Few voices on crypto Twitter have been as consistently bearish on Bitcoin as Peter Schiff. However, in a recent episode of Tom Bilyeu’s Impact Theory podcast, during a debate with former Goldman Sach executive and crypto investor Raoul Pal, Schiff shared a moment of reflection that caught the attention of crypto enthusiasts and skeptics alike. Despite his long-standing disbelief in Bitcoin’s value proposition, Schiff disclosed that he now harbors some regret over not investing in Bitcoin back in its nascent stages.

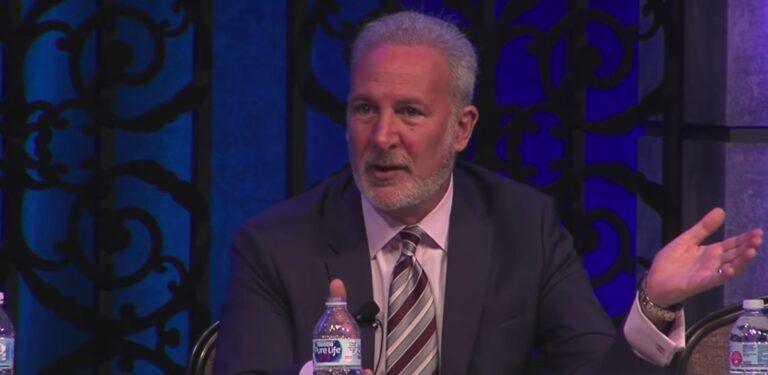

Peter Schiff is a well-known American financial commentator, author, and stockbroker who has gained a reputation for his bearish views on the US economy and his strong advocacy for gold as an investment. He is the CEO and chief global strategist of Euro Pacific Capital Inc., a brokerage firm founded in 1987 that focuses on international markets and precious metals.

Back in 2010, when Bitcoin was merely a budding digital asset valued at just a few dollars, Schiff had the opportunity to invest but chose to pass, unconvinced of its investment merit. Fast forward to the present, Bitcoin’s price hovers around $73,000, marking an astronomical rise from its humble beginnings.

Despite the passage of time and Bitcoin’s significant price appreciation, Schiff’s fundamental view on the cryptocurrency remains unchanged. However, he concedes that, in hindsight, a speculative investment could have been immensely profitable.

“Do I wish I had made the decision to have thrown $10,000, $50,000, $100,000 into it?” Schiff pondered aloud during the podcast. “Sure. I may be worth hundreds of millions assuming I didn’t sell. But again, I don’t know what I would have done had I made that decision.”

Bitcoin’s journey over the past year has seen a surge of 197%, fueled by advancements in technology (such as Ordinals), an increasing institutional interest, and the launch of spot Bitcoin exchange-traded funds (ETFs) in the U.S. Meanwhile, gold, Schiff’s investment of choice, has seen a modest 8.8% increase in value, with an estimated market capitalization of $14 trillion.

Schiff also mentioned that any potential investment in Bitcoin would not have been based on a belief in its long-term success but rather as a bet on the market’s dynamics — specifically, on “other people being dumb enough to buy it and pay a higher price.” This candid admission highlights a dichotomy faced by many traditional investors: the tension between the allure of substantial profits from speculative assets and adherence to investment principles grounded in tangible value.