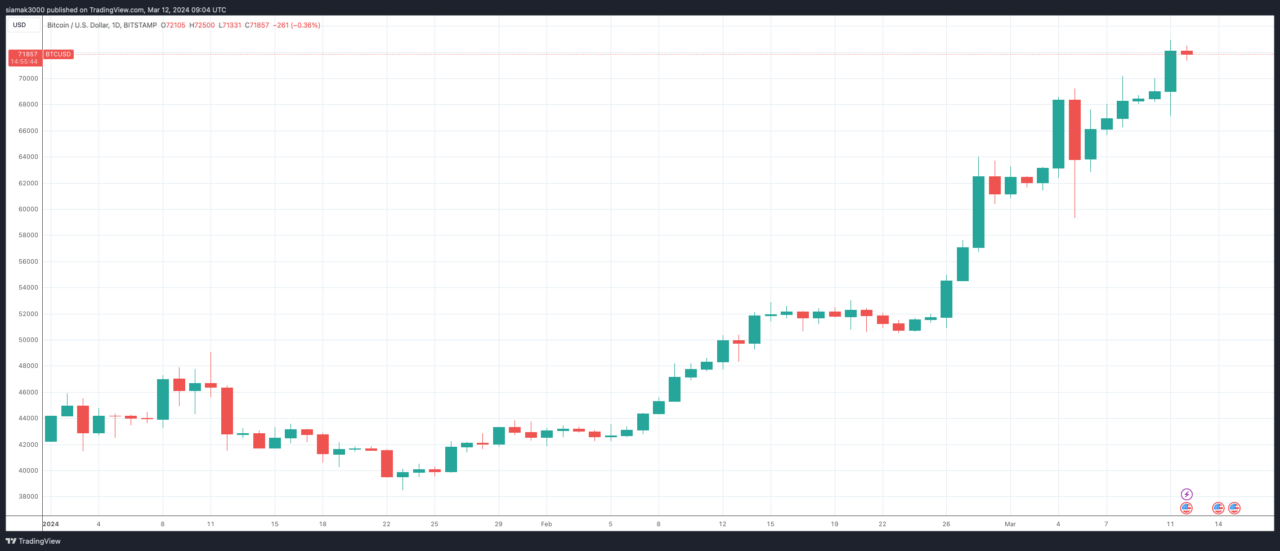

In the latest edition of “The Week Onchain Newsletter,” Glassnode’s lead on-chain analyst, known as “Checkmate,” brings to light Bitcoin’s exhilarating journey to new all-time highs, surpassing $72,300 for the first time. This event, as highlighted by Glassnode, isn’t merely about surpassing price levels; it represents a shift into what’s termed the “Euphoria Zone.” This phase, according to Glassnode, signifies a pivotal moment in investor sentiment and market dynamics, traditionally marked by a notable shift in behavior among Bitcoin investors.

Glassnode points out that alongside Bitcoin’s price, the Realized Cap—a measure reflecting the total value stored in Bitcoin—has also reached a new peak at $504 billion. This surge, as Glassnode notes, is driven by significant capital inflows, partly attributed to the burgeoning interest and success of new U.S. ETF products. The rate of increase in the Realized Cap underscores the substantial investor confidence and capital moving into Bitcoin, drawing parallels with the fervent market activity seen in early 2021.

The newsletter further delves into the concept of wealth transfer within the Bitcoin ecosystem, a recurring theme observed by Glassnode during bull markets. The analysis indicates a marked increase in the activity of “Young coins,” those transacted within the last three months, which Glassnode interprets as a signal of long-term holders beginning to distribute their holdings to newer market entrants, thereby realizing profits as Bitcoin hits new highs.

Glassnode meticulously examines the balance of supply and demand dynamics, emphasizing the significance of distribution by long-term holders to sustain market equilibrium. The analysis suggests that the sale of Bitcoin by these long-term investors introduces new supply into the market, which must be met with corresponding demand from new investors. This interplay, as interpreted by Glassnode, is crucial in preventing market saturation and potentially signaling the nearing of a market cycle peak.

In exploring the mechanisms of wealth transfer, Glassnode highlights the RHODL Ratio, an innovative metric that quantifies the shift from veteran HODLers to new speculators and investors. This ratio, alongside the observed changes in supply from long-term to short-term holders, serves as a barometer for understanding the current market phase in comparison to historical cycles, offering insights into the timing and intensity of wealth redistribution within the Bitcoin market.

The concept of realized profits is central to Glassnode’s analysis, linking capital inflows not only to the increase in the Realized Cap but also to the substantial levels of profit-taking occurring on-chain. This week’s highlighted data shows a spike in realized profits, reflecting conditions akin to the euphoric phases of 2017 and 2021 bull markets, as identified by Glassnode. This pattern suggests a heightened activity of profit realization among investors, reminiscent of previous market highs.

Lastly, Glassnode introduces a comparison between on-chain profit realization and leverage in futures markets, offering a nuanced view of market sentiment and investor behavior during this euphoric phase. The correlation between the Entity-Adjusted SOPR and futures funding rates reveals a congruence in profit-taking and speculative leverage, suggesting that both on-chain and derivative market activities are echoing the bullish sentiment observed in past cycles.

Featured Image via Pixabay