For decades, instability has forced Argentines to seek safe haven in the US dollar. Yet, a startling shift is underway, as reported by Bloomberg. President Javier Milei’s economic reforms and a flagging exchange rate are apparently pushing Argentines to abandon their ‘greenback’ tradition and seek inflation protection in Bitcoin.

Bloomberg highlights that Argentina is one of the world’s top destinations for US dollar shipments, with locals holding approximately $200 billion in US currency. This stems from a long history of financial instability and the need for a safe haven. However, the Bloomberg report suggests this trend is reversing.

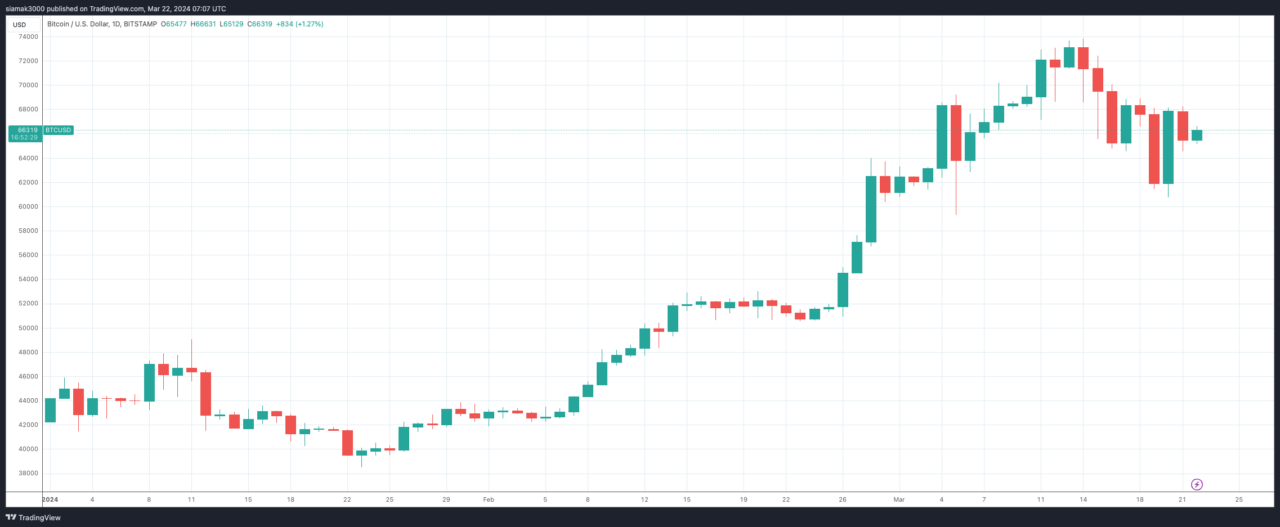

Bloomberg says that President Milei’s economic policies prioritize restricting the money supply and rebuilding Central Bank dollar reserves. This has inadvertently strengthened the peso against the dollar within the parallel exchange market. As Bitcoin simultaneously rallies (up 58% vs USD in the year-to-date period), it becomes a more attractive inflation hedge for Argentines.

It seems that local cryptocurrency exchanges are the bellwethers of this change. The Bloomberg article mentions that Lemon, a popular exchange, saw Bitcoin purchases nearly double their 2023 average in the week ending March 10th. Similar surges are reported by exchanges like Ripio and Belo.

Belo CEO Manuel Beaudroit told Bloomberg that Bitcoin and Ether trading volumes in 2024 were tenfold higher than in the same period last year. Interestingly, he notes that stablecoin purchases (often pegged to the US dollar) have dipped, further suggesting a shift away from traditional dollar-based strategies:

“The user decides to buy Bitcoin when they see the news that the currency is going up, while stablecoin is more pragmatic and many times used for transactional purposes, as a vehicle to make payments abroad.“

Unfortunately, this desperation to shield savings from Argentina’s staggering 276% inflation has a dark side. Bitcoin Argentina, a leading NGO in the sector, reports a concerning increase in cryptocurrency scams. They caution that hasty, uninformed investment decisions driven by this economic climate make Argentines easy targets.

Featured Image via Pixabay