Bloomberg reports that Bitcoin miners, battered by the recent crypto downturn, are back in expansion mode. Its report highlights that they’re spending billions of dollars on equipment and consuming energy at unprecedented levels – all this before a code update that has the potential to disrupt their revenue streams.

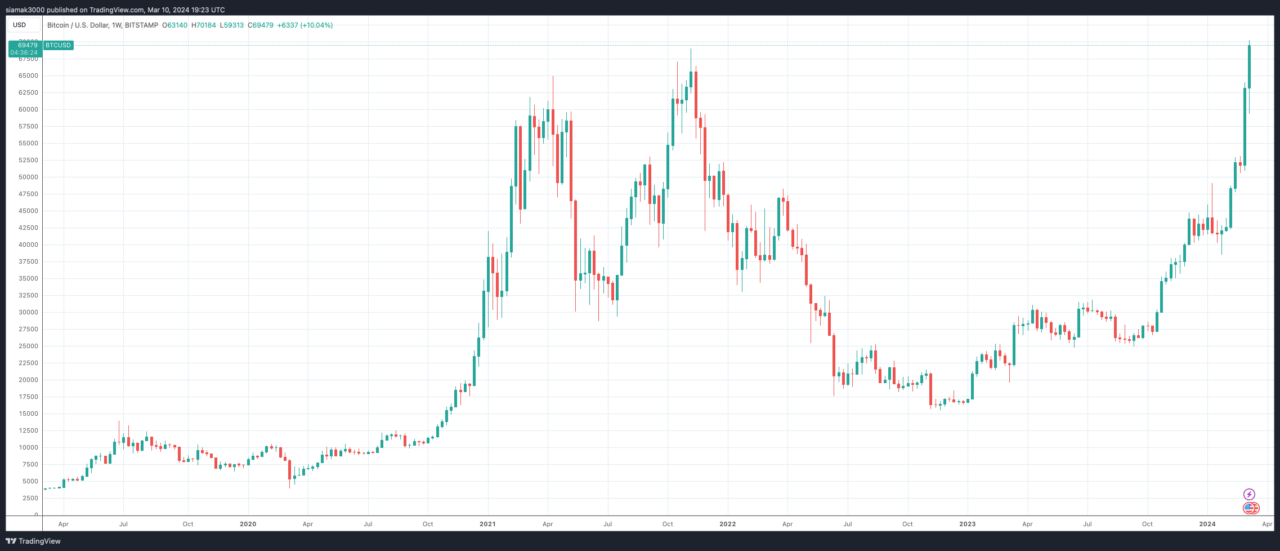

According to Bloomberg, this renewed activity is triggered by several factors, including a significant run-up in Bitcoin’s price, the launch of spot exchange-traded funds, and the looming “halving” event, which is expected to happen in April. Bloomberg notes that the price of the world’s largest cryptocurrency has surged more than fourfold since its 2022 lows amidst a series of industry bankruptcies and scandals.

Bloomberg’s article states that, since February 2023, 13 of the top mining companies have purchased over $1 billion worth of mining hardware. It emphasizes that this investment is aimed at boosting efficiency and securing favorable energy deals. Bloomberg stresses that energy costs are crucial for mining profitability as miners use energy-intensive computers to validate transactions on the blockchain.

Bloomberg also spotlights the immense scale of mining operations by reporting that miners consumed a record 19.6 gigawatts of power last month. Bloomberg indicates that figure represents a significant increase from the same period in 2023 and underscores that this level of energy consumption rivals the power needs of millions of homes.

Bloomberg observes that the rising price of Bitcoin has improved profitability for some miners, leading to a surge in some mining company stock prices. Shares of Marathon and CleanSpark, according to Bloomberg, have appreciated by almost 600% and 900%, respectively, since December 2022.

However, Bloomberg warns that rapid expansion comes with risks and reminds readers that during the last crypto bull run, many mining companies went public, raising enormous sums of money, only to collapse along with the market in 2022. Bloomberg stresses the potential for bankruptcies during market downturns.

Despite the current resurgence, Bloomberg states that the halving event introduces further risks for Bitcoin miners. Bloomberg explains the halving mechanism, noting that it will decrease mining rewards and could push some miners into unprofitable territory, potentially forcing them to shut down.

Featured Image via Unsplash