Founded by Grover Norquist in 1985, Americans for Tax Reform (ATR) stands as a pivotal conservative advocacy group in the U.S., with a primary focus on shaping tax policy to align with free-market principles. At the heart of ATR’s philosophy is the conviction that the government’s power is intrinsically linked to its taxing authority. Consequently, ATR advocates for a significant curtailment of this power, promoting a vision of minimal government intervention in the economy.

ATR is renowned for its Taxpayer Protection Pledge, which has become a litmus test for Republican politicians, urging them to publicly commit to opposing any tax increases. This pledge underscores ATR’s broader agenda to lower taxes for both individuals and corporations, arguing that such tax cuts are crucial for fostering economic prosperity.

Beyond tax reduction, ATR prioritizes slashing government expenditure, which it views as fundamentally profligate. The organization also campaigns against regulatory measures it deems as stifling economic freedom, advocating for a laissez-faire approach to governance. Emphasizing fiscal responsibility, ATR calls for balanced budgets and concerted efforts to reduce the national debt, reflecting its comprehensive stance on economic policy.

ATR’s influence extends through its active lobbying in Congress, aiming to steer legislative action in favor of its tax policy ideals. The organization also engages the public directly, leveraging media appearances, grassroots campaigns, and educational initiatives to mold public opinion on key tax issues.

While ATR’s advocacy has cemented its status as a formidable force in tax policy debates, it has not been without controversy. Critics question the transparency of ATR’s funding sources and highlight potential conflicts of interest with corporate benefactors and wealthy individuals. Additionally, ATR’s staunch opposition to environmental regulations and its dismissive stance on climate change initiatives have sparked further debate about the organization’s policy priorities.

Despite these challenges, Americans for Tax Reform remains a central figure in the discourse on U.S. tax policy, championing a conservative vision of tax reduction, limited government spending, and free-market economics. Its enduring influence reflects the deep resonance of its core principles within conservative political thought.

Earlier today, in an appearance on Fox Business show “The Bottom Line,” Grover Norquist, who is the President of Americans for Tax Reform, shared his insights on the IRS’ remote work policies and the U.S. ranking as the 25th most free economy in the world according to the Heritage Foundation’s annual list.

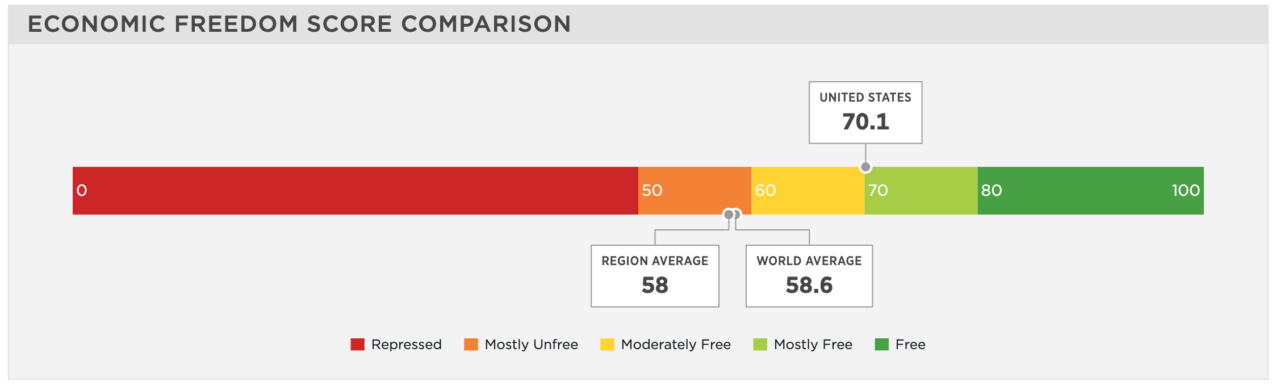

The Heritage Foundation’s 2024 Index of Economic Freedom presents a detailed overview of the current state of the U.S. economy. With an economic freedom score of 70.1, the United States ranks as the 25th freest economy globally. This represents a slight decline of 0.5 point from the previous year. Despite this drop, the U.S. stands 3rd among 32 countries in the Americas region, showcasing an economic freedom score that surpasses both the world and regional averages. The Index categorizes the United States’ economy as “mostly free.”

The report underscores significant policy challenges that threaten the United States’ long-term economic competitiveness. It points out that big-government policies have gradually eroded the traditional limits on government power. Concurrently, public spending has surged, and the regulatory burden businesses face has intensified. These factors collectively hinder the U.S. economy’s transition back to a status of being “free.”

The Foundation highlights that unchecked deficit spending and escalating government debt have been accelerating, further compounded by inflation that undermines the economic well-being of Americans. This combination of economic pressures contributes to an atmosphere of uncertainty and leaves the country’s economic outlook in a state of flux. According to the Heritage Foundation, restoring the U.S. economy to a “free” status necessitates substantial policy reforms aimed at reducing the size and scope of government intervention.

Norquist highlighted the surprising and disappointing position of the United States in the Heritage Foundation’s ranking, trailing behind countries like Singapore, Switzerland, Ireland, Taiwan, and Luxembourg, which made the top five. The U.S.’s ranking at 25th, between the Czech Republic and Israel, serves as a wake-up call for the nation, according to Norquist.

The decline in the U.S.’s economic freedom is attributed to several factors, including zero scoring in fiscal health, excessive government spending, inflation, and an onslaught of regulations and antitrust abuses. Norquist pointed out the dangers of complacency by comparing the U.S. to the historical decline of Argentina, which once was among the top five economies globally but has since fallen due to similar issues.

One of the primary drivers of the U.S.’s decline in economic freedom, according to Norquist, is the regulatory burden across various levels of government and the ongoing war on energy. This includes the push towards less reliable and more expensive energy sources and the extensive permitting required for development projects. Norquist also noted the economic stagnation of states like New York and California, which have embraced heavy regulation and green policies, in contrast to the growth seen in less regulated states like Florida.

Norquist also criticized the IRS’s remote work policies, highlighting the security risks posed by IRS agents working from home, some using personal devices to handle sensitive taxpayer information. He referenced a House testimony where the IRS Commissioner declined to acknowledge the security risk of remote work. Norquist emphasized the potential for misuse and unauthorized access to taxpayer information, citing past incidents of data breaches and misuse within the IRS.

Featured Image via Pixabay