Riot Platforms, Inc., formerly known as Riot Blockchain, is a publicly traded company (NASDAQ: RIOT) deeply involved in the cryptocurrency sector, with a particular emphasis on Bitcoin. Their core business centers around operating one of North America’s largest Bitcoin mining facilities based in Texas. To maximize mining efficiency, they develop and deploy their own specialized immersion-cooled mining machines. Riot continues to aggressively expand its mining capacity aggressively, aiming to become a major force in the global Bitcoin mining industry.

Beyond their direct mining operations, Riot Platforms provides colocation hosting services to other institutional Bitcoin miners. They offer secure facilities, power solutions, and a focus on sustainable energy sources. Riot’s expertise further extends to large-scale electrical engineering. This allows them to consult with power grids in need of stability solutions and demand response programs. Additionally, they work on developing robust infrastructure networks to support both Bitcoin mining and other blockchain-related applications.

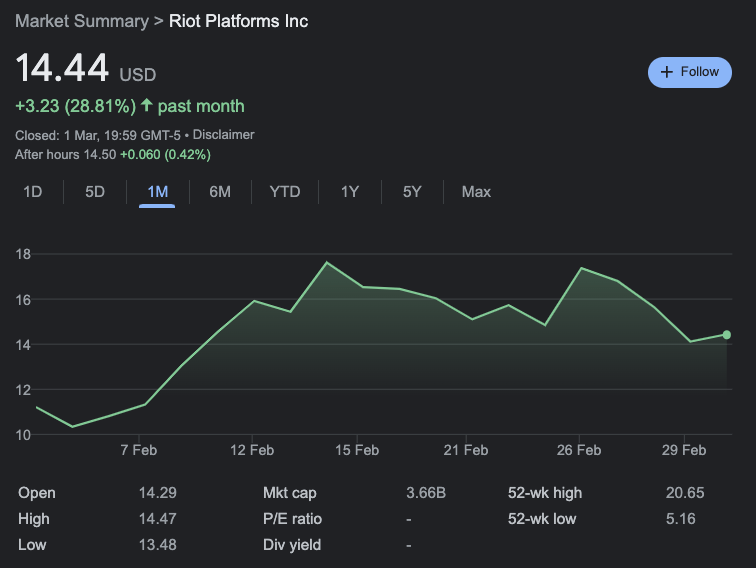

On March 1, Jason Les, CEO of Riot Platforms, joined CNBC’s “Power Lunch” to share his thoughts on Bitcoin.

Les began by acknowledging the significant effect that the approval of spot Bitcoin ETFs has had on the cryptocurrency ecosystem. He highlighted these ETFs as crucial for Bitcoin’s credibility, offering a new pathway that attracts sidelined capital into the market and sends a positive signal from regulators. Les pointed out that while this development is promising, further efforts are necessary to establish a more comprehensive market structure through congressional bills, which could enhance investor confidence and interest by providing clearer regulations.

Discussing the direct impact of spot Bitcoin ETFs on the cryptocurrency market and mining operations, Les expressed a positive outlook. He observed that these ETFs have been tremendously beneficial, especially for Bitcoin mining companies like Riot Platforms. Despite short-term volatility, Les emphasized that the influx of funds into Bitcoin, driven by these ETFs, supports price growth, benefiting miners. He noted that since the ETFs’ approval on January 10, a substantial amount of Bitcoin has been purchased through these financial instruments, highlighting the increasing constraint on new supply, especially with the upcoming halving event that will further reduce the daily output of new Bitcoin. This scenario, according to Les, is favorable for mining operations as it drives up Bitcoin’s price, which is central to their business model.

Les elaborated on Riot Platforms’ ambitious growth plans, aiming to significantly scale up operations despite the halving event’s potential to reduce daily Bitcoin mining output. He detailed the company’s strategy to expand its mining capacity and implement energy cost reduction measures, positioning Riot to mine more Bitcoin per day by the end of 2024. Les shared that Riot’s direct cost per Bitcoin was around $7,500 in 2023, a figure that underscores the company’s efficiency and competitive edge in the mining industry.

When asked about the potential need to adjust growth plans in response to Bitcoin price fluctuations, Les reiterated Riot Platforms’ commitment to its long-term vision. He explained that the company’s expansion efforts are fully funded and in progress, emphasizing that short-term price movements are less concerning compared to the broader, long-term potential of Bitcoin. Les mentioned that the dynamics of the Bitcoin mining industry allow for adjustments based on market conditions, where less efficient miners exit during downturns, potentially increasing profitability for more efficient operators like Riot.

On February 22, Riot Platforms announced its financial results for the full year ended December 31, 2023. Under CEO Jason Les’s leadership, the company not only reported record financial outcomes but also made considerable progress in its strategic development goals, solidifying its status in the Bitcoin mining sector.

The company achieved unprecedented total revenues of $281 million, produced 6,626 Bitcoin, and earned $71 million in power credits, thanks to its innovative power strategy. Key strategic milestones included completing the 700-megawatt expansion of the Rockdale Facility and advancing the development of the Corsicana Facility. The latter, with its 1-gigawatt capacity, is poised to become the largest dedicated Bitcoin mining facility in the world.

A pivotal development in 2023 was Riot’s partnership with MicroBT, ensuring a long-term supply of cutting-edge miners at a fixed price. This strategic move aims to keep Riot at the forefront of mining efficiency. Notably, Riot achieved an industry-leading low cost to mine Bitcoin, averaging $7,539 per Bitcoin for the year, net of power credits. This represents a significant decrease from the previous year’s average cost, highlighting Riot’s focus on cost efficiency and operational excellence.

Riot concluded 2023 with a robust financial standing, including approximately $597 million in cash and 7,362 Bitcoin, valued at around $311 million, with minimal long-term debt. The company has set ambitious targets to expand its hash rate capacity in the coming years, aiming for substantial growth in its mining capabilities.

The increase in Bitcoin production by 19% from the previous year, alongside diversified revenue streams from Bitcoin Mining and Data Center Hosting, underscores Riot’s operational growth. Despite facing a net loss of $49.5 million, an improvement from the prior year’s losses, Riot’s strategic decisions and new accounting practices for Bitcoin valuation have positively impacted its financial metrics.

Featured Image via Pixabay