On February 29, Matt Hougan, Bitwise Asset management’s Chief Investment Officer, joined CNBC’s “Squawk Box” to discuss the burgeoning spot Bitcoin ETF market, the profile of current ETF buyers, the latest Bitcoin rally, and the prospects for an Ethereum ETF, among other topics.

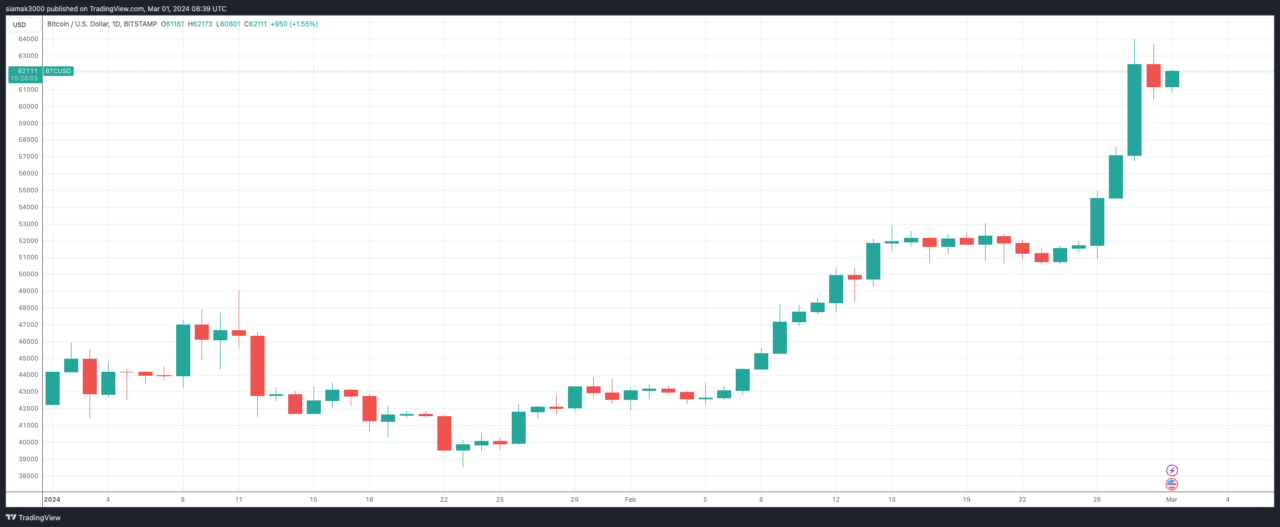

Hougan described the current rally in Bitcoin, which has seen the price reach as high as $64,000 in recent days, as driven significantly by interest in the new US-listed spot Bitcoin ETFs. He characterized the introduction of these ETFs as a pivotal moment for Bitcoin, likening it to an “IPO moment” that has ushered the cryptocurrency into a new era of price discovery.

Hougan says that the demand for the Bitwise Bitcoin ETF, along with other spot Bitcoin ETFs, spans retail investors, hedge funds, and independent financial advisors (RIAs). Hougan anticipates an even larger wave of demand from major wirehouses in the coming months. According to Hougan, initially, demand for new ETFs tends to be primarily from retail investors, independent financial advisors, and hedge funds, given that major institutions and wirehouses may take longer to engage with these products.

Hougan remains bullish on Bitcoin’s potential for further price increases. He attributes the recent rally to the massive supply-demand imbalance created by the ETFs. He mentions that in one week alone, these spot Bitcoin ETFs purchased 30,000 Bitcoins, far outstripping the less than 3,000 Bitcoins produced by miners. This imbalance, he claims, is a driving force behind the price increase.

Initially, Bitwise predicted Bitcoin would reach new all-time highs above $80,000 in 2024. Based on current ETF trends and the overwhelming demand, Hougan now believes those estimates might be too conservative. He suggests that Bitcoin could potentially reach $100,000, $200,000, or even higher due to the significant supply-demand dynamics at play, especially with the upcoming halving event in April, which will further reduce new Bitcoin supply.

Hougan predicts that the market will support six to seven successful spot Bitcoin ETFs long-term, with five already surpassing the billion-dollar mark. He anticipates some market consolidation but also expects innovation, such as the introduction of covered call options, among other variations. He goes to on to say that Bitwise’s spot Bitcoin ETF, already among the fastest-growing ETFs of all time, highlights the substantial market potential for these products, which Hougan estimates to be a $100 billion-plus category.

Looking beyond Bitcoin, Hougan is optimistic about the prospects for spot Ethereum ETFs. Given the success and positive feedback surrounding spot Bitcoin ETFs, he believes the market is ripe for expansion into other cryptocurrencies. Bitwise is keen on being a significant player in this space, aiming to offer a range of spot crypto ETFs, including Ethereum, which he hopes could materialize by the end of the year.

Earlier today, Hunter Horsely, the CEO of Bitwise Asset Management, highlighted the increasing scarcity of Bitcoin in a recent statement on social media platform X, pointing out that approximately 1.35 million Bitcoin remain to be mined over the next century. Horsely’s comments underline the intensifying scarcity as the majority of new demand for Bitcoin will now depend on persuading current holders to sell their holdings.

Featured Image via Pixabay