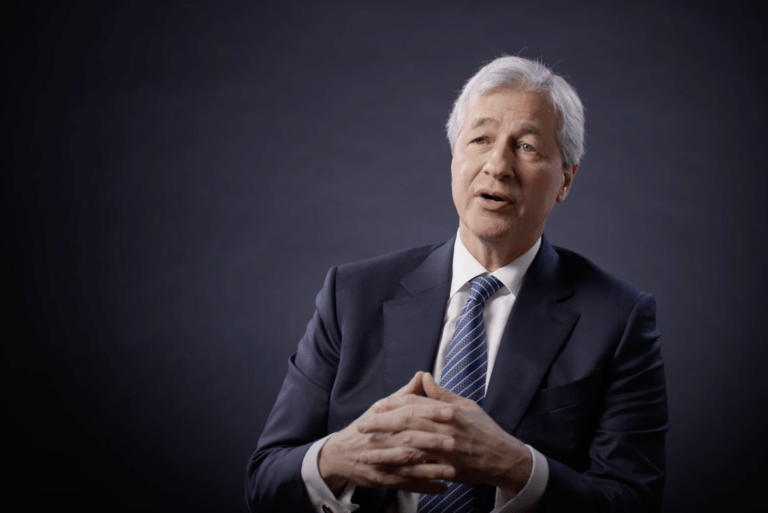

Earlier today, Jamie Dimon, Chairman and CEO of JPMorgan Chase, shared his thoughts on the Federal Reserve’s potential interest rate cuts, the state of the U.S. economy, and his views on Bitcoin and artificial intelligence. While speaking at the Australian Financial Review business summit via livestream from New York on Tuesday, March 12, 2024, Dimon urged the Fed to exercise caution when considering rate cuts.

According to the CNBC report, Dimon believes the Fed should wait past June before cutting interest rates to maintain its credibility in fighting inflation. He stated, “You can always cut it quickly and dramatically. Their credibility is a little bit at stake here. I would even wait past June and let it all sort it out.” This comes as markets are pricing in a high probability of a rate cut in June and a total easing of 90 basis points for the year.

Dimon’s assessment of the U.S. economy, as reported by CNBC, was mixed. While he noted that the economy was performing so well it could almost be characterized as a boom, he cautioned against fully embracing the idea of a soft landing. Dimon put the odds of a recession at around 65% and did not rule out the possibility of stagflation. He also reiterated his previous warnings about geopolitical tensions, such as the conflicts in Ukraine and Gaza, potentially weighing on global growth.

The JPMorgan CEO also addressed the recent surge in debt and equity markets since late 2023. According to CNBC, Dimon attributed some of this growth to the lingering effects of the pandemic-era fiscal and monetary stimulus, stating that it was “still in the system, you can’t say that they’re gone.” He suggested that the surge had some bubble-like characteristics.

Known for his critical stance on Bitcoin, Dimon maintained his skepticism about the cryptocurrency’s practical uses. CNBC reported that he associated a lot of Bitcoin’s usage with illicit activities. However, Dimon also defended an individual’s right to purchase Bitcoin, stating, “I don’t know what the bitcoin itself is for, but I defend your right to smoke a cigarette, I’ll defend your right to buy a bitcoin. I won’t personally ever buy a bitcoin.”

Lastly, the CNBC article highlighted Dimon’s comments on artificial intelligence (AI) and its role at JPMorgan. He revealed that the bank has two thousand people working on 400 use cases for AI technology. Dimon also shared that he personally uses AI at home to summarize books he doesn’t have time to read.

In an interview with CNBC’s Leslie Picker at J.P. Morgan’s 2024 Global Emerging Markets Corporate Conference (February 26-28, 2024) in Miam, Dimon shared his insights on various critical topics that are shaping the financial landscape.

Dimon expressed his unwavering belief in the revolutionary impact of AI, emphasizing that it is not merely hype but a genuine game-changer. He drew a clear distinction between the current AI advancements and the tech bubble of the late 1990s, asserting that AI’s practical applications are already being deployed within JPMorgan. The firm’s commitment to AI is evident in its dedicated team of 200 researchers who are exploring the potential of large language models to drive innovation across various domains, such as cybersecurity and pharmaceutical research.

When discussing the current market outlook, Dimon struck a balance between caution and optimism. While acknowledging the allure of an open equity market and tightening spreads, he emphasized the need to consider potential shifts that could arise from factors such as quantitative tightening, fiscal spending, and geopolitical tensions. Dimon’s prudent approach reflects a broader strategy of hedging against unforeseen economic changes, advocating for a balanced approach to risk and opportunity.

Addressing concerns surrounding commercial real estate and lending, Dimon differentiated between the consumer and commercial sectors. While recognizing the challenges faced by the office real estate market, he suggested that the current situation does not constitute a crisis. Dimon emphasized the importance of navigating potential downturns through strategic refinancing and equity adjustments, viewing defaults as part of a normalization process rather than indicators of systemic failure.

During the interview, Dimon also touched upon the impact of the regulatory landscape on banking competition. He advocated for policies that foster innovation and allow for strategic mergers and acquisitions. Reflecting on the competitive implications of Capital One’s acquisition of Discover, Dimon underscored the importance of fair competition and the adaptability of banks like JPMorgan in responding to market changes.

Featured Image via YouTube (JPMorgan’s Channel)