In a recent interview with Kitco News, Jesse Felder shared his thoughts on the current state of the gold market and the potential for significant gains in the coming years. As reported by Neils Christensen of Kitco News, Felder believes that gold’s technical and fundamental outlooks are both robust, setting the stage for the precious metal to reach new heights.

Felder, the founder of Felder Investment Research, LLC, and the publisher of The Felder Report, has had a distinguished career in the finance industry. He started his professional journey at Bear, Stearns & Co. before going on to co-found a hedge fund firm based in Santa Monica, California, which managed assets worth billions of dollars. Since establishing his own investment research company, Felder’s insights and analysis have been sought after by major financial media outlets, including The Wall Street Journal, Barron’s, Yahoo!Finance, Business Insider, and Investing.com, among others, solidifying his reputation as a respected voice in the investment community.

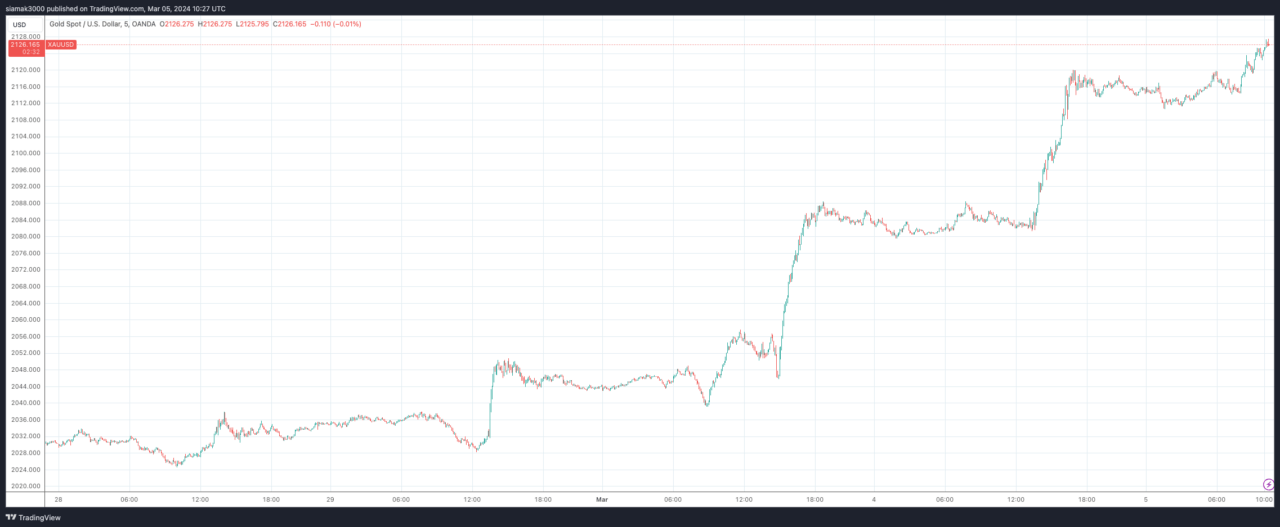

From a technical standpoint, Felder told Kitco that gold has been forming consistent bullish flag patterns, with the price spiking higher, consolidating, and then experiencing another price spike. He sees a short-term projected target of a couple of hundred dollars higher for gold, with the potential for the metal to reach $2,700 or $2,800 over the next year or two.

Felder also discussed the fundamental outlook for gold with Kitco, stating that he doesn’t expect the Federal Reserve to be able to bring inflation down to its 2% target. He believes that persistently higher inflation could lead to investors losing faith in the U.S. central bank, weakening the U.S. dollar and making gold an attractive asset. Additionally, Felder told Kitco that a weakening economy may force the Federal Reserve to reintroduce quantitative easing while maintaining its restrictive monetary policy, which would be the “ultimate bull case for gold”.

Christensen reports that Felder also touched on the deteriorating credit conditions within global financial markets during the Kitco interview. Felder noted that the Federal Reserve would eventually need to pump more liquidity into the market to address this issue.

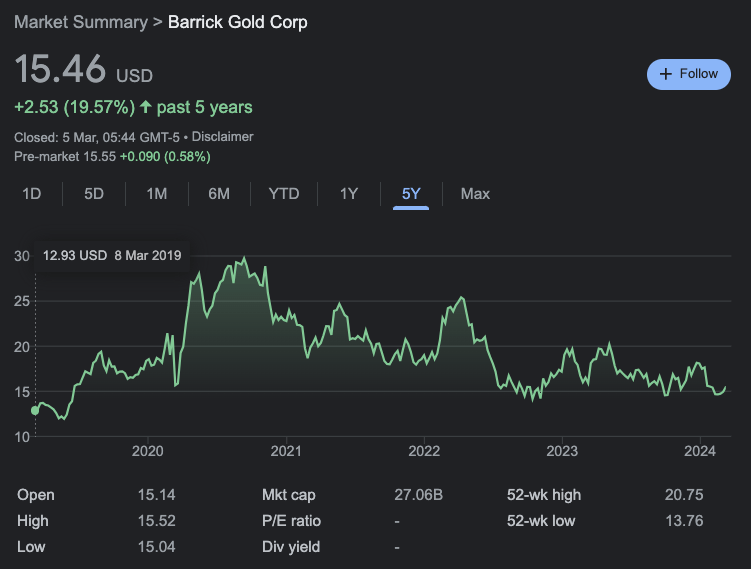

Beyond the precious metal itself, Felder expressed his bullishness on precious metals miners to Kitco, stating that the sector hasn’t been this beat up since the bear market lows in 2015. However, he pointed out that the negative sentiment does not align with the sector’s solid fundamentals, telling Kitco, “It’s the ultimate irony: miners are trading as if gold is in a major bear market, but gold is holding near record highs.”

Felder suggested to Kitco that a rally in gold could entice investors back into the mining space, and a correction in the broader equity market could also push some funds into miners. He noted that investors are currently avoiding commodities due to recession concerns, but he believes that equities may be more vulnerable, as corporate profits tend to fall faster than demand for commodities during a recession.

When it comes to specific opportunities in the mining sector, Felder said that major producers like Barrick, Newmont, and Agnico Eagle are likely to benefit from increased cash flows due to higher gold prices. He also mentioned that these companies represent less risk for generalist investors, with senior producers being “about as dirt cheap as they can get.”

The price of gold extended its upward trend for the fifth consecutive day on Tuesday, hitting a new three-month high of around $2,126 during early European trading hours.

Peter Schiff is a well-known American financial commentator, economist, and broker. Schiff is known for his strong advocacy of gold as an investment and his bearish views on the US dollar and the US economy. He is the CEO and chief global strategist of Euro Pacific Capital Inc., a broker-dealer based in Westport, Connecticut.

Schiff is known for his frequent appearances as a guest on financial television shows and his commentary on economic issues. He is a proponent of the Austrian School of economic thought, which emphasizes free-market principles and the risks of government intervention in the economy. Schiff has been a long-time critic of the Federal Reserve’s monetary policies, arguing that they will lead to inflation and a weakening of the US dollar. He is a strong advocate for investing in gold, silver, and other precious metals as a hedge against inflation and economic downturns.

Schiff has authored several books on economics and investing, including “Crash Proof: How to Profit from the Coming Economic Collapse” and “The Real Crash: America’s Coming Bankruptcy.” While Schiff has gained a significant following for his economic commentary and investment advice, it is important to note that his views are sometimes considered contrarian, and not all of his predictions have come to pass.

On March 4, Schiff took to social media platform X to share his insights on the current state of the gold market. In his post, Schiff highlighted the disparity between the performance of physical gold and gold mining stocks. He noted that while the SPDR Gold Trust ($GLD), a popular gold ETF, has reached a new all-time high, gold mining stocks still have significant ground to cover.

Schiff pointed out that gold mining stocks need to rally 15% to reach their December 2023 levels, 50% to get back to their April 2022 levels, 65% to return to their August 2020 levels, and an impressive 130% to reach the heights seen in April 2011.

Featured Image via Unsplash