Adam Back is a highly influential figure in the cryptocurrency and blockchain technology space. He is best known for being the inventor of Hashcash, a proof-of-work system used to limit email spam and denial-of-service attacks, and is cited in the Bitcoin whitepaper by Satoshi Nakamoto as one of the technologies that inspired Bitcoin’s own proof-of-work algorithm. Back is also the co-founder and CEO of Blockstream.

Blockstream stands as a pivotal force in the realm of blockchain technology, particularly within the Bitcoin ecosystem, since its inception in 2014. The company has dedicated itself to expanding the functionality, scalability, and security of Bitcoin through innovative solutions.

One of its hallmark contributions is the development of sidechains, such as the Liquid Network, which allow for the creation and transfer of assets across parallel blockchains without impacting the main Bitcoin network. This technology facilitates faster transactions and enhanced privacy for users. Additionally, Blockstream has ventured into making Bitcoin more accessible and robust through its satellite network, which broadcasts the Bitcoin blockchain globally, ensuring the network’s operability even in regions lacking reliable internet connectivity.

Beyond these innovations, Blockstream’s involvement extends to sustainable Bitcoin mining efforts, focusing on renewable energy sources and advanced cooling technologies to mitigate environmental concerns.

In a thread posted on social media platform X on February 28, the Blockstream CEO made a bold prediction: Bitcoin is on its trajectory to reach $100,000 by the upcoming halving day, which is roughly 50 days away.

This proclamation isn’t just a shot in the dark but a reflection of the changing tides within the crypto market, signaling a potent mix of optimism and strategic shifts among investors and market dynamics. Let’s unpack the jargon and insights behind this statement to understand the underpinnings of this prediction and its implications for the Bitcoin ecosystem.

At the heart of this optimistic outlook is the concept of “halving,” a fundamental mechanism within the Bitcoin network that reduces the reward for mining new blocks by half approximately every four years. This event is a significant driver of Bitcoin’s scarcity and has historically been a precursor to price increases. The anticipation of scarcity post-halving, combined with growing investor interest, is a crucial factor fueling predictions of a price surge.

The CEO’s message captures a vivid picture of the current market dynamics. He mentions “bears, leveraged shorts rekt,” referring to bearish traders (those who bet on the price falling) and leveraged short positions (borrowed money to bet against Bitcoin) facing substantial losses (“rekt” is slang for “wrecked”). This scenario typically occurs when the market moves against them, forcing liquidations and contributing to upward price pressure.

He also notes that “leveraged shorts” have been “scared-off,” indicating that traders using leverage to short Bitcoin are exiting their positions due to the unfavorable market movement, further easing downward pressure on Bitcoin prices. Meanwhile, “profit take limit orders” being moved upwards or deleted reflects the shifting sentiment among investors. A limit order is an order to buy or sell a cryptocurrency at a specified price or better. Adjusting these orders to higher prices or removing them in anticipation of further gains suggests confidence in Bitcoin’s upward trajectory.

The mention of “OTC desks out of coins” refers to over-the-counter (OTC) trading desks facing a shortage of Bitcoin. OTC desks facilitate direct transactions between parties, often used by institutional investors and high-net-worth individuals to execute large trades without impacting the market price directly. A shortage here indicates a strong buying pressure and a dwindling supply available for large trades.

The statement about “daily $500m / 10k BTC ETF buy walls” highlights substantial buying interest, with buy walls referring to a large number of buy orders at a particular price point. This can act as a support level for the price, indicating strong investor demand. Spot Bitcoin ETFs, or exchange-traded funds, buying into Bitcoin signal institutional interest and support for its growing valuation.

Finally, the CEO touches on the behavioral aspect of investors, noting that those waiting for a dip to buy may “finally give up and just panic buy,” driven by the fear of missing out (FOMO) as prices continue to climb. This behavior contributes to the momentum, pushing prices even higher.

He concludes with a philosophical reflection on the “Bitcoin owner evolution,” suggesting that the market’s dynamics naturally select for individuals who are “HODLers” – a term coined from a misspelled “hold” in a Bitcoin forum, now meaning to hold onto one’s investment through volatility, rather than selling in panic. According to him, Bitcoin’s ecosystem is self-selecting for those who adapt to its principles of long-term holding, thereby strengthening the community with investors who are resilient, informed, and committed.

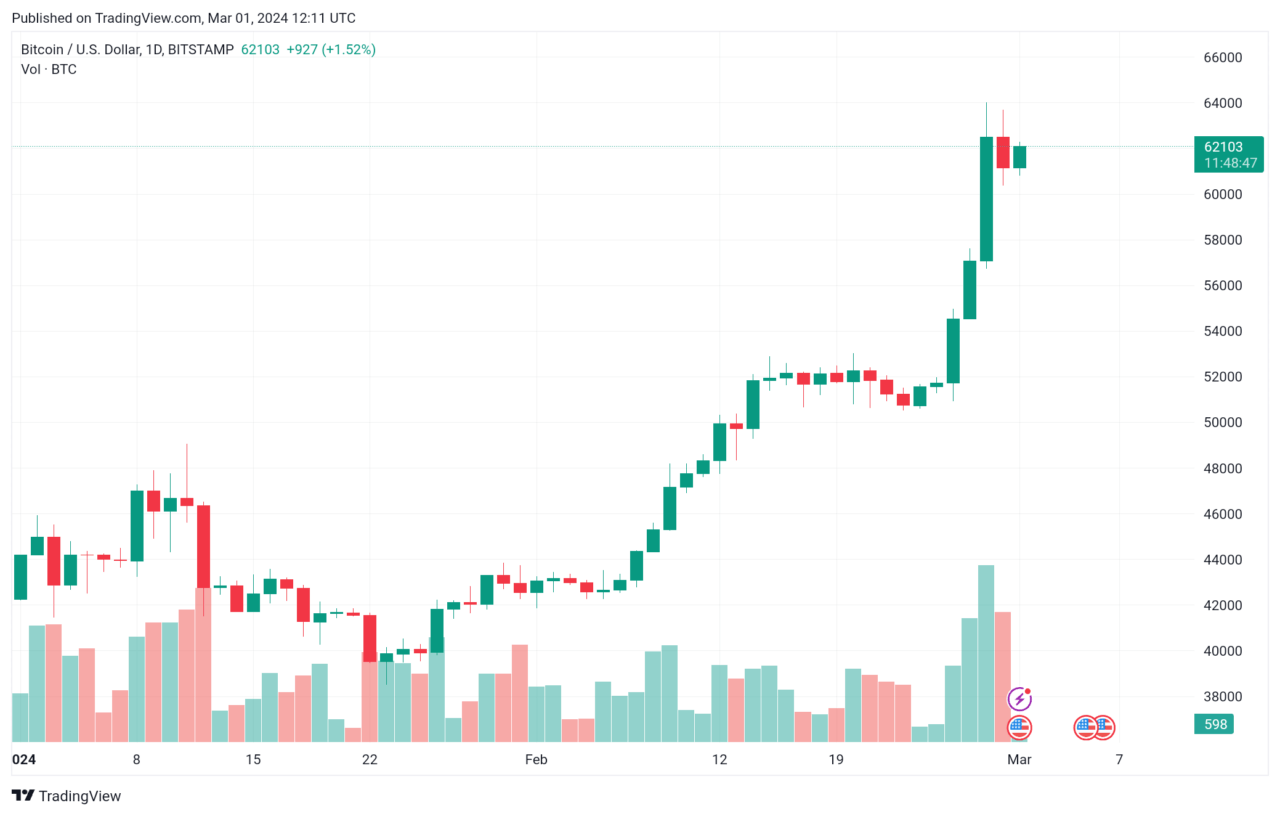

At the time of writing, Bitcoin is trading at around $61,987, up 45.6% in the past 30-day period.

Featured Image via Unsplash