On March 12, 2024, during an appearance on Fox Business’s “The Claman Countdown,” Zach Pandl, Grayscale’s Managing Director of Research, provided insightful commentary on the current state of Bitcoin, spot Bitcoin ETFs, and the broader crypto market, highlighting a bullish outlook for the U.S.

Bitcoin’s Rally and the Impact of Spot Bitcoin ETFs

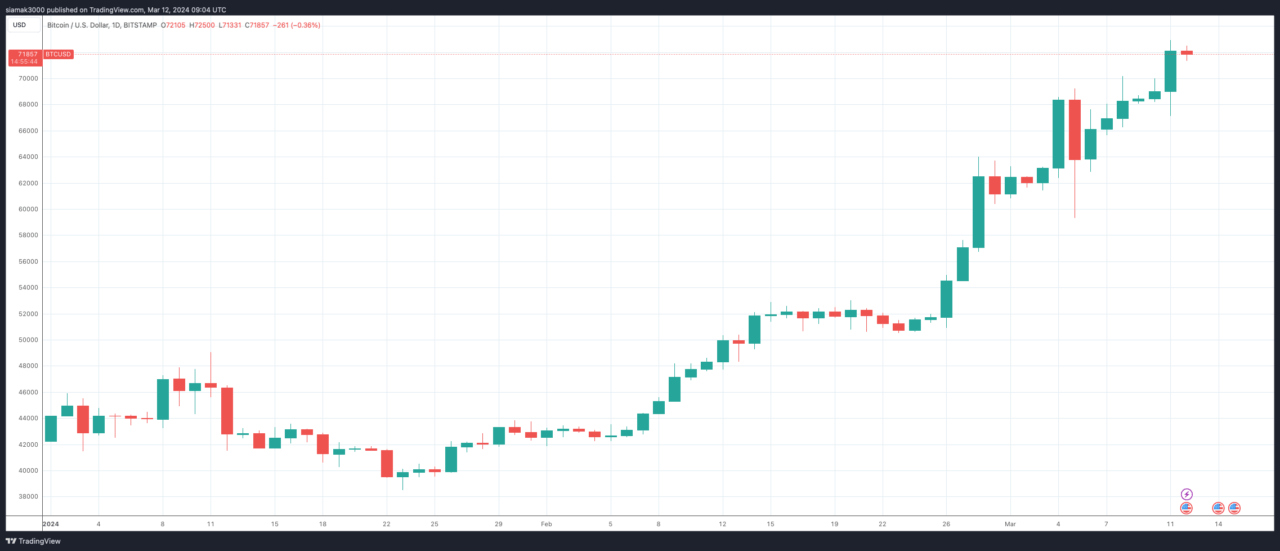

The host started opened conversation with a reflection on Bitcoin’s remarkable journey to new heights, with prices soaring to an all-time high of $72,000. This surge was attributed to the UK’s Financial Conduct Authority (FCA) not objecting to the creation of crypto-backed exchange-traded notes, thereby allowing the London Stock Exchange to announce that it would start accepting proposals for Bitcoin and Ether backed ETNs in Q2 2024.

Pandl highlighted the significant impact of spot Bitcoin ETFs on the market. Since their introduction in early January 2024, these ETFs have witnessed approximately $10 billion in inflows, underscoring the growing demand for Bitcoin and the cyclical nature of the crypto market. According to Pandl, the main driver behind Bitcoin’s stellar performance has been the momentum from these ETFs, suggesting a strong bullish market sentiment.

The Role of Macroeconomic Factors

Discussing the potential trajectory for Bitcoin, Pandl emphasized the importance of the macroeconomic backdrop in the U.S., including inflation rates and Federal Reserve policies. He noted that Bitcoin, as a macro asset, competes with the US dollar, making these factors crucial for investors considering the sustainability of the current bull market.

Grayscale’s Approach and Future Plans

When questioned about Grayscale’s flagship product, GBTC, and its market performance, Pandl expressed pride in the product’s role within the crypto ecosystem and its historical returns for investors. He indicated a commitment to making GBTC a more competitive product, hinting at potential fee reductions in the future.

Outlook on Spot Ethereum ETFs and Crypto’s Legislative Environment

Pandl expressed optimism regarding the approval of spot Ethereum ETFs, considering it a matter of “when” rather than “if.” He drew parallels between the circumstances surrounding Bitcoin and Ethereum ETFs, suggesting that an Ethereum ETF could significantly broaden investors’ perspectives on the crypto industry’s possibilities.

The discussion also touched upon the upcoming general election in the U.S. and its implications for cryptocurrency. Pandl noted the bipartisan nature of current legislative discussions around crypto, indicating that progress on issues like stablecoins could occur regardless of the election’s outcome. He also stressed the importance of macro policy issues, such as deficit spending and inflation risks, which could influence demand for Bitcoin and other cryptocurrencies.

The Resilience of the Crypto Industry

Reflecting on the crypto industry’s journey since the collapse of FTX, Pandl remarked on the sector’s resilience and its ability to bounce back. He emphasized the industry’s excitement to showcase the potential of crypto technology moving forward.

Featured Image via Pixabay