In a recent discourse on the social media platform X, Craig Salm, the Chief Legal Officer (CLO) of Grayscale Investments, shared his insights and optimism regarding the approval of spot Ethereum ETFs in the U.S., despite what many perceive as a lack of engagement from the U.S. SEC.

Salm began the thread by addressing the current buzz around spot Ethereum ETFs, expressing his belief in their viability and the need for approval. He recounted the constructive interactions Grayscale and other entities had with the SEC in the months leading to the Bitcoin ETF approvals. These discussions covered crucial operational aspects like creation and redemption procedures and the distinction between cash versus in-kind contributions, among others.

Drawing parallels between the previously approved spot Bitcoin ETFs and the proposed spot Ethereum ETFs, Salm noted that the fundamental processes remain identical, with the primary difference being the underlying asset. This observation led him to argue that the SEC has, in fact, engaged with the issuers on similar grounds before, implying there may be less necessity for engagement this time around.

As the decision timeline approaches its climax in late May 2024, Salm shared his perspective that the current perceived lack of SEC interaction does not necessarily predict the outcome of the spot Ethereum ETF applications. He supported his stance by aligning with opinions from industry leaders like Paul Grewal, Chief Legal Officer of Coinbase and Brian Quintenz, Head of Global Policy at a16z Crypto, who have cited consistency with ETH futures ETFs, the classification of ETH futures as commodity futures, and the high correlation between futures and spot markets as reasons for approval.

Salm emphasized the demand and rightful expectation among investors for an accessible spot Ethereum ETF, stating Grayscale’s commitment to advocating for these investment products.

Shortly after Grayscale’s CLO shared his thoughts on the potential approval of spot Ethereum ETFs, Eric Balchunas, who is a Senior ETF Analyst at Bloomberg, offered a contrasting viewpoint, expressing skepticism about the SEC’s likelihood to approve any spot Ethereum ETFs in May 2024. Balchunas pegged the chances at a “very pessimistic” 25%, attributing the SEC’s lack of engagement not to delay but to a deliberate stance, with no positive indicators or intelligence suggesting a favorable outcome. Despite his personal hopes for approval, Balchunas’s analysis paints a grim picture for the immediate future of Ethereum ETFs.

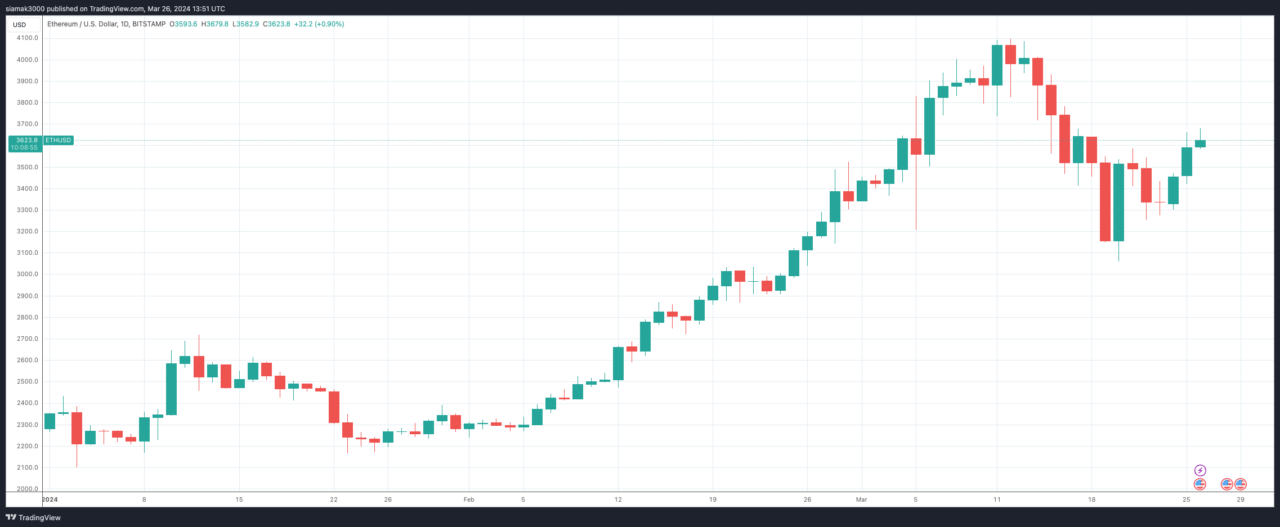

At the time of writing, ETH is trading at around $3,629, up 5.1% in the past 24-hour period.

Featured Image via Pixabay