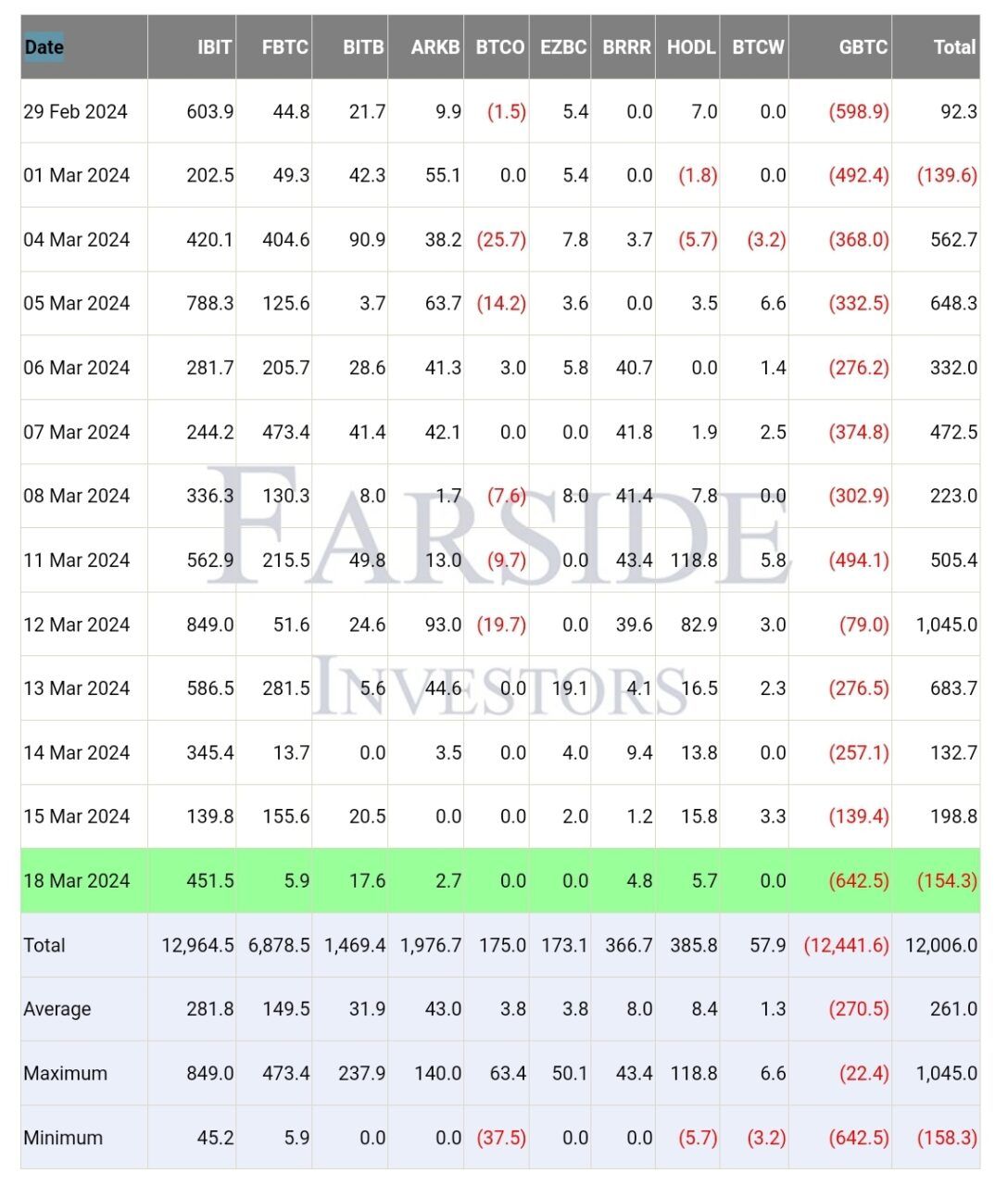

Grayscale’s spot Bitcoin ETF saw an unprecedented outflow of more than $640 million on March 18. This marks the largest single-day outflow since the fund’s conversion from a closed-end fund to a spot ETF on January 11.

According to data from Farside Investors, Grayscale’s Bitcoin ETF experienced a staggering $642.5 million in outflows on March 18. Simultaneously, inflows into the second-largest fund, Fidelity’s Bitcoin ETF, hit a record low of just $5.9 million. The combination of these events led to a net outflow of $154.3 million for spot Bitcoin ETFs.

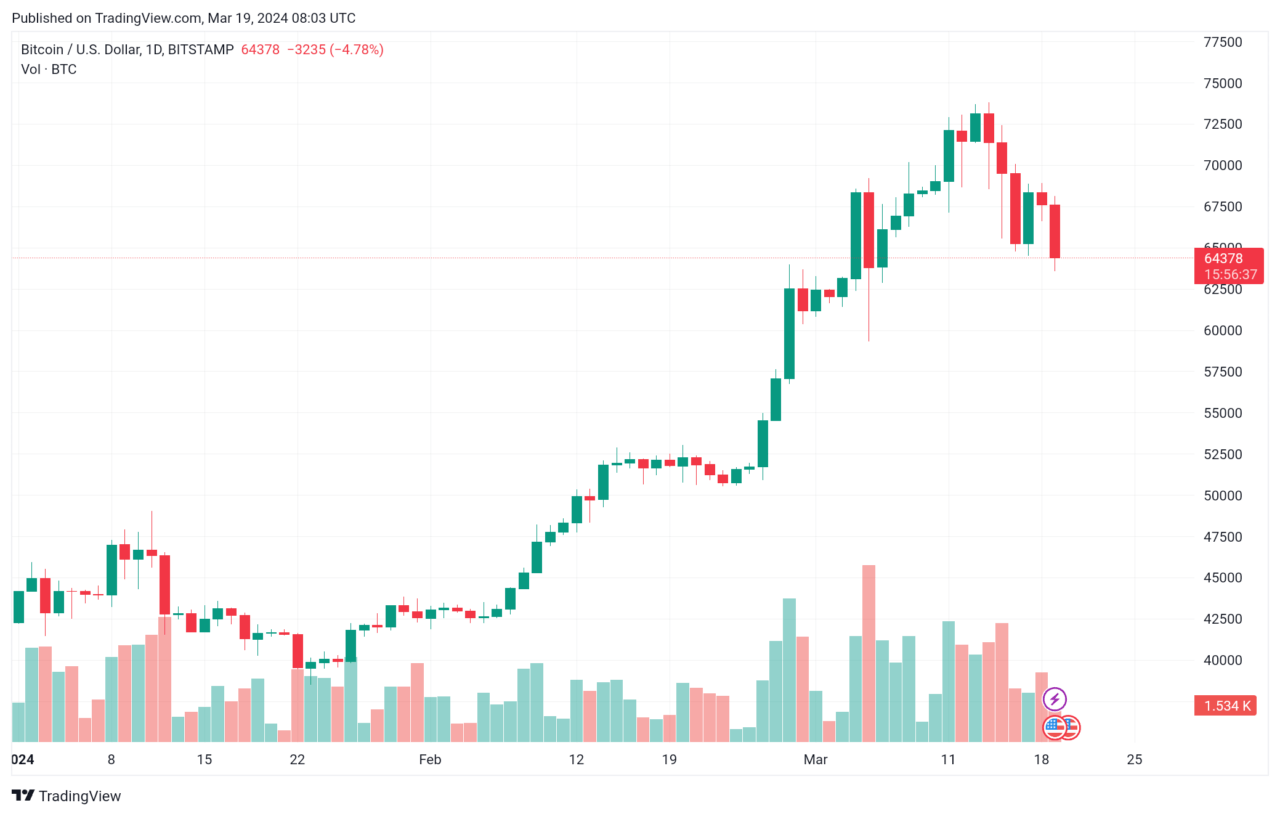

The price of Bitcoin has been under pressure in recent days, with the cryptocurrency trading at $64,410 at the time of writing, down 5.5% over the past 24 hours.

Market analysts have attributed this depressed price action to various factors, including slowing Bitcoin ETF flows, the upcoming halving event, and the Federal Reserve’s FOMC meeting scheduled for March 20.

However, despite the current market sentiment, some analysts remain optimistic about the future of Bitcoin ETF flows. Grant Englebart, vice president of investment firm Carlson Group, shared insights during a Bloomberg TV interview. Englebart told Scarlet Fu and Katie Greifeld on Bloomberg ETF IQ that only a handful of his firm’s advisers had seen clients allocate funds to Bitcoin ETFs, with an average investment ratio of 3.5% of total funds.

Commenting on the interview, Bloomberg ETF analyst Eric Balchunas confirmed that the observations aligned with what he had been hearing from Bitcoin ETF fund issuers. Balchunas emphasized that only a small group of early adopters had been making significant allocations to spot Bitcoin ETFs, and that advisors were not yet actively soliciting their clients to invest in these products. He added that the current flows were primarily driven by inbound traffic, suggesting that Bitcoin ETF inflows could continue to gain momentum in the future.

Interestingly, Standard Chartered recently updated its Bitcoin (BTC) price forecast, raising its year-end prediction from $100,000 to an impressive $150,000, as reported by CoinDesk. This adjustment, based on an investment note the bank distributed, signals an increasing confidence in Bitcoin’s price potential, with further expectations for BTC to hit a cycle peak of $250,000 in the next year and then level off around $200,000.

The bank’s reasoning draws an intriguing parallel between the current Bitcoin scenario and the historical effects that the introduction of gold ETFs had on gold’s pricing. According to Standard Chartered, the US’s recent rollout of spot Bitcoin ETFs might have a similar groundbreaking impact on Bitcoin prices. This analogy is used to underpin the bank’s medium-term price forecasts for Bitcoin.

The investment note elaborates, “The analogy with gold, considering the effects of ETFs and the ideal portfolio composition, provides a reliable framework for determining Bitcoin’s prospective price range in the medium term.” The bank’s analysis suggests that with spot ETF inflows potentially hitting the $75 billion mark, or should reserve managers start buying BTC, Bitcoin’s price could very well surge to $250,000 by sometime in 2025.

Featured Image via Pixabay