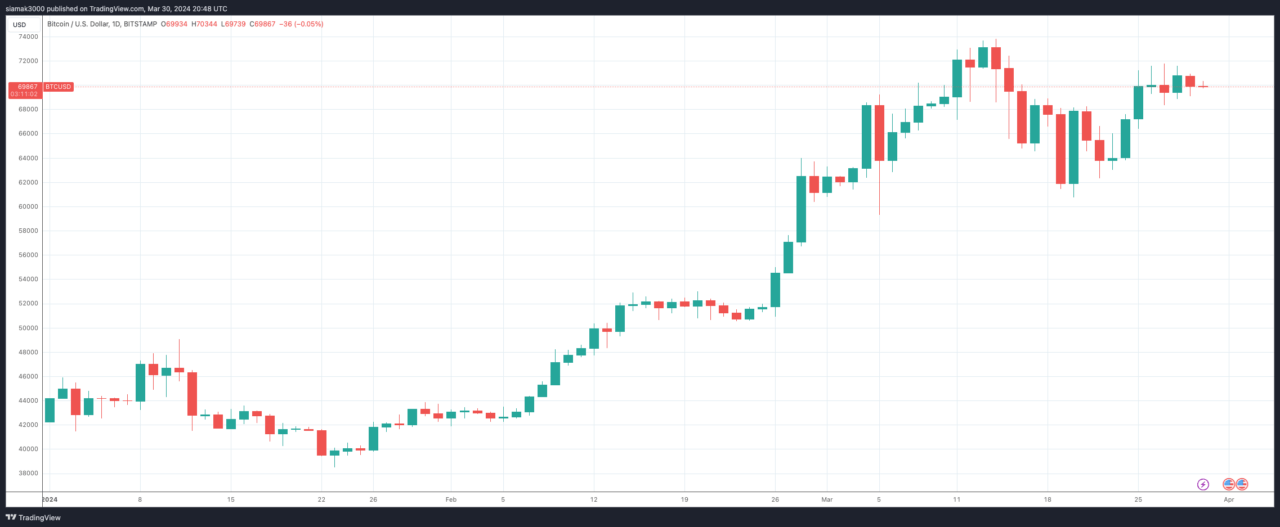

Amidst the dramatic surge in Bitcoin, short sellers are not backing down from their pessimistic bets on cryptocurrency-related stocks, wagering billions in anticipation of a market downturn. According to a Bloomberg report by Carmen Reinicke published on March 26, data from S3 Partners LLC reveals that total short interest in the crypto sector has escalated to nearly $11 billion this year. This surge in short selling is predominantly aimed at MicroStrategy Inc. (NASDAQ: MSTR) and Coinbase Global Inc. (NASDAQ: COIN), which together constitute over 80% of the sector’s total short interest.

Despite facing paper losses nearing $6 billion, owing to Bitcoin’s significant year-to-date increase of over 65%, which in turn boosted related stocks, these traders remain steadfast. Bloomberg cites Ihor Dusaniwsky, managing director of predictive analytics at S3, who explains that these contrarian investors might be seeking a downturn in Bitcoin’s rally or utilizing these short positions as a strategic hedge against actual Bitcoin holdings.

Bloomberg highlights a noticeable trend where short sellers have been intensifying their positions against crypto-linked stocks, particularly MicroStrategy. This focus persists despite the company’s share price climbing, with traders injecting $974 million into bets predicting a decline in the software company’s value. This activity contrasts with some short covering in other crypto-related companies like Coinbase, Marathon Digital Holdings Inc., and Hive Digital Technologies Ltd., as reported by S3.

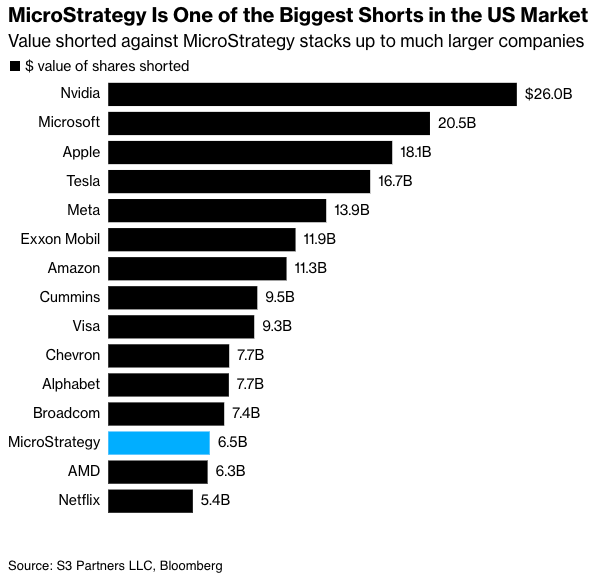

This increasing skepticism has elevated MicroStrategy’s short interest to over 20% of its total float, positioning it among the most shorted stocks in the U.S. market, alongside industry giants such as Nvidia Corp., Microsoft Corp., and Apple Inc.

However, Bloomberg notes that short sellers might face further challenges. Many stocks in the crypto sector are ripe for short squeezes—situations that compel short sellers to purchase stocks to close their losing bets, inadvertently driving prices up and exacerbating pressures on other traders. S3’s report identifies MicroStrategy, Coinbase, and Cleanspark Inc. as prime candidates for such squeezes, given their significant price rallies and the dwindling number of shares available for shorting. Year-to-date, MicroStrategy’s shares have soared by 148%, while Coinbase and Cleanspark have witnessed increases of approximately 69% and 95%, respectively.

As CryptoGlobe reported on March 29, Kerrisdale Capital Management recently published a report titled “Long Bitcoin / Short MicroStrategy Inc (MSTR): Know When to HODL, Know When to FODL,” proposing a daring approach to investing by recommending buying Bitcoin directly and simultaneously shorting MicroStrategy shares. Known for its bold short-selling strategies, Kerrisdale Capital typically targets overvalued companies or those with dubious operations, backing their bets with comprehensive research. Despite facing criticism for its confrontational style and the inherent conflicts of interest in short selling, Kerrisdale has a notable record in spotting companies’ vulnerabilities.

The report critiques MicroStrategy’s inflated stock value, which suggests a Bitcoin worth over $177,000—significantly higher than the actual market price—arguing that such a premium is not sustainable. Kerrisdale forecasts a decline in MicroStrategy’s allure with the emergence of more accessible Bitcoin investment alternatives like ETFs and ETPs.

Challenging MicroStrategy’s claim as a “Bitcoin development company,” Kerrisdale observes that the firm’s valuation heavily relies on its Bitcoin investments, acquired through considerable debt and equity offerings, rather than its primary software analytics business. The firm argues that the strategy of leveraging and diluting shares to acquire Bitcoin does not inherently generate more value for shareholders than directly investing in Bitcoin would.

Kerrisdale also dismisses the rationale behind MicroStrategy’s market premium, including the negligible impact of reinvesting software business cash flows into Bitcoin and the comparison of management fees between MicroStrategy and spot Bitcoin ETFs.

The core of Kerrisdale’s argument is that MicroStrategy’s stock premium over Bitcoin is due for a correction to align more closely with historical averages. With MicroStrategy’s premium rarely surpassing 2.0x and averaging around 1.3x, Kerrisdale anticipates a significant price adjustment for MicroStrategy shares.

The investment strategy Kerrisdale proposes is predicated not on a negative outlook on Bitcoin or MicroStrategy but on an anticipated alignment between the valuation of MicroStrategy’s shares and Bitcoin’s actual market price. Kerrisdale, holding positions both short in MicroStrategy and long in spot Bitcoin ETFs, stands to benefit if their predictive analysis holds true.

Featured Image via Pixabay