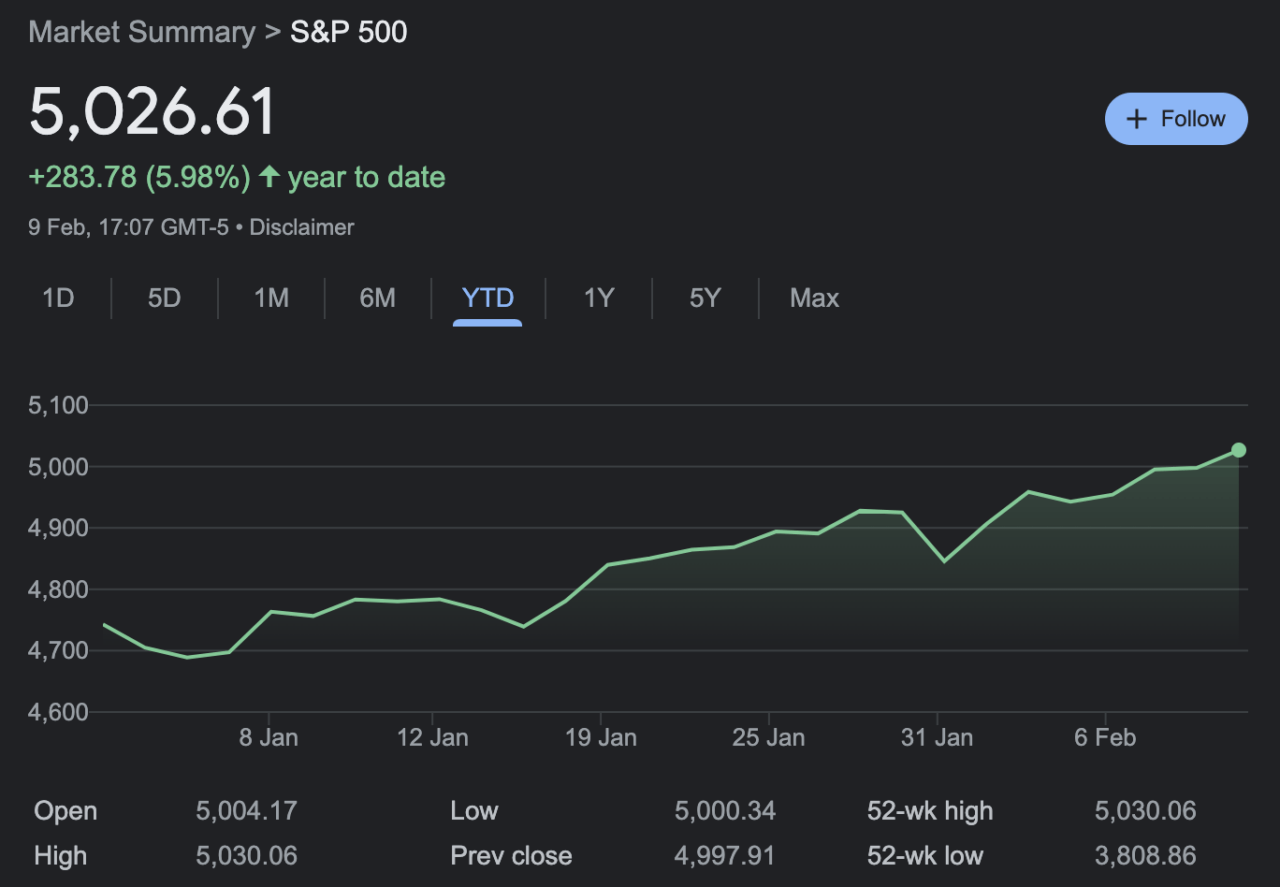

On February 9, the day that the S&P 500 closed above 5,000 for the first time, in an enlightening interview with Bloomberg TV, Scott Bessent, CEO & CIO of Key Square Capital, shared his expert analysis on the current state of the US stock market, attributing the recent rally to anticipations of a Trump victory and its associated policies. Bessent’s insights offer a deep dive into the mechanics behind the US stock market’s movements and what investors might expect going forward.

The Trump Rally: A Market Phenomenon

Bessent recalls the 2016 market scenario, drawing parallels to the present, where the anticipation of Trump’s policy implementations has investors in a bullish stance. “In 2016, the market crashed on election eve and then took off for three, four weeks after that had a big run,” Bessent noted, highlighting the market’s Pavlovian response to Trump’s potential win in 2024. The policies fueling this optimism primarily revolve around taxes, regulation, energy independence, and a calmer international stage under Trump’s leadership.

Tax Cuts and Regulation

According to the Key Square Capital CEO, a significant factor in the rally is the expectation that Trump’s tax cuts, set to expire in 2025, would be reinstated and extended. Bessent points out, “Light touch regulation, energy independence,” as key elements of Trump’s policy that the market finds favorable. This anticipation builds a strong case for a market-friendly environment should Trump secure a victory.

International Trade and Tariffs

On the topic of trade, particularly Trump’s stance on imposing tariffs, Bessent offers a nuanced view. He suggests that the extreme position of imposing tariffs is a strategic move to strengthen negotiation stances without necessarily intending to implement them. “I actually think that they’re putting the gun on the table with the notion of not having to fire it,” he explains, indicating a tactical approach to international trade discussions.

The Fed’s Role in the Rally

Bessent also touches on the Federal Reserve’s influence, suggesting that its actions are in part motivated by the political landscape. He observes a correlation between the Fed’s activities and the incumbent’s performance, stating, “Since 1952, the market has never had a down year when an incumbent’s running.” He claims that this pattern suggests an economic apparatus at work, aiming to sustain market buoyancy through liquidity and program releases.

Market Trends and Polls

An interesting aspect of Bessent’s analysis is the correlation between Trump’s polling numbers and market performance. “The more Trump gets ahead in the polls, the better the market does,” he points out, backing his observation with data that shows a cumulative gain of 35% during periods when Trump’s polling numbers rise, compared to a mere 3% when Biden leads.

In a striking declaration on his “Truth Social” platform, fTrump has attributed the recent upswing in the U.S. stock market to the positive polling numbers he holds against President Joe Biden. Trump’s assertion suggests that investor confidence is buoyed by the prospect of his victory in the upcoming election.

As CNBC reported, on 29 January 2024, in a post on Truth Social, Trump emphatically stated:

“THIS IS THE TRUMP STOCK MARKET BECAUSE MY POLLS AGAINST BIDEN ARE SO GOOD THAT INVESTORS ARE PROJECTING THAT I WILL WIN, AND THAT WILL DRIVE THE MARKET UP – EVERYTHING ELSE IS TERRIBLE (WATCH THE MIDDLE EAST!), AND RECORD SETTING INFLATION HAS ALREADY TAKEN ITS TOLL. MAKE AMERICA GREAT AGAIN!!!”

Featured Image via Pixabay