In an appearance yesterday on CNBC’s “Squawk Box,” Anthony Pompliano, founder of Pomp Investments, discussed the current bitcoin rally, its potential heights, and the factors driving its ascent.

Pompliano began by acknowledging Bitcoin’s return to record highs, a level not seen since a couple of years ago.

He pointed out the importance of understanding the forces behind Bitcoin’s movement, including the upcoming halving, the adoption of spot ETFs, and the significant inflows of money into the market, especially from big players like BlackRock. Pompliano mentioned that with $11 billion in their ETF and adding a billion dollars in just the last day, the demand for Bitcoin far outpaces the supply produced by the network.

Spot ETF approvals have been a monumental development for Bitcoin, according to Pompliano, with 11 ETFs now channelling massive inflows into the cryptocurrency. Pompliano highlighted the historical pattern where Bitcoin has doubled in price in less than 18 days after breaking past record highs in three out of four instances. With the halving event approaching, reducing the daily bitcoin supply from 900 to 450, he argued it’s hard to see a scenario where Bitcoin doesn’t climb higher, and at a pace faster than expected.

Despite his bullish outlook, Pompliano advised caution, suggesting that traditional portfolios should allocate only 1 to 5% to bitcoin. He stressed the importance of recognizing the asset’s risks, even as he outlined a compelling case for significant short-term gains.

Pompliano identified three main new buyer groups poised to enter the market: public pension funds, sovereign wealth funds, and individual investors attracted by the new spot ETFs. He shared an anecdote of two public pension funds that have seen a 12x return on their Bitcoin exposure, suggesting that even a minimal allocation could significantly impact fund statuses over the long term.

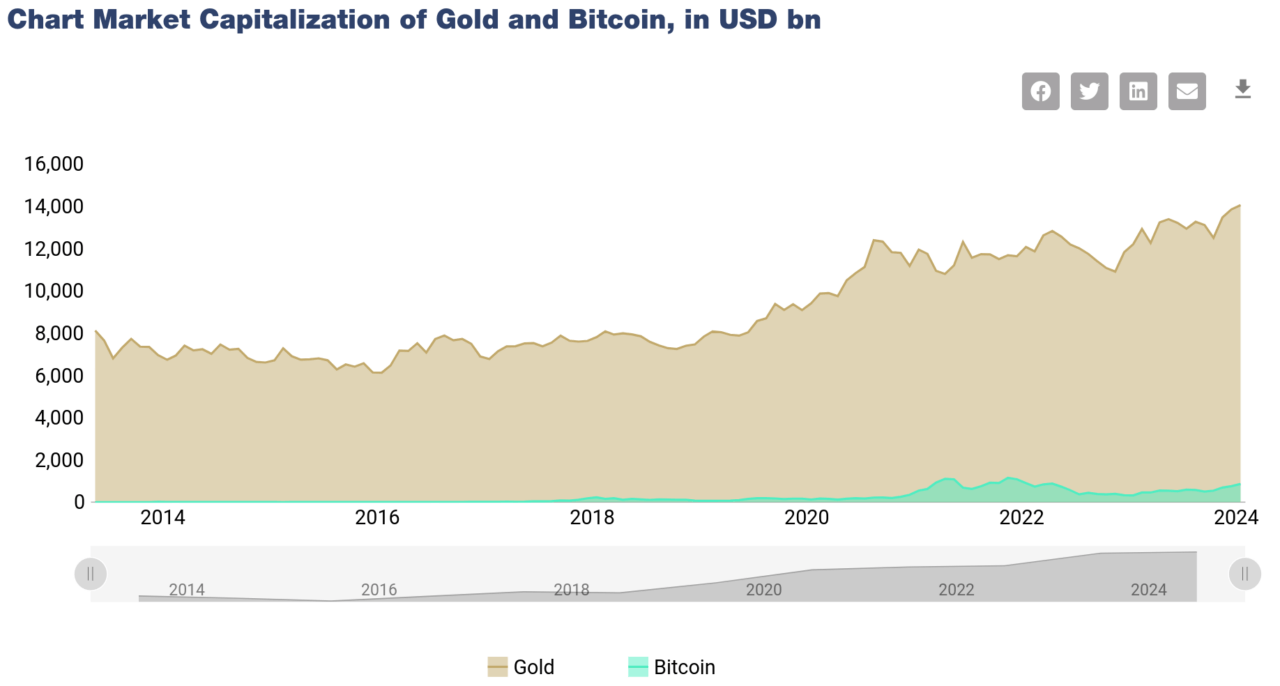

The discussion touched on Bitcoin’s role in relation to gold and its response to global liquidity trends. Pompliano argued that Bitcoin has become an index for global liquidity, benefiting from both the dollar’s debasement and an increase in global liquidity. He believes Bitcoin could eventually match or even surpass gold’s market cap, asserting that Bitcoin is a “10x improvement” on gold:

“Some people are looking for Bitcoin to be 10% or 50% of the market cap … It will go past gold eventually. Bitcoin is a 10x improvement on gold. If you are a 10x improvement, to be two times the market cap makes sense.”

Concluding his interview, Pompliano remains highly bullish on Bitcoin’s prospects. Despite acknowledging the risks, he pointed to the structural factors supporting Bitcoin’s growth, the new categories of investors, and the cryptocurrency’s intrinsic advantages over traditional assets like gold. His vision for Bitcoin is not just of a temporary rally but of a fundamental shift in the financial landscape that recognizes Bitcoin’s unique value and potential.

Shortly after this interview, the BTC price set a new all-time high of $69,210 on the crypto exchange Bitstamp, finally beating the previous all-time high of $69,044, which was set on 10 November 2021.

Unlike stocks or cryptocurrencies, where the total number of units is known, pinpointing an exact market capitalization for gold is tricky. Traditional market cap calculations rely on a clear-cut circulating supply, which is difficult to determine for a physical asset like gold. After all, it’s been mined for centuries, and reliable records don’t exist for all of it. Additionally, gold’s price fluctuates continuously, just like any traded commodity.

Despite these challenges, we can get a sense of gold’s scale through estimation. Several sources have attempted to quantify the total value of all above-ground gold. While the methodology varies, these estimates often fall in the range of $12 trillion or higher.

Featured Image via Pixabay