The Congressional Budget Office (CBO) in the United States is a nonpartisan agency that provides Congress with objective, impartial analysis of economic and budgetary issues. Its primary responsibilities include:

- Budget Analysis: The CBO analyzes the budgetary impact of proposed legislation, providing cost estimates for bills under consideration by Congress. This helps lawmakers understand the potential fiscal implications of their policy proposals.

- Economic Analysis: The CBO conducts economic research and analysis to assess the current state of the economy, including projections of economic growth, employment, inflation, and other key economic indicators. This analysis helps inform congressional decision-making on fiscal and economic policy.

- Budgetary Projections: The CBO produces long-term budget projections, typically covering a period of 10 years, to forecast future trends in federal spending, revenues, deficits, and debt. These projections serve as a basis for evaluating the fiscal sustainability of current policies and the potential impact of proposed changes.

- Policy Evaluation: The CBO evaluates the effectiveness of existing government programs and policies, assessing their outcomes and costs. This evaluation helps policymakers determine whether programs are achieving their intended goals and whether changes are needed to improve efficiency or effectiveness.

In a press briefing on February 7, CBO Director Phillip Swagel unveiled the agency’s budget and economic outlook report for the years 2024 to 2034, shedding light on the anticipated fiscal challenges and economic trends in the United States.

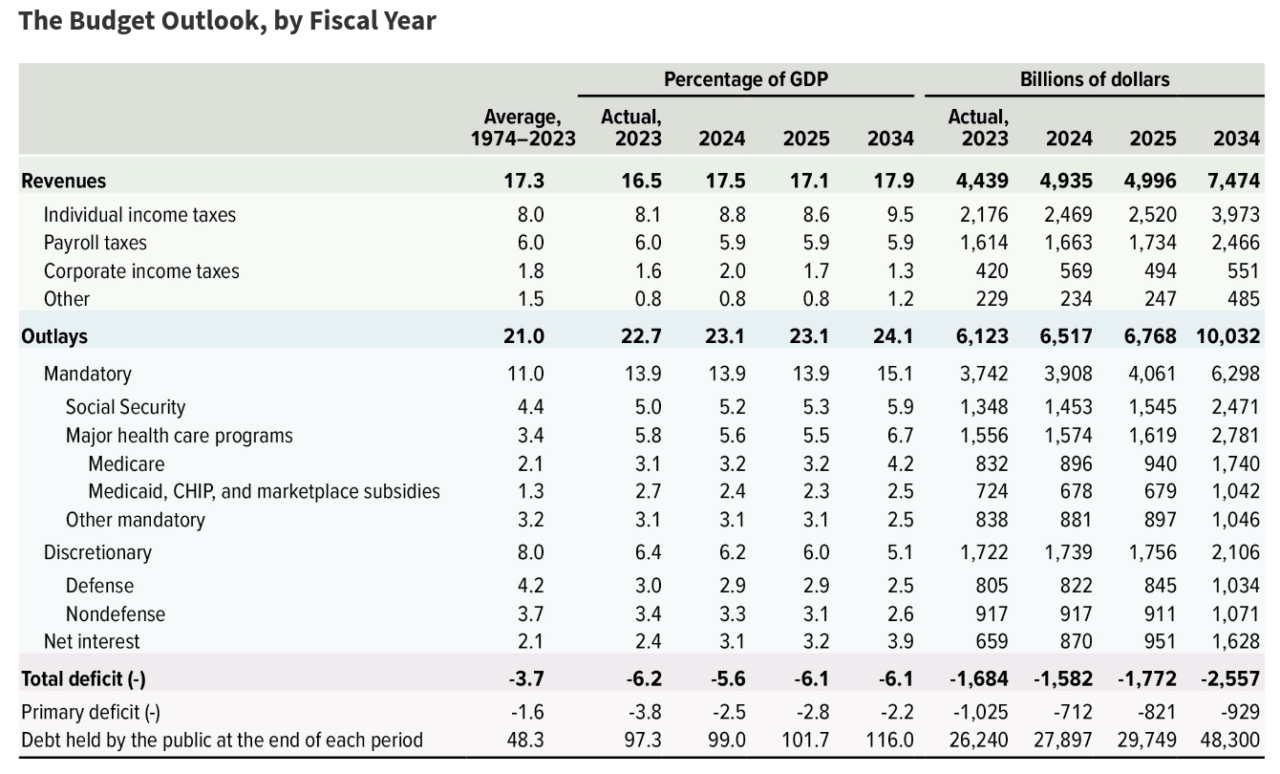

Swagel began by outlining the budget projections, noting a concerning increase in the federal deficit from $1.6 trillion in 2024 to $2.6 trillion by 2034.

According to Swagel, these deficits, when measured against the nation’s economic output, are projected to be about 50 percent larger than the historical average over the past 50 years. He identified net interest costs as a significant factor contributing to the deficit’s growth, accounting for roughly three-quarters of the increase over the decade.

The CBO director further explained that by 2034, net interest costs are expected to reach $1.6 trillion, surpassing both defense and nondefense discretionary spending by approximately one and a half times. Swagel highlighted two underlying trends exacerbating the deficit: the aging population and the rise in federal healthcare costs per beneficiary, which put upward pressure on mandatory spending.

Swagel also discussed the impact of recent legislative actions on the budget outlook. He credited the Fiscal Responsibility Act of 2023 and subsequent continuing resolutions with reducing the growth of discretionary spending. These measures, Swagel noted, along with their effects on debt service, are projected to reduce deficits by $2.6 trillion over the next decade.

On labor force changes, Swagel pointed out that a larger labor force, bolstered by higher net immigration, contributes to an increase in economic output and revenues. He stated that the GDP is expected to be $7 trillion greater and revenues $1 trillion higher from 2023 to 2034 than previously projected, thanks to these changes in the labor force.

However, Swagel mentioned that these positive adjustments are partially offset by higher net interest costs due to increased interest rates and the unexpectedly high costs of energy-related tax provisions. He elaborated that these costs reflect new emissions standards, market developments, and administrative actions to implement the tax provisions.

Turning to the economic outlook, Swagel reported that the U.S. economy grew faster in 2023 compared to 2022, even as inflation slowed. He projected economic growth to slow in 2024 amid increased unemployment and lower inflation, with the Federal Reserve expected to respond by reducing interest rates starting in the middle of the calendar year.

Swagel concluded by noting that since the CBO’s last full economic forecast in February 2023, the agency has lowered its projections of economic growth and inflation for 2024. He also expects interest rates to be higher from 2024 to 2027 than previously projected, with economic forecasts for growth after 2027 generally similar to past projections.

Last week, in an appearance on CNBC’s ‘Squawk Box,’ the CBO director talked to the show’s co-anchor, Joe Kernen, about the pressing issues surrounding the U.S. economy, including the burgeoning national debt, deficit projections, and the role of IRS tax enforcement in shaping future revenue collections.

Swagel opened the discussion by addressing the current state of U.S. debt, emphasizing its rapid growth and the potential risks it poses to the economy’s stability. He outlined the factors contributing to the increase in debt levels, such as significant government spending during the pandemic and the structural challenges of an aging population coupled with rising healthcare costs.

The conversation then pivoted to the CBO’s latest deficit forecast. Swagel explained the methodology behind these projections, highlighting the interplay between economic growth, employment rates, and federal spending patterns. He stressed the importance of sustainable fiscal policies to mitigate the long-term impact of these deficits on the economy.

A significant portion of the interview focused on the potential impact of enhanced IRS tax enforcement on revenue collection. Swagel discussed the CBO’s analysis of recent legislative changes aimed at increasing the IRS’s capacity to enforce tax laws more effectively. He shared insights into how these measures could lead to improved revenue collection, thereby affecting the overall deficit outlook.

Swagel and Kernen also talked about the broader implications of the current fiscal situation for the U.S. economy. The CBO director underscored the need for comprehensive policy solutions to address the dual challenges of managing debt and fostering economic growth. He highlighted the opportunities for reform in tax policy and government spending to create a more sustainable fiscal future.

Featured Image via Pixabay