Deribit’s Bitcoin Volatility Index (DVOL), a measure of the 30-day implied volatility of Bitcoin options, has surged to a 16-month high, according to an article by Omkar Godbole for CoinDesk published earlier today. The index has risen from an annualized 41% to 76% in just one month, reaching its highest level since November 2022. This surge in volatility is good news for Bitcoin holders looking to generate additional income from the options market.

The DVOL is a forward-looking measure of volatility that uses the implied volatility smile of the relevant Bitcoin option expiries to output a single value representing the expected volatility over the next 30 days. Unlike traditional markets, where volatility indices are often referred to as “fear gauges,” the DVOL is considered an “action gauge” or a “fear and greed gauge” in the Bitcoin market. This distinction arises from the unique characteristic of Bitcoin options, which often have a positive skew for both calls and puts, meaning that significant price moves can be expected on both the upside and downside.

To interpret the DVOL value, traders can divide the index value by 20 to get a rough estimate of the expected daily move in Bitcoin. For a more precise estimate, the DVOL should be divided by the square root of 365. For example, the current DVOL value of 76 suggests an expected daily move of around 3.8%.

As Godbole notes, the rise in implied volatility positively impacts the prices of options, with the greater the volatility, the higher the option premium. This presents an opportunity for savvy investors to “overwrite” or sell call options at levels higher than the underlying asset’s going market rate, generating additional income on top of their spot market holdings.

A recent increase in DVOL has sparked renewed enthusiasm for call overwriting on Deribit, which dominates the crypto options market with an 85% share. Godbole highlights a scenario shared by Lin Chen from Deribit’s Asia business development team, in which 250 contracts for $75,000 call options set to expire in December were sold, generating a premium of $4.258 million.

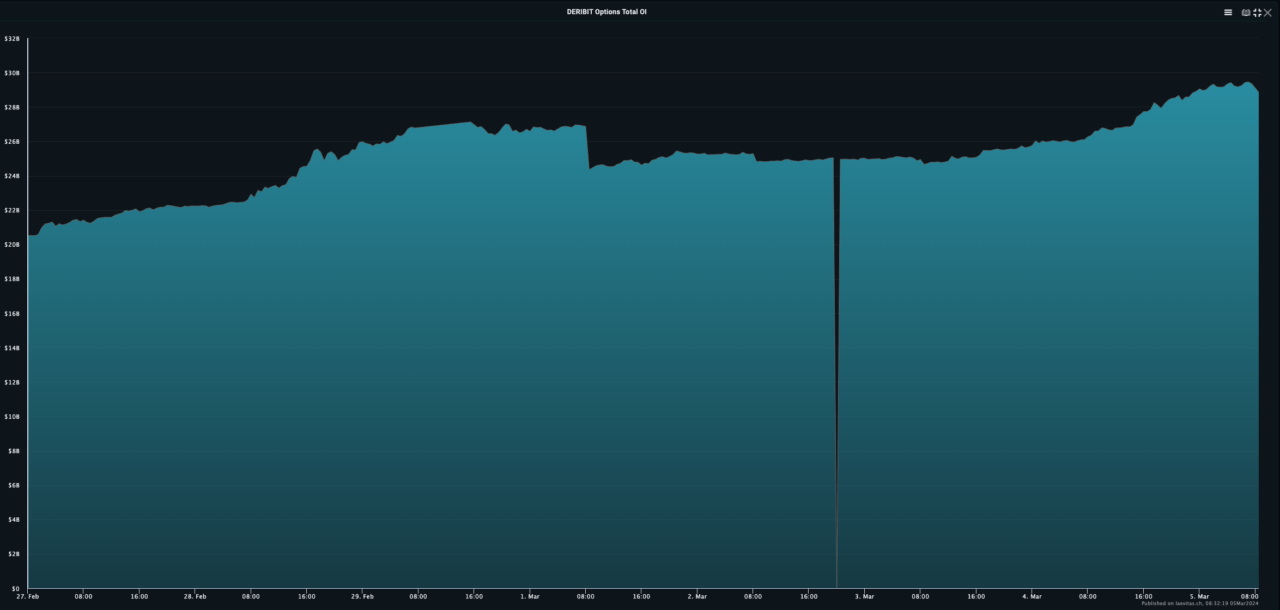

Deribit’s overall trading activity has surged alongside Bitcoin’s 58% increase this year, bringing it close to its all-time high of just above $69,000. The total notional open interest across crypto futures and options on Deribit has reached a new peak of $32 billion, with the options market contributing almost $30 billion to this figure.

Furthermore, Godbole notes significant interest in Deribit’s call options, even at strike prices up to $200,000, reflecting some analysts’ predictions that Bitcoin’s current uptrend could reach as high as $200,000 by September 2024.

Featured Image via Pixabay