Elon Musk’s electric car market, Tesla, acquired $1.5 billion worth of the flagship cryptocurrency Bitcoin back in early 2021 and briefly accepted BTC payments. Its support for the cryptocurrency was dropped shortly after, but now data seemingly suggests it’s now accumulating again.

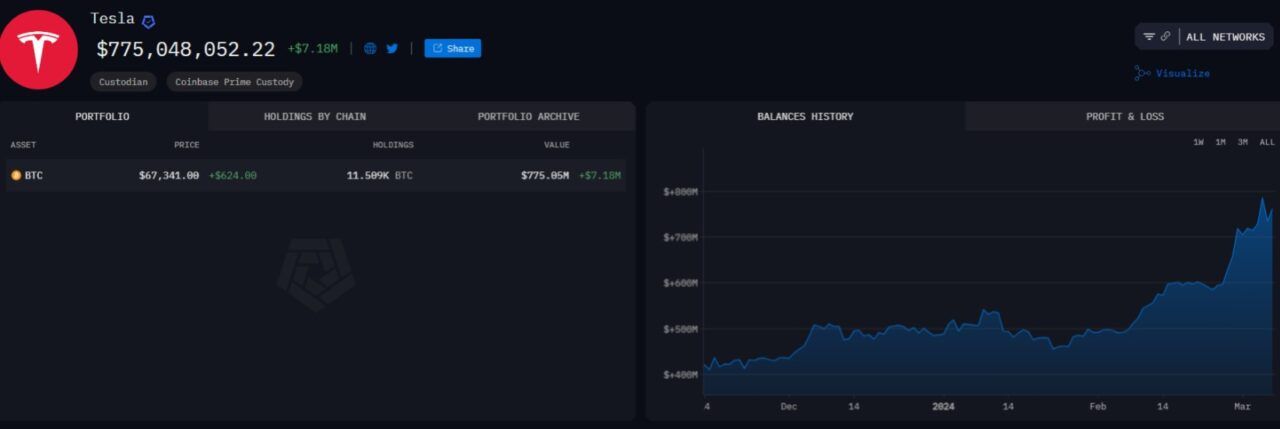

According to data from Arkham Intelligence, first reported on by Cointelegraph, a feature tracking Tesla’s Bitcoin wallet shows that it’s currently holding onto 11,509 BTC, a figure that marks a significant increase from the 9,720 BTC reported during the company’s last earnings report.

Tesla’s history with Bitcoin is tumultuous, as after acquiring $1.5 billion worth of the cryptocurrency during its bull run, the firm sold about 10% of its holdings in an initial test, that was followed by it dumping around 75% of its remaining holdings in the second quarter of 2022.

After selling those coins the company hasn’t reported any significant changes to its Bitcoin holdings, and while it’s natural for large wallets to receive small amounts of BTC in potential dusting attacks, an increase of 1,789 BTC (around $120.4 million) suggests the electric car maker is once again accumulating.

The company reversed its stance on Bitcoin shortly after investing in the cryptocurrency after its CEO Elon Musk cited environmental concerns related to BTC mining, which also prompted it to halt accepting BTC payments.

The recent increase in Tesla’s Bitcoin holdings has sparked speculation within the crypto community, with users debating on the microblogging platform X (formerly known as Twitter) whether Tesla has resumed purchasing Bitcoin or if the discrepancy is simply an accounting error.

Some speculate that the company might have started buying Bitcoin after its lastest earnings report, with the new holdings potentially reflected in the next financial disclosure, at a time in which spot Bitcoin exchange-traded funds (ETFs) are attracting institutional investors.

Beyond Tesla, Musk’s space exploration company, SpaceX, also holds Bitcoin on its balance sheet, influenced by Michael Saylor, co-founder and executive chairman of MicroStrategy.

Saylor, known for his bullish stance on Bitcoin, reportedly convinced Musk to incorporate the cryptocurrency into his company’s holdings. MicroStrategy itself holds a massive 193,000 BTC, making it the world’s largest institutional holder of Bitcoin.