosaki’s investment recommendations is rooted in a critical analysis of global economic conditions. He cites the United States as the world’s largest debtor nation, the looming crisis in China’s property market, Japan’s long-term economic stagnation, and Germany’s slide towards recession. Additionally, he touches on the average consumer’s increasing reliance on credit cards, the banking sector’s instability, and the looming threat of global conflict as indicators of impending economic turmoil.

In this context, Kiyosaki, alongside Michael Saylor—a prominent advocate of Bitcoin, known for his substantial cryptocurrency investments through MicroStrategy—and Andy Schectman, aims to guide their audience away from traditional fiat currencies, which they view as “fake” money due to its detachment from tangible assets. They argue that saving in fiat currencies is a path to financial impoverishment.

Emphasizing the accessibility of investment in precious metals and cryptocurrency, Kiyosaki notes the current price points of Bitcoin (around $70,000), gold (approximately $2,500 a coin), and silver (roughly, $35 a coin), advocating for these as smarter alternatives to saving fiat money. He stresses that almost everyone can afford at least one silver coin or a fraction of Bitcoin, known as a Satoshi, highlighting the inclusivity of his investment advice.