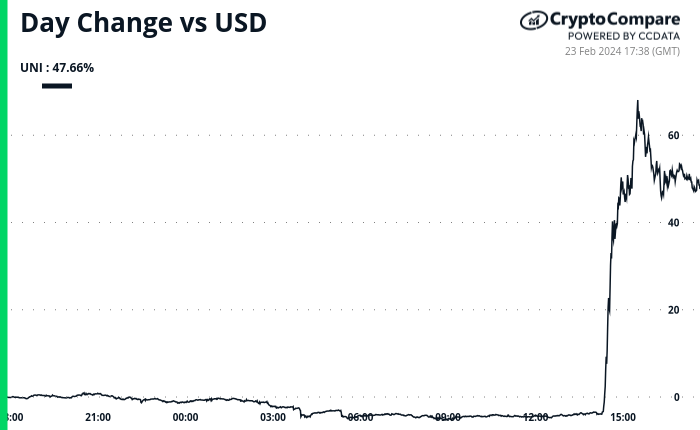

The price of the native token of leading decentralized cryptocurrency exchange Uniswap ($UNI) has surged by nearly 50% over the last 24-hour period over a recently filed proposal to “strengthen and invigorate” Uniswap’s governance and reward UNI token holders.

The proposal, submitted by the Uniswap Foundation’s governance lead Erin Koen, would reward UNI token holders who have staked and delegated their tokens in a bid to improve Uniswap governance’s “resilience and decentralization.”

Explaining the proposal Koen noted that Uniswap Protocol is “immensely useful” after it processed trillions of dollars’ worth of token swaps since launch, while being “governance minimized.” As a result, he said, the protocol “built a market share lead with a very low level of Governance activity.”

Maintaining its lead, Koen added, is only going to get harder as liquidity is fragmenting over multiple blockchains as competition grows. As such, he said “Uniswap Governance needs to use its reputational, financial & technical capital for good.

Koen’s proposal for Uniswap represents a notable shift in the platform’s approach to fees and differs from an earlier initiative, launched last June, which sought to incentivize token holders by distributing accumulated protocol fees.

In a decisive vote, the Uniswap community ultimately rejected that proposal, which would have activated fees across numerous liquidity pools and directed a portion of the revenue to token holders. However, October saw a different approach implemented, with the exchange introducing a 0.15% fee on crypto swaps involving specific tokens, including ETH and USDC.

If Koen’s proposal is approved by Uniswap’s community, it would enable a permissionless collection of protocol fees that would then be distributed to UNI token holders who have staked and delegated their votes.

Reacting to the proposal the price of Uniswap’s native UNI token surged by nearly 50% to now trade at around $11, up from around $7.1 before it started surging.

The governance proposal comes shortly after the Uniswap Foundation, the organization that supports the decentralized finance (DeFi) protocol, announced its plans to launch version 4 of the protocol following the upcoming Dencun upgrade on Ethereum’s mainnet.

The Uniswap Foundation anticipates launching Uniswap v4 on the Ethereum mainnet in the third quarter of 2024. However, this timeline is tentative and depends on the progression of the Dencun upgrade on Ethereum.

Ethereum’s Dencun upgrade is set to go live on the network’s mainnet on March 13. It includes the introduction of proto-danksharding and blobs, aiming to significantly reduce transaction costs on layer-2 networks.

Featured image via Unsplash.